Summary

Looking to hire globally without setting up a local entity? An Employer of Record (EOR) offers a faster, low-risk way to expand. From $99 to $2,000/month per employee, EOR costs vary by region, services, and benefits. Here’s how to optimize your cost without cutting corners.

Understanding the true cost of an Employer of Record (EOR) becomes absolutely vital for any organization planning to hire internationally. As global teams become more common, Global EORs provide a compliant, cost-efficient, low-risk solution.

But how much does an employer of record cost, and what are the benefits you get by onboarding a reliable EOR partner?

What Determines the Cost of an Employer of Record?

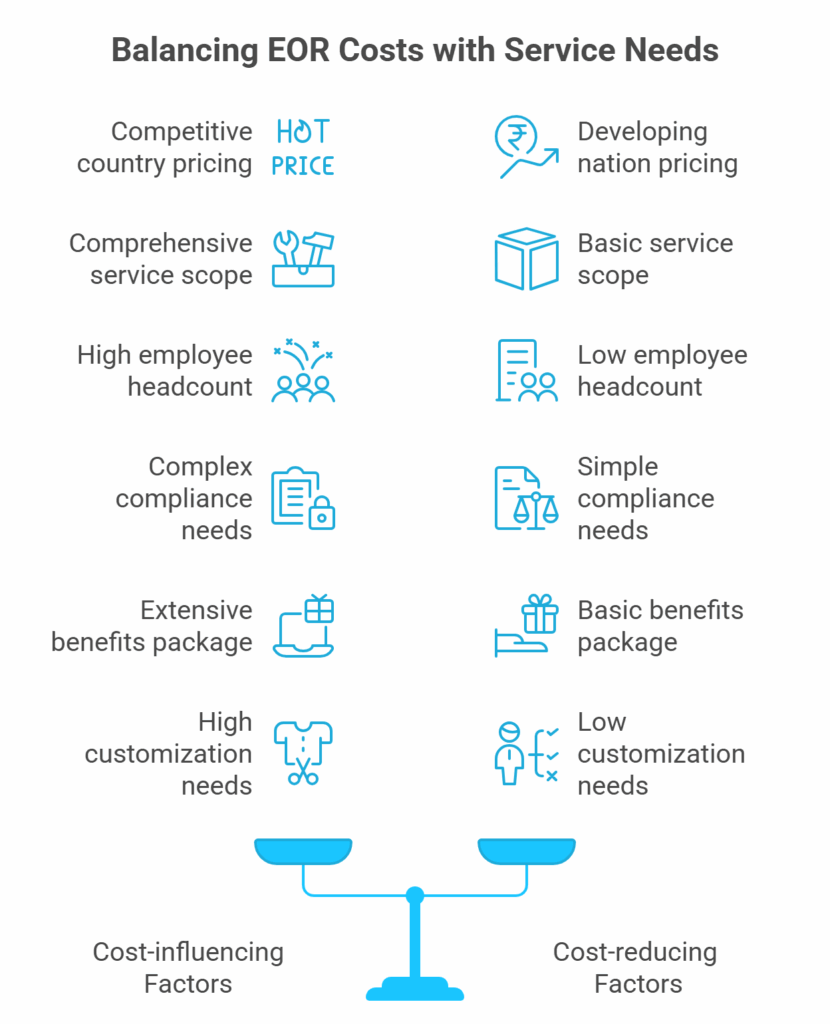

The pricing of EOR services depends on six core factors:

-

- Country of employment – One key element that determines the base pricing and all the associated costs with hiring is the country of employment. More competitive countries/ the developing nations are able to present more lucrative pricing when compared with the countries that introduce the concept of EOR services.

- Scope of services – Another element that walks hand in hand with the country of employment is the scope of services opted for while choosing the ideal EOR partner for your business needs. This huge swing in price is a result of EOR as a whole offering many services bundled together, ranging from recruitment support to IT asset management.

- Employee headcount – While not a major factor, employee headcount can help you get a good discount across the board, as you have good bargaining power over everything, right from managed offices to IT assets.

- Complexity of compliance – Compliance can truly be a headache, particularly if you are operating in a niche domain. This also means more documentation and a lot of legal jargon to navigate through, and this is what could lead to a rise in the cost of the contract or the final cost of the Employer of Record to run your operations.

