Summary

Understand how Employer of Record services differ largely from payroll solutions. Learn that EOR handles compliance, hiring, and HR, while payroll solutions focus on the salary management of employees. Discover which option aligns best with your business needs for smooth operations and global team management.

An Employer of Record (EOR) and payroll solutions are often confused due to overlapping functions. While both address employee management needs, they operate on entirely different levels. EOR services provide a comprehensive solution for international hiring and compliance. It acts as the legal employer for workers in foreign countries.

Payroll solutions, on the other hand, focus solely on processing salaries and managing tax deductions. Even though both handle employee-related tasks, they serve very different purposes. This blog aims to dissect these two models, clear the air about employer of record, payroll services, clarify their differences, and help you decide which fits your business needs.

What Is an Employer of Record (EOR)?

An Employer of Record is a service provider that acts as the legal employer for your workforce in a particular country. Such an arrangement enables businesses to hire employees in regions where they lack a legal entity.

The employer of record payroll services ensures that the company is compliant with the local labor laws. When it comes to payroll services, employer of record manages it all. It also handles employment contracts, enabling companies to focus on their core operations. EOR is your trusted ally who helps you face the stormy seas of global employment.

That means that the employer of record payroll services acts like a bridge between your company and an international workforce. It ensures all requirements regarding regulation and the law are followed. Unlike payroll services, employer of record also takes care of the fact that you onboard your employees smoothly, and operate in full confidence. It allows you to do so without the setup of a physical or legal presence in another country.

What Are Payroll Solutions?

Payroll solutions are software or service-based systems designed to manage salary disbursement and tax compliance. They act like your in-house accountant’s best friend. Unlike employer of record payroll services, complete payroll solutions cater to businesses that already have a legal entity in a specific country.

However, they are in dire need of efficient payroll processing. Payroll solutions, much like employer of record payroll automate and simplify salary management. But, they do not extend to broader labor law compliance or legal employer responsibilities.

Go through our blog to learn more about payroll services in India

Key Differences Between EOR and Payroll Solutions

Here are the most common and significant EOR vs Payroll Solutions differences described in detail for you:

-

Employment Contracts and Onboarding

Drafting legally sound employment contracts is a critical task, especially in foreign territories. The employer of record ensures that all contracts adhere to local regulations. Additionally, they manage the onboarding process, making sure new hires have everything they need to start their roles effectively.

They ensure that the new hires receive essential resources, tools, policy training, and orientation. This includes facilitating access to local workplace systems, clarifying job roles, and ensuring compliance with cultural and professional norms.

Read through our blog to learn how Remunance conducts effective employee onboarding for all its clients.

-

Employee Lifecycle Support

From onboarding to exit interviews, the EOR manages the entire employee lifecycle. This support extends to resolving disputes, managing benefits, and facilitating employee transitions. A few of the unique ones are elaborated on here:

- Conflict Resolution: EORs mediate disputes, offering you neutral solutions. These solutions comply with your company’s laws and protect employer-employee relationships.

- Benefits Administration: Managing benefits like health insurance, retirement plans, and leave policies, ensuring employees receive entitlements on time.

- Career Development: Some EORs provide training opportunities, career path guidance, and professional development support.

- Exit Processes: From resignations to layoffs, the EOR ensures all legal and procedural requirements are met. This includes severance calculations and final settlements.

-

Compliance with Labor Laws

Every country has unique labor laws, and keeping up with these can be challenging. A few of the challenges are listed below:

- Frequent Updates: Labor laws can change periodically, requiring constant monitoring to avoid violations.

- Regional Variations: Different regions within the same country may have varying regulations, complicating compliance.

- Complex Terminology: Legal jargon and intricate clauses make interpretation and application daunting for businesses unfamiliar with local frameworks.

- Severe Penalties: Non-compliance can lead to hefty fines, legal action, or reputational damage.

Employer of record payroll services ensures you’re always on the right side of them. The EORs take care of all local employment laws, covering aspects like working hours, minimum wages, and termination procedures.

4. Employee Misclassification Prevention

An EOR solution categorizes workers as either employees or independent contractors based on their jobs and responsibilities. Misclassification attracts heavy penalties, litigation, lawsuits, and loss of goodwill for the firm. For example, a wrongly classified employee could claim unpaid benefits or back pay.

Did you know? Some countries like the US and the EU can penalize errant companies that classify employees as independent contractors at the rate of up to USD 100,000 per violation. By conducting thorough role evaluations, EORs mitigate these risks. They handle employee lifecycle in line with classification rules.

