Summary

This article breaks down India’s minimum wage in USD for 2025. It opens with a historical view of the Minimum Wages Act of 1948 and the revolutionary Code on Wages, 2019. The twin function of central and state governments helps to explain how wages vary depending on sector, geography, and degree of skill level.

This blog offers a thorough investigation of India’s minimum wage in USD scene for 2025. We go over the changes in pay policies, look at regional differences, and talk about how these affect local companies as well as foreign investment. To negotiate this complicated environment, our study covers historical background, legislative reforms, sector-specific breakdowns, and compliance techniques.

Evolution of Minimum Wage Policies in India

Historical Context and the Minimum Wages Act

Beginning with the adoption of the Minimum Wages Act of 1948, India’s attitude to pay control has a legendary background. This law has changed and been amended several times throughout the years to fit the demands of a changing economy. Originally intended to establish a floor for income in a post-colonial environment, the Act has given the basis for pay calculation in many different fields. The Act gives central and state governments authority to set minimum salaries fit for local circumstances and industry-specific needs.

The Code on Wages, 2019

A significant turning point in India’s labor laws came with the 2019 Code on Wages. Combining various prior statutes, the Payment of Wages Act, the Minimum Wages Act, the Payment of Bonus Act, and the Equal Remuneration Act Code streamlined the structure for pay control. Although regional and sectoral differences are still permitted, the new laws offer a more uniform and flexible approach. Its focus on Consumer Price Index (CPI)-based changes guarantees that salary levels remain in line with the cost of living, so it is a key instrument for upgrading labor laws.

National Minimum Wage Framework – Central and State Roles

Dual Authority in Wage Determination

India does not set a minimum wage based on one size fits all. Instead, the regulatory structure is distinguished by a dual system of wage computation:

- The central body sets minimum pay for some jobs with national relevance. This guarantees that a uniform pay floor benefits roles and important sectors.

- State Government Discretion – Though most pay decisions are under the purview of state governments. Every state crafts its pay rules depending on industry composition, cost of living, and local economic situation.

This dual structure causes notable differences among areas, which calls for rigorous analysis of local conditions by companies and investors.

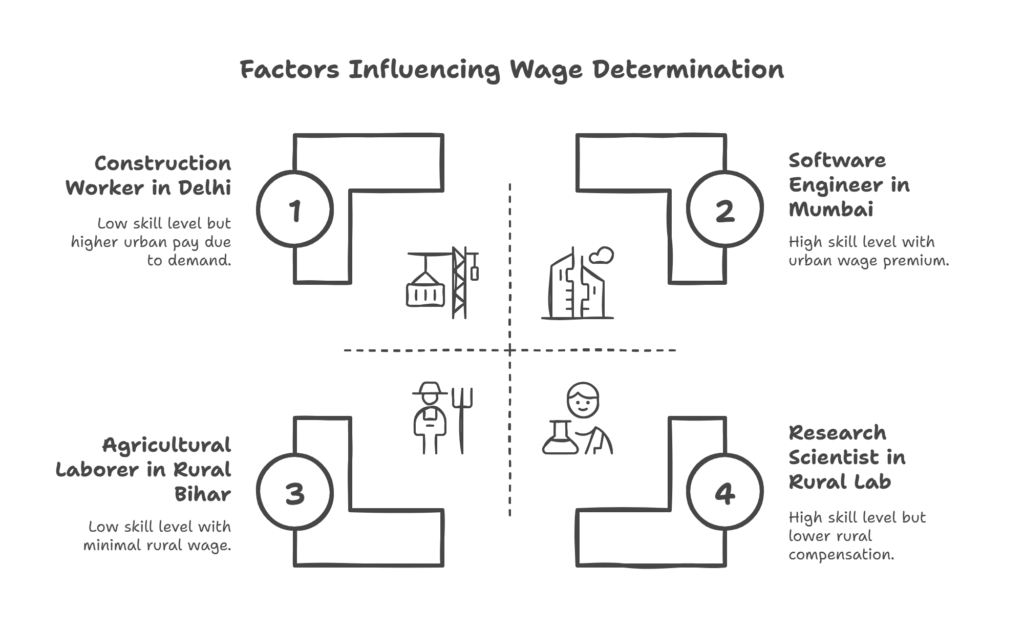

Key Factors Influencing Wage Decisions

The minimum wage in India is determined by a variety of factors, including:

- Skill Level: Workers fall into unskilled, semi-skilled, skilled, or highly skilled categories. Pay scales change to match the degree of knowledge needed.