- Benefits offered – The benefits you wish to pass on to your employees also alter the cost of EOR significantly. A lot of the organizations go for a very basic package of health insurance and retirement contribution (PF/ 401K), while others could opt for additional benefits like bonuses, wellness programs, annual getaway, etc.

- Customization needs – The last element that could increase your final EOR cost is the degree of customization you wish to attain in your contract. Deviating from the common offering for a style that reflects the style of your parent organization could contribute actively to increasing the Employer of Record cost.

Need Tailored Guidance for Your India Launch?

Book a free 30-minute strategy call with our India market entry specialists.

Book Your Free Strategy CallEmployer of Record Pricing Models

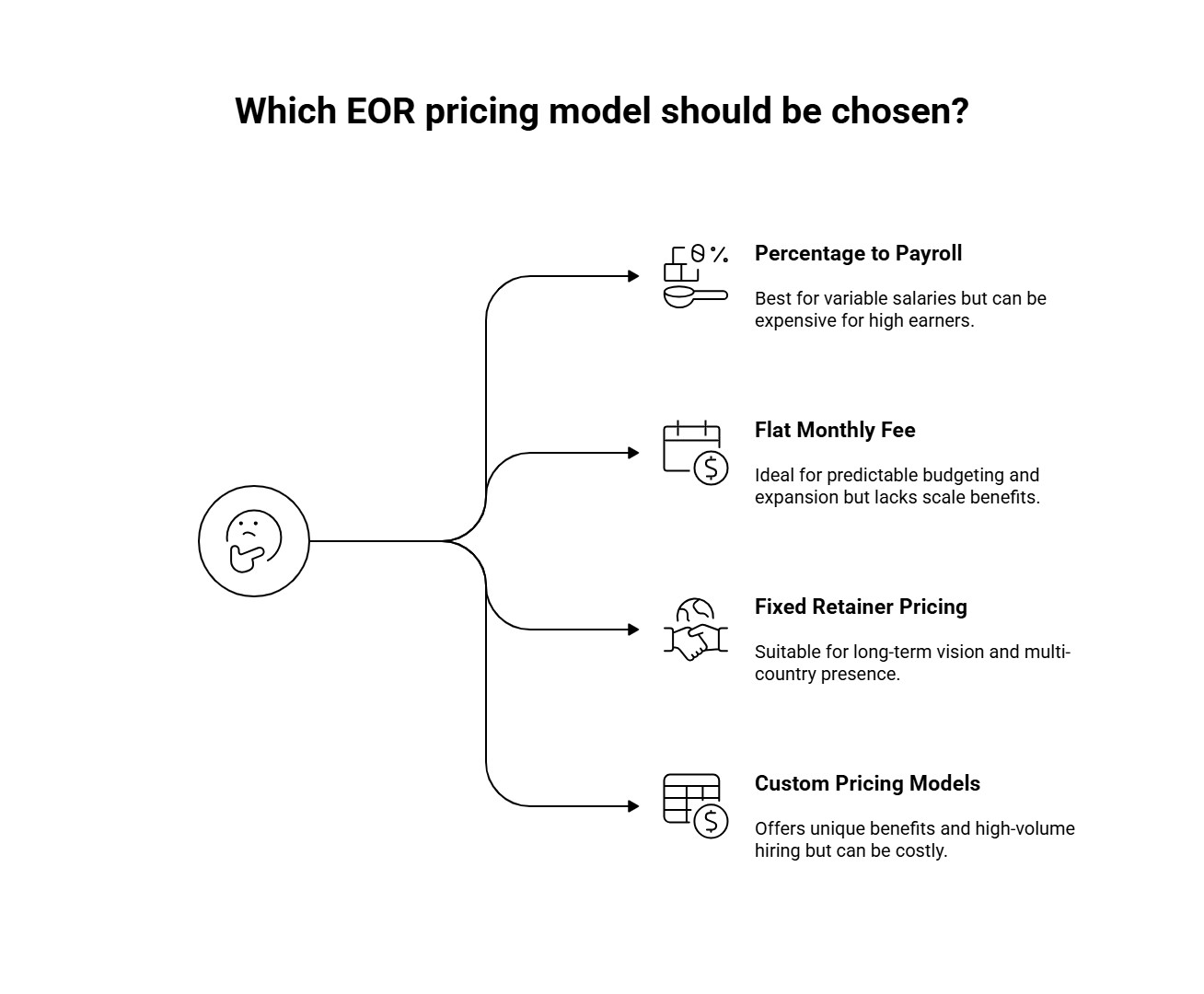

1. Percentage of Payroll

Percentage to payroll is one of the most common and industry-wide accepted models that offers flexibility and is best suited for smaller organizations and companies with employees who have highly variable salary ranges or salaries on a lower spectrum.

The Range at which the EOR companies charge is set at roughly 5% to 20% of gross monthly salary. However, the very risk associated with this mode is that it becomes exponentially expensive for high-earning employees.