The following chart gives you an exhaustive list of the differences between the two models. Care to have a look?

| Aspect | Employer of Record (EOR) | Payroll Solutions |

| Scope of Services | Comprehensive HR, compliance, and payroll support | Focused only on payroll management |

| Legal Employer | Acts as the legal employer for workers | Does not take on the role of legal employer |

| Employee Misclassification | Prevents misclassification risks and liabilities | Offers no solutions for misclassification issues |

| Employment Contracts | Drafted, maintained, and compliant with local laws | Not handled by payroll solutions |

| Compliance Management | Ensures compliance with labor laws, tax laws, and employment standards | Only ensures payroll-related compliance |

| Employee Lifecycle Support | Provides end-to-end lifecycle management, including onboarding and exit support | Limited to payroll functions |

| Geographic Reach | Enables global hiring without local entities | Works best within countries where companies have legal entities |

| Risk Mitigation | High level of risk mitigation across compliance and employment | Low-risk mitigation, specific to payroll |

| Support for Global Expansion | Ideal for expanding into new markets | Not suitable for global expansion management |

| Administrative Burden | Significantly reduces administrative workload for HR and compliance tasks | Reduces payroll-specific administrative tasks only |

| Cost Implications | Comprehensive service comes at an optimized cost but adds value to your remote team | Cost-effective for payroll-only needs |

To give you a more detailed overview of EOR vs Payroll Solutions differences, we have jotted down the key responsibilities of both models. Let’s have a look at them.

What Are the Key Responsibilities of an EOR?

An EOR is more than just a middleman. It shoulders multiple responsibilities to simplify international employment. Here’s what it handles:

- Hiring International Talent: An EOR solution scouts talent across borders and helps you build the dream team.

- Payroll and Tax Management: A report by Ernst & Young said that companies identify payroll as the most significant challenge in managing and securing talent for the company. An employer of record payroll administers the payroll, including salary disbursement, tax deductions, and compliance with local taxation law on your behalf.

- Employee Rights Protection: This encompasses the EOR solutions addressing potential instances of discrimination, harassment, unequal pay, or wrongful termination.

What Are the Key Responsibilities of Payroll Solutions?

This section mainly talks about the significant contributions made by payroll solutions. Hence, you will notice the payroll solutions tasks deviating from the employer of record payroll tasks here.

- Salary Disbursement: Payroll solutions ensure employees are paid accurately and on time. These systems handle complex calculations, including overtime, bonuses, and deductions.

- Tax Compliance: By managing tax deductions and timely filings, payroll solutions help companies avoid penalties for non-compliance.

- Detailed Payroll Reports: Payroll solutions provide comprehensive reports that give insights into payroll trends, tax liabilities, and employee costs.

Eyeing the key features closely, we can establish the fact that “complete payroll solutions” is a widely different concept from EOR solution and EOR payroll.

What Are the Benefits of Choosing EOR Payroll Over Payroll Solutions?

I’m sure you’ve understood the concepts of payroll services, employer of record, and the key differences of EOR vs payroll solutions as clearly as a glass by now. We’ll thus move to the next big things to know about them. Hence the elaboration on the benefits of EOR. Let’s get started.

1. Performance Management

Employer of record provides tools and systems to monitor employee performance effectively. This includes productivity levels, the completion rate of tasks, and the adherence of employees to KPIs. EORs facilitate performance reviews, feedback loops, and goal-setting sessions.

2. Employee Engagement

Employer of record leverages localized expertise to design team-building events and wellness programs and celebrate regional festivals. Regular surveys, feedback sessions, and employee achievement programs help gauge employee sentiment and address concerns promptly. Such customized engagement strategies lead to higher retention rates and a motivated workforce.

3. Employee Satisfaction

Employer of record contributes to employee satisfaction by offering a sense of job security to employees. EOR solution addresses grievances promptly and provides clear communication about policies and expectations. Employees feel valued when their professional and personal needs are met.

4. IT Support

EOR solutions often offer IT support to bridge technological gaps for remote teams. This includes providing secure communication platforms, collaboration tools, and technical assistance. EOR solutions facilitate cybersecurity and swift troubleshooting services.

5. IP Protection

EOR solution drafts comprehensive employment contracts that include clear intellectual property (IP) clauses. These contracts specify ownership of creations, inventions, or ideas developed during employment. EORs ensure that businesses retain exclusive rights to their intellectual assets. They minimize risks associated with IP theft or misuse.

Which One Between EOR Payroll and Payroll Solutions Should You Choose?

Here comes the pivotal question for which you’ve gained knowledge about EOR payroll and complete payroll solutions from this blog and maybe 10 others that you’ve come across. While measuring on a weighing scale, both models will have their respective wins in some situations. Let’s assess those situations starting with the EOR payroll.

However, which model among EOR vs payroll solutions wins when it comes to a decision? Well, this is entirely based on what your business demands. Let’s see how.

