Following negotiations with officials from Ford, General Motors (GM), and Stellantis, the Trump administration has declared a temporary, one-month exemption from recently imposed tariffs on vehicle imports from Mexico and Canada. This choice highlights more general questions about American trade policy even while it gives U.S. manufacturers a temporary window to adapt to the new trading environment.

Emphasizing domestic investment and relocation of manufacturing activities to the United States as the only way to avoid long-term tariff consequences, white house press secretary Karoline Leavitt stated that President Trump pushed automakers to act fast. The statement immediately raised the stock prices of big automakers, indicating cautious industry hope.

The Expanding Scope of U.S. Tariffs

Originally presented as a way to lower trade deficits, Trump’s tariffs have evolved into several arguments, including stopping fentanyl trafficking, stopping illegal immigration, and enhancing national security. The government levies duties on goods from China, Mexico, and Canada as of Tuesday, which has caused a global reaction.

Canada’s Retaliatory Measures

Key trading partner and long-time friend Canada has reacted forcefully against the proposed taxes. Declaring, “zero tariffs, and that is it,” Ontario Premier Doug Ford has promised not to give in. Without a quick fix, Canadian officials estimate that assembly lines might stop running within 10 days, causing significant job losses in Canada and the United States.

Mexico’s Countermeasures

Mexico has declared its own set of counter-tariffs, scheduled for publication on Sunday. Early hints point to Mexico focusing on critical American exports, so aggravating the trade conflict even if the specifics are yet unknown.

China’s Response: A Trade War Escalates

By levying retaliatory tariffs of up to 15% on American agricultural goods and tightening regulations on American companies functioning within China, China has intensified the confrontation even more. “If war is what the U.S. wants, be it a tariff war, a trade war, or any other type of war, we’re ready to fight till the end,” China’s embassy to the United States said in a sharply worded statement.

The Economic Fallout: Who Pays the Price?

Tariffs operate as indirect taxes for consumers and companies. Usually, importers transfer more extraordinary expenses resulting from tariffs on consumers by means of higher pricing.

For the auto industry, this means:

- Higher Car Prices: Rising import part prices would cause consumers to see price increases on both new and used vehicles.

- Job Losses: Should factories move or cut expenses, layoffs are likely to follow, impacting suppliers and assembly line workers both.

- Market Uncertainty: Trade uncertainty still makes investors and companies cautious, which influences stock market stability and investment choices.

U.S. Automakers’ Reactions

Ford, GM, and Stellantis have indicated moderate support for Trump’s choice despite the economic uncertainty. Ford underlined again its dedication to “a healthy and honest conversation with the Administration to help achieve a bright future for our industry and U.S. manufacturing.” Emphasizing their desire for measures allowing American industries to flourish, GM and Stellantis also shared similar ideas.

Auto CEOs are well aware, meanwhile, that the one-month exemption merely delays a more serious reckoning. The approaching April 2 deadline looms huge and carries the possibility of even more severe tariffs should negotiations fail.

Broader Implications for U.S. Trade Policy

Apart from the automotive sector, Trump’s larger trade agenda consists of tariffs on:

- Computer chips and pharmaceuticals: Critical imports from Asia could face increased taxation.

- Steel and aluminum: The administration has ended exemptions on previous metal tariffs, affecting construction and manufacturing industries.

- Energy products: Canadian oil and electricity are now taxed at 10%, further straining relations with the northern neighbor.

Trump has defended these policies as required for economic recovery, projecting that they will boost domestic manufacturing and employment creation. Economists caution, meanwhile, that such protectionist policies run the danger of aggravating inflation and slowing down economic growth.

The Political Ramifications

Ahead of the 2024 contest, trade policy is still a divisive topic. Trump’s moves have upset conventional friends and split public opinion, even while he has presented tariffs as a tool for bolstering American industry.

Both Democratic and Republican legislators have expressed worries about the long-term effects of trade battles. Voters might feel the pressure in their wallets as tariffs raise costs, which might affect political dynamics in the following months.

Diplomatic Struggles

Trump’s tariff approach has frayed ties with important world allies. Prime Minister Justin Trudeau has refused to relax retaliatory tariffs unless the United States reverses its own, even although the government has indicated openness to talking with Canada and Mexico. The standoff emphasizes a basic change in North American trade policies.

Beijing’s austere reaction meanwhile points to China’s readiness for protracted economic conflict. The continuous conflicts between the two biggest economies might have broad effects on world commerce and financial markets.

What Comes Next?

The one-month exemption in place forces manufacturers to make quick decisions on pricing policies, supply networks, and investments. The April 2 deadline represents a turning point since reciprocal tariffs might change the global car sector.