2. Flat Monthly Fee Per Employee

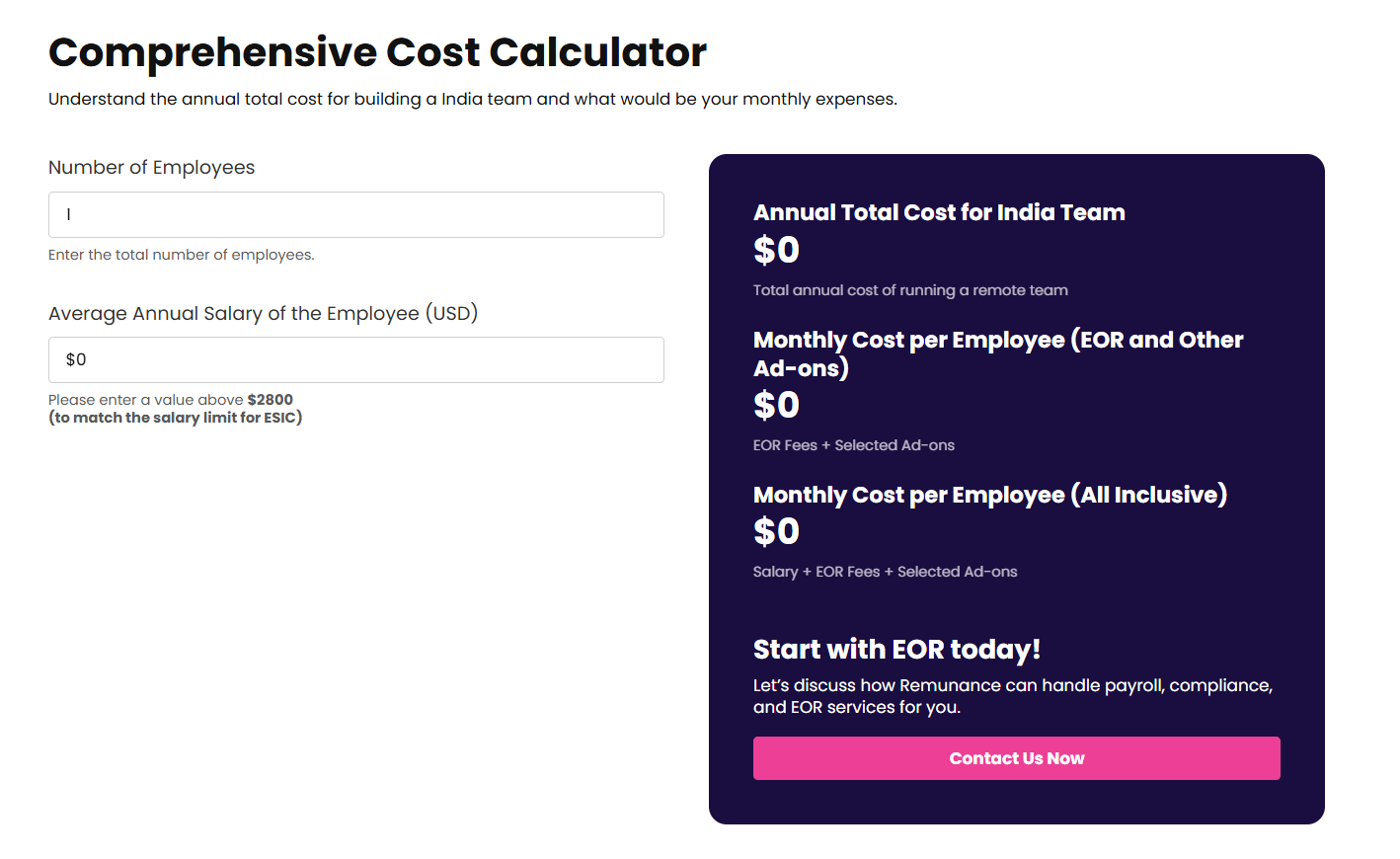

This is the best model when it comes to optimizing the cost of Employer of Record for your business expansion. In this model, the EOR partner or your global EOR service provider would charge you a fixed monthly fee per employee that ranges from $99 for low-salaried individuals and can go as high $2000 for the US workforce.

Organizations like Remunance, however, help you with finding the best Indian resources for your business, and as they are a local EOR (Indian EOR), they would never charge you above $250 per employee per month.

Local EOR businesses like Remunance generally charge their client monthly EOR fees of $99-$249. You can click on the calculator below to get the exact idea and details of the associated fees.

The key benefits of this model are that it helps organizations with predictable budgeting for the future and is ideal for businesses that are looking forward to aggressive business expansion or setting up an operations center through satellite offices in India.

The only limitation associated with this model is the lack of opportunity for economies of scale for large headcounts.

3. Fixed Retainer Pricing

The third most commonly used model by EOR service providers is the fixed retainer pricing model, which is built for organizations that have a long-term vision with the hired resources and do not wish to scale/ increase the number of headcount significantly in the near future.

Fixed retainer pricing model covers a pre-agreed number of employees over a term period and is mostly used by organizations that avoid variable costs and have a multi-country presence/ mission.

4. Custom Pricing Models

The fourth pricing model is the one that comes with a few notes and conditions of its own. It is best suited for organizations looking to offer unique benefits, have a hybrid entity, or are looking to go on roll with high-volume hiring across the market.

As this model is built to cater to the exact requirement of the business looking to expand their workforce overseas, this model has no particular drawback; the only point pulling it down can be the costs associated with the customization.