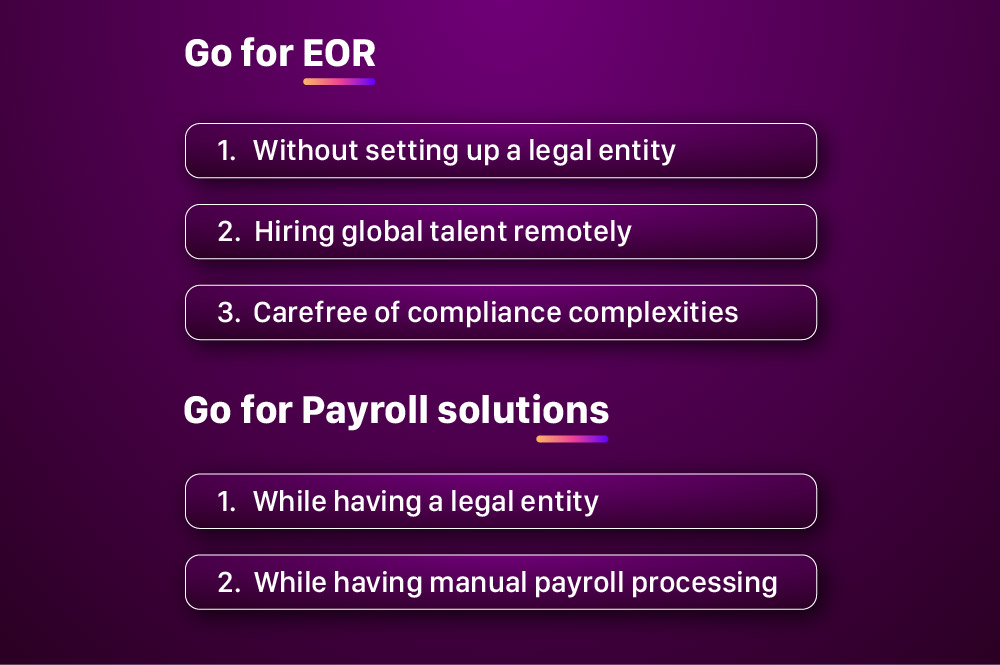

Choose employer of record payroll services when:

Expanding into New Countries or Regions Without Setting Up a Legal Entity

Setting up a legal entity in a foreign country is expensive and time-intensive. It may take months to establish a presence, especially when navigating unfamiliar regulations. An EOR eliminates the need for a legal entity by acting as the employer on paper. This allows you to operate in the new market almost immediately.

Startups Hiring Remote Global Talent

Startups often want to hire the best talent worldwide but lack the resources to cope with international compliance. Employing talent from different countries means dealing with diverse employment structures. Take, for example, facilitating payment in local currency. For a lean startup, handling this complexity in-house is impractical. EORs simplify the process by managing these intricacies on your behalf.

Companies Seeking to Offload Compliance Complexities

An EOR becomes your compliance partner. They ensure your employees are hired and paid legally by staying updated with local regulations. They relieve businesses of the burden of varied tax regulations, and employment standards.

Opt for Complete Payroll Solutions when:

Companies with Established Legal Entities in a Region

Companies that already have a legal entity and HR infrastructure, may not need an EOR to provide its services. However, the payroll management is still handled manually. This entails that mistakes, delays, and inefficiencies can persist. A complete payroll solution connects to the company’s HR system to ensure accurate and timely payments.

Businesses That Independently Manage Compliance and HR But Need Efficient Payroll Processing

Even if your company has a strong HR and compliance team, payroll calculations are prone to human error. Manual mistakes can lead to underpayments, tax penalties, or employee dissatisfaction. Payroll solutions use algorithms to process accurate calculations and automate reporting.

Conclusion

I will conclude this blog by creating a Venn diagram comparing payroll services, employer of record as two individual sets. The diagram portrays that all EOR services take care of payroll solutions for employees. However, no payroll solution assumes the responsibilities of an EOR.

Their point of intersection lies in timely and accurate payments to all employees. Now which set to choose? I’m confident that this blog is capable of helping you with that. If you still need more clarity or information, our experts are always available to cater to your queries.

FAQs

What is the primary difference between EOR and payroll services?

EOR manages the entire employment lifecycle, including compliance, onboarding, benefits, and payroll, while payroll services merely process employee salary and tax deductions.

Why do businesses need EOR over payroll services?

EORs provide an all-in-one employment solution, including legal compliance, labor laws, and employee benefits, and are perfect for international hiring or expansion. Payroll services do not manage employment liability or compliance issues.

Is an EOR better at managing international employees than payroll services?

Yes, EORs are experts in the local labor laws, tax regulations, and compliance of various countries, which makes them more capable of managing employees globally than payroll services.

Does an EOR include payroll services in its offering?

Yes, payroll management is one of the many services offered by an EOR. However, it is combined with compliance, benefits administration, and HR support to provide a full employment solution.

Is an EOR appropriate for startups and small businesses?

Absolutely! EORs enable startups and small businesses to expand internationally without needing a local entity. They handle all compliance, reducing risks and allowing businesses to focus on growth.

Schedule a free call

Schedule a free call