U.S. Economy Adds 151,000 Jobs in February Amid Policy Shifts

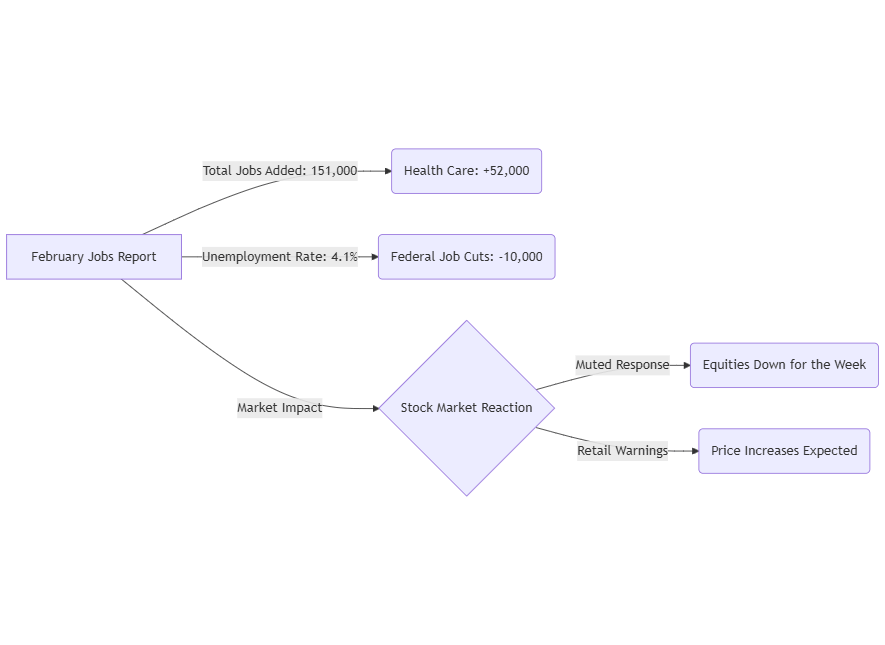

Reflecting modest employment increases across essential sectors, the United States labor market created 151,000 jobs in February. Although the Bureau of Labor Statistics (BLS)’s estimate of 170,000 new jobs fell short, the revised January count of 125,000 points to ongoing, although cautious, growth. As government job cuts started to take effect, the jobless rate crept up to 4.1%, suggesting possible economic headwinds.

Employment Trends Across Key Sectors

Several sectors saw strong hiring trends despite changes in policies and uncertainty:

- Healthcare added 52,000 new positions, which is still a strong foundation for employment creation.

- Financial services: Added 21,000 roles to indicate consistent economic growth.

- Transportation and warehouses: Reflecting steady demand for logistics and supply chain operations, increased by 18,000 positions

- Retail sector: Shed 6,000 jobs in line with changing consumer expenditure patterns and business reorganization.

However, the dramatic drop in federal employment—10,000 positions lost in February—as well as the expected 62,000 more government job losses recorded by Challenger, Gray & Christmas highlight mounting issues with the government’s budgetary practices.

The Impact of Government Workforce Reductions

Under the administration’s aggressive cost-cutting efforts, Elon Musk’s Department of Government Efficiency (DOGE) has set off significant job losses in federal employment. Given that federal payrolls account for 1.5% of total U.S. employment, Barclays economists contend that the broader economic impact may be controlled even though other analysts predict total job losses could reach 500,000.

The long-term consequences of these staff cuts are unknown, mainly because they affect contractor roles and customer attitudes. Still, this change has already helped to drive the overall count to 4.9 million—the greatest since the recession of the epidemic—by contributing to a 460,000 rise in part-time employment for economic reasons.

Market and Economic Reactions

Stock Market Adjustments

The conflicting employment statistics caused investors to react gingerly. Though others worried about a more noticeable recession, the market attitude stayed relatively constant. Although equities markets closed lower for the week, Wall Street experts observed that had primarily priced in expectations of a slowing labor market.

Consumer Confidence and Business Outlook

- Consumer confidence has dropped as consumers demonstrate more behavior related to savings over discretionary spending.

- Target and Best Buy, among other stores, have expressed worries about Trump’s trade policy and cautioned about possible customer price increases.

- The biggest retailer in the country, Walmart, admitted that even if it strives to slow down cost rises, it might not be totally free from the effects of new trade taxes.

The Political and Economic Landscape

The job market is responding to new fiscal and trade policies while the Trump administration implements bold policy changes within weeks of the president’s second term. Although some analysts view job growth as a trailing indicator, reflecting past economic conditions rather than instantaneous changes, uncertainties around tariffs, reduced immigration rates, and government budget limits could present long-term issues.

Labor Market Cooling: A Sign of Stagflation?

Rising unemployment, declining consumer confidence, and tariff-induced pricing pressures taken together create questions about stagflation—a situation in which poor economic development coexists with inflationary pressures. While the present employment statistics do not conclusively prove this possibility, economists are keenly observing critical economic indicators for evidence of a more general slowdown.

Conclusion

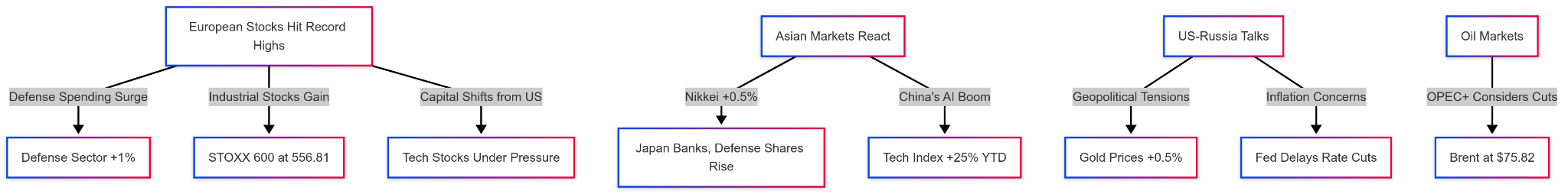

The global financial landscape is evolving rapidly, with European stocks leading the charge amid rising defense expenditures and industrial sector strength. While U.S. equities face uncertainty due to inflationary pressures and Federal Reserve policy constraints, investors are increasingly turning to Europe for value-driven opportunities. Meanwhile, Asia’s markets continue to benefit from China’s AI boom and strategic government intervention.

Looking ahead, traders will closely watch U.S.-Russia talks, upcoming inflation reports, and OPEC+ decisions, all of which could significantly shape market trends in the coming weeks. With global economic conditions shifting, diversification and strategic positioning remain key for investors navigating these turbulent times.

Conclusion: A Market at a Crossroads

The February employment report highlights a labor market in change, balancing meager job increases against mounting economic headwinds. Businesses and consumers both have to negotiate a changing terrain in the following months as the private sector shows strong but measured hiring and government job cuts create additional uncertainty. The soundness of the U.S. labor market will remain a crucial indicator of general economic health as fresh economic policies take effect.

The next months will show a better picture of whether the U.S. labor market can keep its momentum or experience an extended period of decline given the changing economic background and new policy hurdles. We will be tracking vital economic statistics influencing American employment going forward as companies and legislators respond.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.