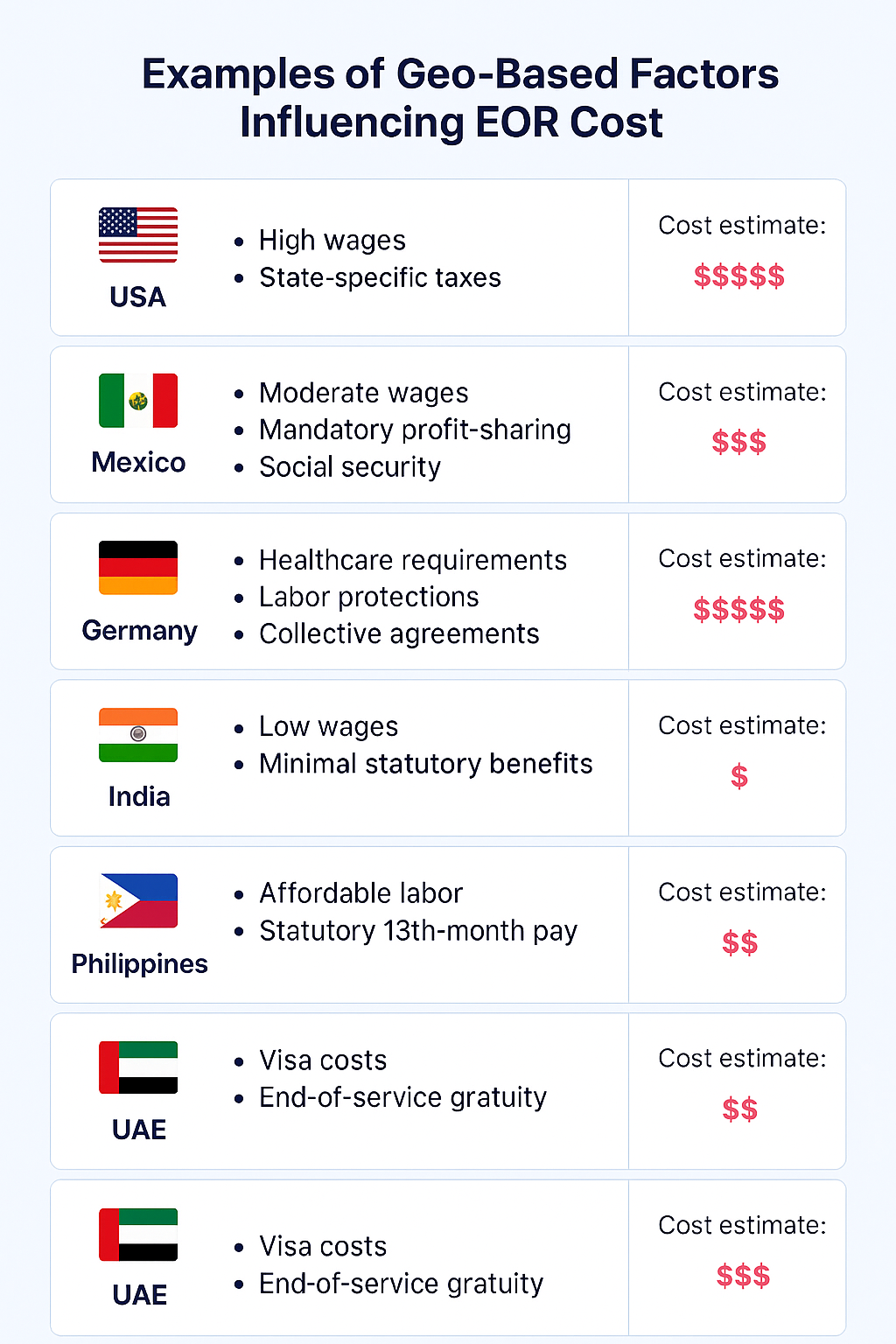

Actual EOR Pricing by Country

| Region | Average Cost per Employee/Month |

| United States | $1,000–$2,000 |

| United Kingdom | £600–£1,200 |

| Germany | €800–€1,500 |

| India | $99–$400 |

| Singapore | $400–$1,200 |

| Brazil | $600–$1,200 |

| South Africa | $250–$700 |

These are indicative ranges and may vary based on provider and scope of services.