- Geographical Area: Apart from states with different economic profiles, urban and rural areas have pretty different wages. Higher cost of living areas like metropolitan centers typically pay more.

- Nature of Work: Jobs with dangerous or demanding conditions usually call for better minimum pay. This guarantees a pay commensurate for the risks involved.

- Sectoral Differences: Each sector, including mining, construction, maintenance, and agriculture, has a different pay system. This sector-specific strategy lets one make focused changes depending on the state of the business.

Understanding India’s Minimum Wage in USD – Conversion and Global Context

Converting INR to USD

India’s minimum pay should be expressed in USD, given the worldwide emphasis on economic competitiveness. Accounting for purchasing power parity and current exchange rates forms part of the conversion process. For example, although the national minimum pay may be set in Indian Rupees (INR), its USD equivalent provides a more readily available comparison for companies functioning internationally and foreign investors.

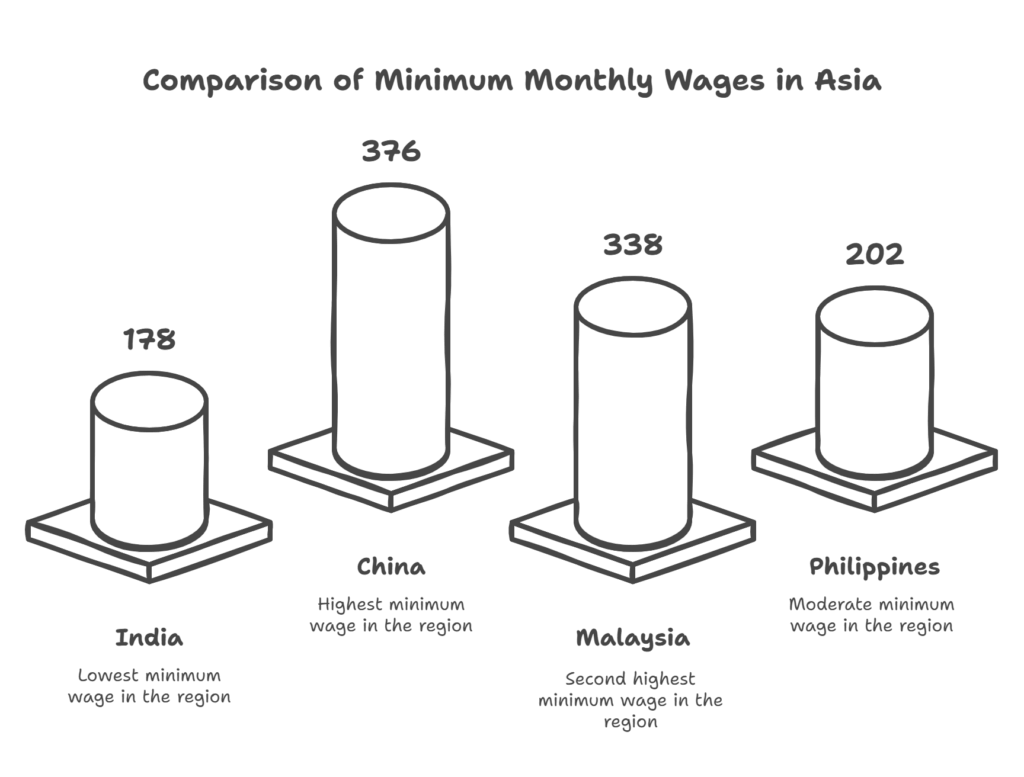

Comparative Analysis with Regional Economies

India’s minimum pay still falls on the lower end of the scale when compared to surrounding nations. For instance, whereas India’s minimum pay is about USD 178 per month, other countries in the region provide far greater rates:

This disparity emphasizes not just the cost advantage for Indian labor-intensive businesses but also the difficulties in guaranteeing an acceptable quality of living for employees. By offering this contrasting viewpoint, we enable companies to grasp the local competitive dynamics.

