Foreign businesses expanding in different countries often tend to find employee liabilities and the ways to cover them as one of the most critical tasks. Employee liability in fact makes it to the priority list when it comes to global workforce management. International business owners are expected to protect their employees from all sorts of work-related emergencies. It can to some extent also extend to personal threats and damage.

Understandably, international businesses are novices in local employment laws. Hence, the responsibility of employee liability management can only be handed over to an absolute expert. This is where an international PEO, known for its expertise in managing HR and administrative roles for international businesses comes into the picture. An international PEO or a similar concept known as an employer of record (EOR) strategically takes on employee liability management. An employer of record follows a comprehensive approach toward employee liability coverage. It meets every requirement as per the Employee Liability Act formed by the local government. This way the EOR frees up enough time for the foreign company to focus on business growth and operations. The EOR simultaneously protects it from any employment-related legal challenges as well.

This blog is aimed at educating the readers about all the technical details of employee liability management in India. It also talks about how an EOR takes care of the mechanisms of employee liability management. Besides, it mentions location-specific employee liability and how the local EORs cohesively handle it all. This is all while bridging the cultural gap between foreign client and their remote employees.

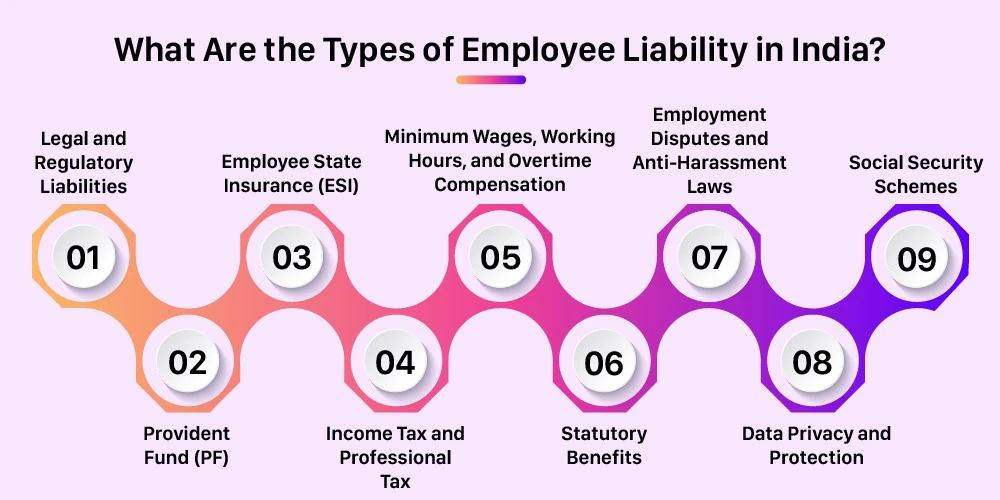

What Are the Types of Employee Liability in India?

According to reports, India was home to an estimated 75 million MSMEs by the end of the 2023 fiscal year. This large number of companies led to mass hiring in the country. Consequently, employee liability management became the spotlight of the employee lifecycle. Let us discuss a few of the major employee liabilities commonly practiced in India for a better understanding of the readers.

- Legal and Regulatory Liabilities: This covers a spectrum of employee liabilities in India. Here, both the employer and the employee are liable to the Indian government in certain aspects financially or otherwise.

- Provident Fund (PF): In India, it is mandatory for the employer to contribute to the Employees’ Provident Fund Organization (EPFO). The employer is expected to cover EPFO for each individual employee. It is a government savings scheme for Indian professionals. This provides the employees with financial security after retirement.

- Employee State Insurance (ESI): This is yet another government scheme in India. Here, the employer is expected to safeguard the Indian employee’s interests in terms of medical emergencies. The emergency can be of any type including sickness, maternity, or accidents. The employer contributions can be made through insurance or cash benefits. This scheme also includes employee welfare provisions and other healthcare benefits for the employees.

- Income Tax and Professional Tax: The Indian tax system mandates employers to deduct a certain percentage of employee’s salaries. This amount is deducted in the form of income tax. Professional taxes are also meant to be deducted and paid to the Indian government. However, this is applicable only in certain states.

- Minimum Wages, Working Hours, and Overtime Compensation: Employers are expected to pay their employees the minimum wage according to Indian labor laws. They are also expected to comply with the maximum working hours and make overtime payments if any.

- Statutory Benefits: This kind of employee liability refers to some compulsory employee benefits that Indian professionals are entitled to. These benefits are drafted by the Indian parliament and include gratuity, employee bonuses, leave policies, etc.

Gratuity payments are made to employees who have completed at least five years of being an Indian working professional. Leave policies include sick leave, casual leave, maternity leave, festival holidays, and leave encashment policies. Additionally, the Payment of Bonus Act mandates employers to pay statutory bonuses to their employees.