Direct Cost Breakdown

| Cost Category | Estimated Range | Notes |

| Setup Fee | $500 – $2,000 | One-time onboarding |

| Monthly Fee | $300 – $2,000 | Based on country & services |

| Security Deposit | 1–2 months of salary | Refundable |

| Compliance & Legal | Included or $500–$2,000/year | Country-specific laws |

| Benefits Admin | $100 – $500/employee/month | Optional or bundled |

| Termination Cost | Varies by market | Based on notice and local law |

| Visa/Immigration | $500 – $5,000+ | For sponsored hires |

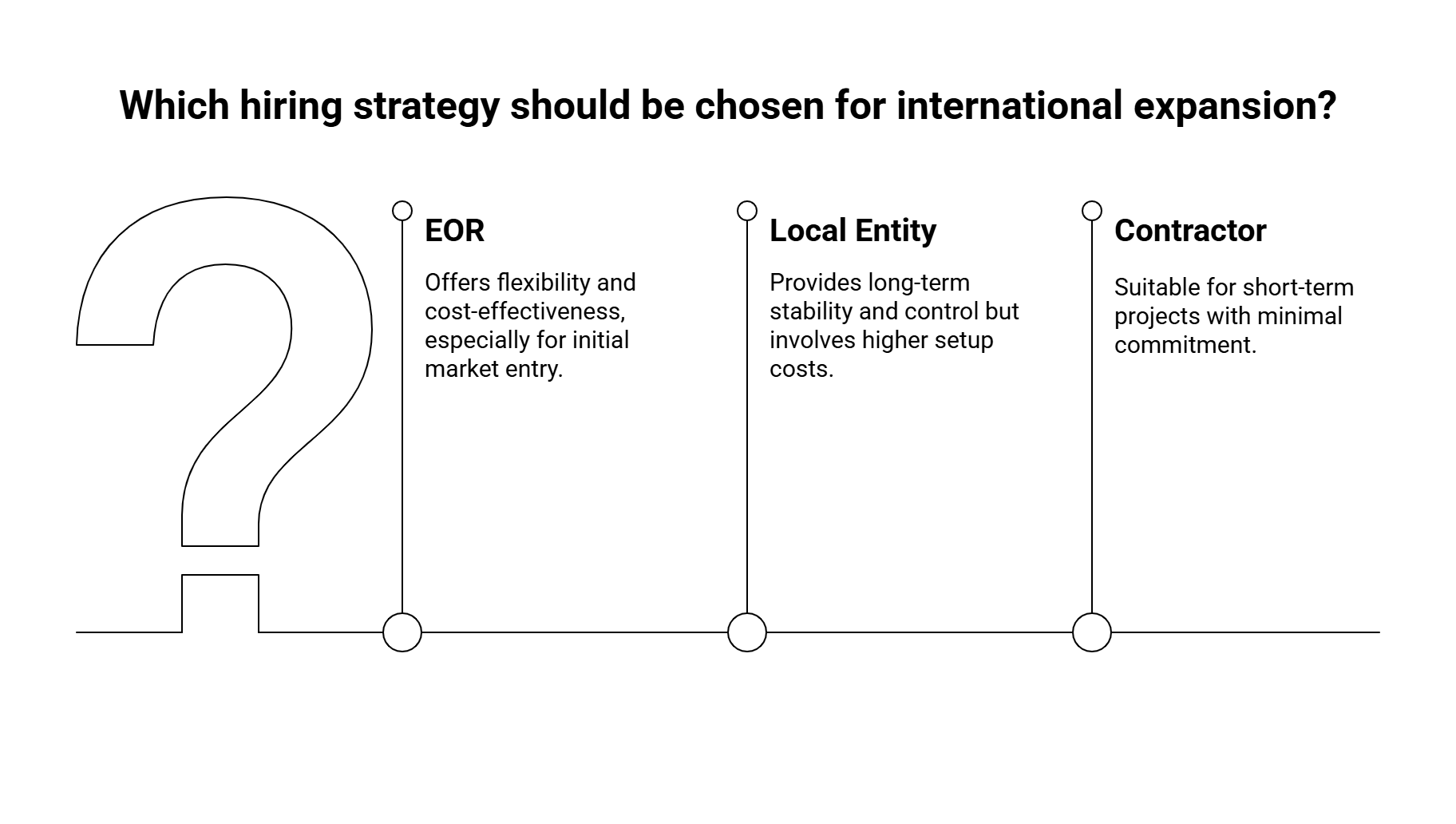

EOR vs Local Entity vs Contractor Costs

While an ideal breakdown of an EOR vs a Local entity would look like what has been mentioned below, you can read about the other associated costs and which could potentially be the costs that could be avoided in our blog, EOR vs establishing an entity.

| Expense | EOR | Local Entity | Contractor |

| Setup Cost | $500–$2,000 | $10,000–$50,000+ | $0 |

| Monthly Admin | $99–$2,000 | $5,000–$20,000+ | $0 |

| Payroll Compliance | Included | $1,000–$5,000/year | Not included |

| Tax Filing | Included | $1,000–$3,000+ | Not applicable |

| Office Costs | Not applicable | $2,000–$10,000/month | Not applicable |

| Termination Costs | Included or minimal | Legal + Severance | Often none |

The best part of the above-mentioned blog, Eor vs Establishing an entity, is that it comes with a cost calculator, so you have all the freedom to plug and play your numbers, take our tool for a ride.

The EOR vs local entity tool also helps you understand what difference it would make in terms of pricing to have an entity in India or hire resources in India as compared to European countries such as the United Kingdom and Germany.

What’s Included in EOR Fees?

There is a major misconception that EOR costs are directly associated with payroll and related expenses. EOR costs cover much more than just payroll; it takes care of compliance requirements, tax withholding, onboarding, retirement funds, insurance monitoring, leave policy management, bonuses, performance tracking system, employee engagement tools, and even ESOPs.

How to Reduce EOR Costs Without Compromising Compliance

While EOR cost is something that significantly leads the decision of choosing the right Employer of Record, it isn’t just about finding the cheapest option. It’s about cost-efficiency without legal or operational risk.