Sector-Wise Analysis of Minimum Wages in India

Agriculture: Foundational Insights

With so many people working in it, agriculture still the pillar of India’s economy. Different areas have quite different minimum pay for agricultural laborers. States with strong agriculture policies modify their pay system to account for local cost-of-living indices as well as seasonal fluctuations.

- Unskilled Workers: Rates in some regions may start as low as USD 5.40 per day.

- Skilled Labor: Highly skilled workers in agriculture can command wages approaching USD 7.80 per day.

These variances guarantee that pay scales are competitive and mirror of the local economic situation.

Mining: Above and Below Ground Disparities

The mining industry offers a special situation whereby pay systems differ depending on the type of work above ground against below ground operations.

- Above Ground Operations: Unskilled workers might receive wages starting at approximately USD 6.30 per day.

- Below Ground Operations: Due to the increased risks and working conditions, wages for similar workers can be as high as USD 7.80 per day.

These distinctions are critical for employers in managing labor costs and ensuring compliance with safety and wage regulations.

Construction & Maintenance: Detailed Breakdown

Another sector with complicated salary trends is the building and maintenance one. Given India’s fast urbanization, pay criteria in this industry are always changing.

- Unskilled Labor: Geographical location determines daily costs ranging from USD 6.30 to USD 9.30.

- Semi-Skilled and Skilled Workers: Usually earning much more to reflect their experience and the complexity of the task involved, these employees gain from a systematic pay progression.

- Overtime and Special Conditions: To reflect longer work hours, the Code on Wages requires overtime pay usually at double the ordinary rate.

This detailed breakdown is essential for businesses that need to maintain accurate budgeting and cost estimations.

Regional Disparities In-Depth Case Studies

Kerala – A Model of Moderate to High Wages

Kerala distinguishes itself with its particular socioeconomic situation and more focus on worker welfare. Reflecting the state’s progressive labor policy and greater cost of living, minimum salaries in Kerala are usually moderate to high.

- Wage Trends: While professional workers can get upwards of USD 205, unskilled labour in Kerala is thought to pay on average USD 140.

- Local Policies: The state is a model for other areas since its proactive policies in matching salaries with living expenses have helped to align them.

New Delhi -The Urban Benchmark

As the capital, New Delhi naturally shows more minimum salaries influenced by industrial activity and greater cost of living.

- Wage Rates: Unskilled laborers in New Delhi may make about USD 215 a month; semi-skilled and skilled workers would make increasingly more.

- Economic Factors: Higher pay rates are a result of the concentration of corporate headquarters, growing service industry, and great demand for trained workers.

Additional Regional Examples

Other states such as Maharashtra and Karnataka also demonstrate distinct wage patterns:

- Maharashtra and Karnataka: Usually because of urban concentration and industrialization, these states have higher minimum salaries. Companies here have to take market-driven pay into account in addition to the statutory minimums to draw qualified workers.

- Bihar, Jharkhand, and Odisha: These areas often have lower minimum wages, which reflect reduced living expenses and an essentially agricultural economy.

The regional differences highlight the need of companies customizing their pay plans in line with local circumstances and economic reality.

Workflow of Minimum Wage Determination in India

Minimum wage distribution is not as straightforward as it looks; in India, multiple factors are considered before the trigger of minimum wage sets in!

It all starts with the general economic assessment, followed closely by the cost of living of the targeted region. The second factor that sets in is the skill level of the target employee; semi-skilled labor costs considerably less than skilled labor in the urban locale.

In addition, the local government inputs (regional/ state) with the industry operation capacity and regional economic conditions take the last action in deciding the wage best suited for the employee.

Implications for Business and Foreign Investment

Cost Estimation and Budgeting

Accurate cost calculation for companies ready to operate in India depends on knowing the minimum wage structure. Turning salaries into USD offers overseas investors a clear baseline. Especially in labor-intensive industries where pay costs account for a sizable portion of total spending, this helps to improve planning and resource allocation.