The U.S. government is under more and more pressure to negotiate these obstacles and minimize negative economic consequences. Whether by renegotiation, exemption, or more escalation, the following weeks will be crucial in deciding the direction of American trade policy.

Conclusion

Although the Trump administration’s temporary exemption provides a little window of relief, the more significant trade conflict is still far from fixed. With China, Mexico, and Canada all enacting remedies, the global economic scene is moving into unknown terrain. Businesses, consumers, and legislators have to get ready for the possible effects of protracted trade battles as the matter develops.

Conclusion

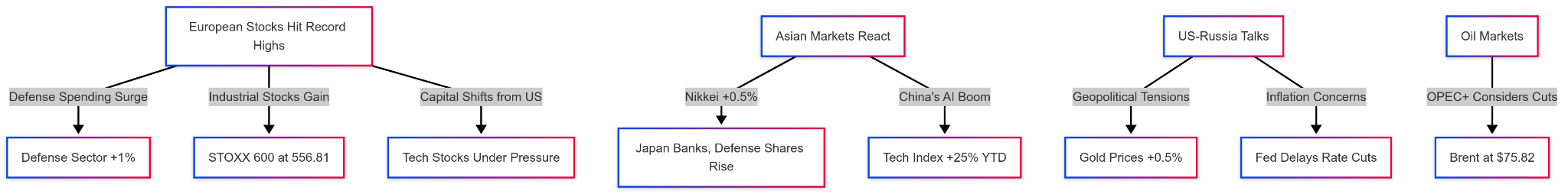

The global financial landscape is evolving rapidly, with European stocks leading the charge amid rising defense expenditures and industrial sector strength. While U.S. equities face uncertainty due to inflationary pressures and Federal Reserve policy constraints, investors are increasingly turning to Europe for value-driven opportunities. Meanwhile, Asia’s markets continue to benefit from China’s AI boom and strategic government intervention.

Looking ahead, traders will closely watch U.S.-Russia talks, upcoming inflation reports, and OPEC+ decisions, all of which could significantly shape market trends in the coming weeks. With global economic conditions shifting, diversification and strategic positioning remain key for investors navigating these turbulent times.

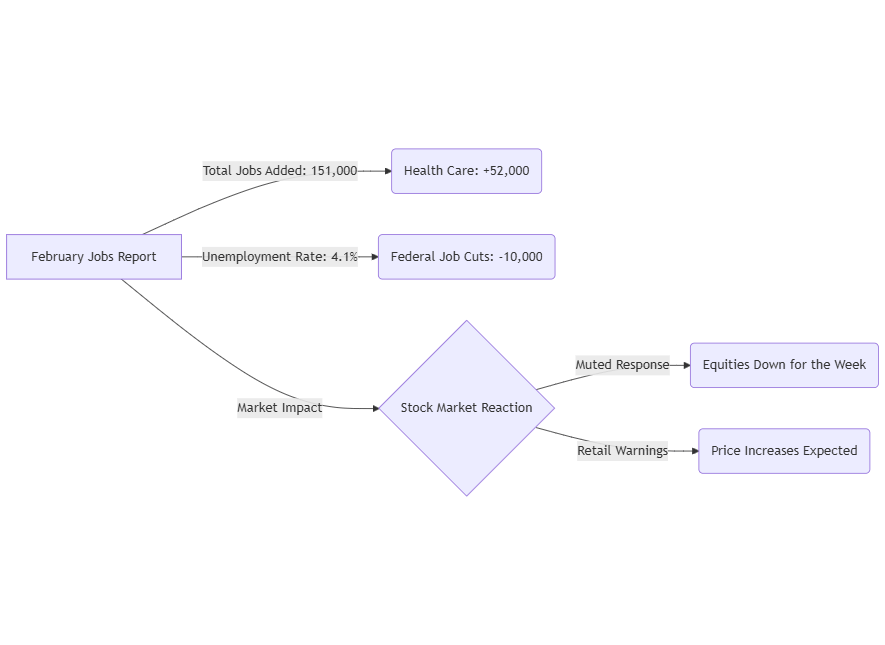

Conclusion: A Market at a Crossroads

The February employment report highlights a labor market in change, balancing meager job increases against mounting economic headwinds. Businesses and consumers both have to negotiate a changing terrain in the following months as the private sector shows strong but measured hiring and government job cuts create additional uncertainty. The soundness of the U.S. labor market will remain a crucial indicator of general economic health as fresh economic policies take effect.

The next months will show a better picture of whether the U.S. labor market can keep its momentum or experience an extended period of decline given the changing economic background and new policy hurdles. We will be tracking vital economic statistics influencing American employment going forward as companies and legislators respond.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.