So, to find a perfect match between cost efficiency and compliance, here is a short checklist on things you can do to reduce EOR costs without compromising on compliance and legal parameters.

1. Hire in Cost-Effective Regions

The simplest way to manage compliance and cost is to prioritize developing countries as your preferred location. As a rule of thumb, developing nations are opportunity hungry and very appreciative of capital invested in their workforce.

So the best countries to fit this bracket are India and the Philippines, where India stands out as the country with the highest English-speaking and work-ready population.

2. Limit Add-On Services

EOR services (especially the tool-based EOR) are bundled with numerous offerings. Make sure you select the tools/ add-ons you require, and remove all the optional benefits. Make sure you select only things needed legally, so you are able to effectively cut down on the recurring costs.

3. Negotiate Volume-Based Discounts

The best way to secure discounts is to work through economies of scale, so if you plan to scale or have a big team handy, work to get the discounts locked in for the number of employees. Few EOR service providers even offer tiered discounts for the number of hires.

4. Localize Payroll Cycles

Payroll, when done locally, ensures you are able to provide the best facilities for your workforce and remain highly compliant with the local law. Being compliant with local law ensures you save millions of dollars in the future.

Need Tailored Guidance for Your India Launch?

Book a free 30-minute strategy call with our India market entry specialists.

Book Your Free Strategy CallWhen Is an EOR Cheaper Than a Local Entity?

There are a few scenarios when EOR is better than setting up a legal entity, one of which is having less than 10 full-time employees in a country, as in this scenario, it doesn’t make sense to go through the process of spending $20k-$100K to get an entity registered.

Opting for an EOR (Employer of Record) instead of establishing a local entity can be a strategic advantage when time is critical. With an EOR, you can hire and onboard your workforce within a week or two, enabling you to get up and running much faster.

While this may not directly save money upfront, it significantly reduces the time-to-market, allowing your team to start delivering results within weeks rather than the months it would typically take to set up a local entity. This faster ramp-up can lead to greater overall cost savings by accelerating your operations and minimizing delays.

Last but not least, it makes perfect sense to go with an EOR and not worry about the EOR cost if you want to avoid permanent establishment risk.

Hidden Employer of Record Costs to Watch For

| Hidden Cost | Impact |

| Early Termination Fees | Charged if you end the contract before the agreed term |

| Currency Conversion | Margins added by providers for paying in local currencies |

| Mandatory Bonuses | Required in countries like Brazil or India |

| Backdated Compliance Penalties | If misclassification occurs |

| Onboarding or Exit Admin Charges | Charged per employee outside the monthly fee |

Employer of Record Cost vs Value

As we have discussed in the article above, the cost associated with EOR is not always bad; while some EORs may charge higher fees, they often bring substantial value, such as:

-

- Faster time to market – Quick onboarding and fast resource integration could add immense value to a few organizations over the direct costs associated with the EOR services, so they would perceive that as money well spent over the general EOR costs.

- Reduced legal exposure – EOR service providers in India, like Remunance, are local compliance and payroll experts who take care of all the tax withholding and documentation, which reduces legal exposure significantly and safeguards the organization from PE risk, saving money in the future.

- Effortless scaling into new countries – While a few EORs cost a lot more than the others, they could be a lot more beneficial than a cheaper EOR, as they could support your new country exploration and even multi-country payroll, saving time and resource involvement.

- Elimination of HR administrative load – A lot of EORs are loaded with HR functionalities such as recruitment and benefit monitoring, while the cheaper EORs may skip on those things to make it price-effective. If the saved EOR cost adds HR administrative load on your organization, it may not be worth it.

- Improved employee satisfaction and retention – Legacy EORs or local EORs with years of experience piled up generally have great employee retention policies and even work towards employee welfare goals and offer great employee benefits, so it would be worth spending those extra bucks on getting a more “Expensive EOR.”

These benefits often outweigh the marginal increase in cost, especially in legally complex or high-risk regions.

Is EOR Worth the Cost?

Looking at the bigger picture, yes, the cost of EOR is completely justified as it helps you work towards your goal of global expansion. With a good EOR, you are able to reduce risk, minimize your upfront costs, and safeguard yourself from local compliance. With an EOR, the upside is immense.

But select carefully to align the cost with the level of support your business needs.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.