- Employment Disputes and Anti-Harassment Laws: The employees are legally protected by the Indian government in case of any employment dispute. This includes employee discrimination or wrongful termination. The laws extend to workplace harassment which includes the prohibition of sexual harassment of women in the workplace. The employer is held accountable for any of the above-mentioned scenarios. And has to undergo financial and legal penalties in case of non-compliance.

- Data Privacy and Protection: This includes confidentiality agreements and strict adherence to the protection of employee data. There are various data protection acts created by the Indian government like the Information Technology Act.

- Social Security Schemes: This includes employer’s Contributions to Employee Pension Scheme (EPS), National Family Benefit Scheme (NFBS), etc.

It can be clearly stated that a huge number of factors are associated with employee liability. Hence, a dedicated team of local experts is required for proper employee liability management. Fortunately, Remunance meets all such employee demands and liabilities. Remunance shields its clients from any legal or financial blow. The next section of this blog describes how so.

The Remunance Ethos: Redefining Employee Wellbeing

International businesses need a totally aware team to handle complex employee liabilities in India. There is no better way to do that than joining hands with the best-in-class employer of record in the country. That way the EOR can take all the employee liability-related responsibilities off the clients’ shoulders. This will help the business flourish in the new country.

Remunance, being the leading EOR partner in India, takes an exhaustive approach towards employee liability for its clients. Remunance covers basic employee liabilities like retirement plans, gratuity, Provident Funds, and medical insurance. It also takes care of employee welfare in a holistic manner. Remunance goes above and beyond to cater to the employee’s needs and demands. Let us discuss some unique features that Remunance offers to employees. This makes their professional and personal lives safe, secure, and trouble-free.

- Health Insurance for Foreign Employees: Health insurance is a prime factor of employee liability. The importance is even more heightened with expatriates or foreign employees. The expatriates being new to the country often find themselves at a loss. They have difficulties understanding the health insurance plans and benefits that are to be provided by the employer. This is where Remunance makes the job easy for its clients. Remunance clarifies and covers all the health-related employee liabilities for the expatriates.

This includes all medical insurance expenses, and routine or emergency health check-ups. This liability coverage provides a sense of relief and health-wise security to expat employees. It also helps them thrive in their new work location. - Employee Welfare Contributions: This type of employee liability is not mandated by the Indian government. Yet, Remunance goes the extra mile to ensure that the overall well-being of the employees is taken care of. Remunance funds for all the necessary employee welfare contributions on the client’s behalf. This includes skill development policies, childcare policies, etc. Other welfare policies include flexible work arrangement policy and casual leave policy among others.

- Leaves and Holidays: Having a proper leave policy is a vital point of employee liability management. It represents the work culture and flexibility of the EOR and its client. However, maintaining a lean and transparent leave policy becomes more complex for international businesses hiring an offshore remote team. Fortunately, Remunance has a team of experts who proactively update themselves about the local leave policies. The team also makes sure that the employees are entitled to all the allotted leaves.

Further, India being rich in culture and heritage witnesses many festivities around the year. Thus there are a few necessary festival holidays as well that are allotted to the employees. This includes Diwali, Vasant Panchami, and Dussehra among others. Proper leave and holiday policy ensures mental satisfaction and an increase in productivity levels among employees. - NPS Contributions: Remunance helps employees with solid financial planning for their retirement. The Indian government follows a national pension system (NPS). Here, the employers help their employees make some voluntary savings that can only be utilized after their retirement. There are certain percentages of tax exemptions for both the employer and the employee if they contribute to the NPS scheme.

- Cultural Diversity: India is known as the land of diversity and for a good reason. It is a mix of multiple cultures, languages, religions, and traditions. The experience of building a remote team in such a diverse country can be fulfilling yet challenging.

Remunance makes sure to promote diversity and inclusiveness among all the employees. It guides the foreign clients on the local cultural practices at the same time. This promotes a positive work environment and helps in employee retention within the organization.

Conclusion

To provide a fine example to our fellow readers, we are concluding this blog with one of the client’s stories of Remunanace. This business has been guided and helped by Remunance to flourish in India. Formality Pty, an Australian-based software company specializes in providing a simplified e-signature platform to customers for easy navigation of documents. The CEO of Formality, Craig Wallace, was looking for the right employer of record partner. The requirement was to get the best employee management solutions while expanding the business in India.

Remunance came as a blessing to Formality and made the India Dream of Formality come true. Remunance holistically took care of all the India employees of Formality. It helped them stay compliant with every employee liability standard in India. Hence, Remunance has over the years set a benchmark for Formality and all of its other clients. It has tactfully handled employee liability in India and ensured maximum employee satisfaction.

Recent

Disclaimer

This blog is created for informational purposes. Everybody is requested to seek advice from an expert before making a decision based on the information given in the blog. Remunance disclaims any liability/loss or damage caused by using the information, directly/indirectly, given in this blog.

Schedule a free call

Schedule a free call