Ensuring Legal Compliance and Avoiding Penalties

Following India’s minimum pay rules is not a choice. Severe financial fines, legal action, and reputational harm can all follow from non-adherence. Companies have to keep alert about regular pay rate changes and modify their payroll systems in line. To make sure all legislative criteria are satisfied, we advise frequent audits and legal expert consultations.

Strategic Advantages in Talent Acquisition

The cost-competitive pay environment of India offers companies chances to draw a sizable, trained workforce. This benefit, then, has to be weighed against moral work ethics and competitive pay scales. Companies can improve their personnel acquisition plans and keep local law compliance by matching pay policies with industry benchmarks and area requirements.

Impact on Foreign Direct Investment (FDI)

The rather low minimum pay in India is a two-edged blade. One may argue that it provides a notable cost benefit, which draws FDI particularly in industries like manufacturing and IT services. Conversely, it also reflects more general socioeconomic issues that might affect worker happiness and output. Investors wishing to enter the Indian market need a sophisticated knowledge of these dynamics.

India’s Minimum Wage Compliance and Enforcement Mechanisms

Legal Framework and Government Agencies

Multiple government agencies oversee the enforcement of minimum wage laws in India:

- State Labor Departments: Implementing and monitoring pay rules inside their respective states falls mostly on these authorities.

- Inspectorate of Labour: Regular audits by specialized inspectors guarantee that companies follow minimum pay policies.

- Labor Courts and Tribunals: When there are conflicts, these courts act as the last arbiters to guarantee workers get their due pay.

Filing Complaints and Seeking Redress

Workers who believe their pay falls short of statutory minimums have several channels for remedy:

- State Labor Departments: Formal complaints can be lodged by employees with the local labor department.

- Labor Courts: Labor courts’ lawsuit in unresolved conflicts can ensure compliance and guarantee back pay.

- Union Representation: For employees dealing with pay issues, trade unions sometimes offer legal counsel and support.

Best Practices for Employers

Employers should put strong internal procedures in place to reduce non-compliance risks:

- Regular Audits: Review payroll systems often to guarantee follow-through to the most recent pay rules.

- Accurate Record-Keeping: Keep thorough records of allowances, overtime, and salary to help audits be transparent.

- Employee Training: Teach payroll and HR departments the nuances of minimum wage rules and any recent changes, or better yet connect with Employer of Record service providers so they can take care of all the local compliance requirements.

These techniques help companies create a culture of compliance and fairness while shielding themselves from legal and financial concerns.

Future Trends in India’s Minimum Wage Landscape

CPI-Based Revisions and Economic Adjustments

Regular adjustments based on the Consumer Price Index (CPI) define one of the main features of India’s minimum pay policy. This system guarantees that pay scales stay sensitive to changes in cost of living and inflation. We expect ongoing dependence on CPI-based adjustments as the economy develops to reconcile worker welfare with competitiveness.

Sector-Specific Revisions and Informal Sector Integration

Emerging trends show an increasing focus on pay changes tailored to particular sectors. Industries with great labor-intensity or those prone to fast economic change will probably undergo more frequent changes. Moreover, initiatives to include pay rules into the unofficial sector where a sizable fraction of India’s labor is engaged are projected to gather steam. These steps are meant to bring more workers within the cover of legislative protections.

Predictions for 2025 and Beyond

Looking ahead, a number of important developments are probably going to define India’s minimum pay scene:

- Increased Harmonization: Although regional inequalities will always exist, there could be slow movements toward unifying pay standards to minimize major state variances.

- Enhanced Enforcement: Rising awareness and better technology systems should help to make wage law enforcement more strong, thereby lowering non-compliance rates.

- Global Benchmarking: India can progressively benchmark its pay practices to international norms as global economic integration deepens in order to draw foreign investment and provide a fair quality of living for workers.

These patterns highlight the dynamic character of India’s labor market and the requirement of companies to keep flexible in their pay control policies.

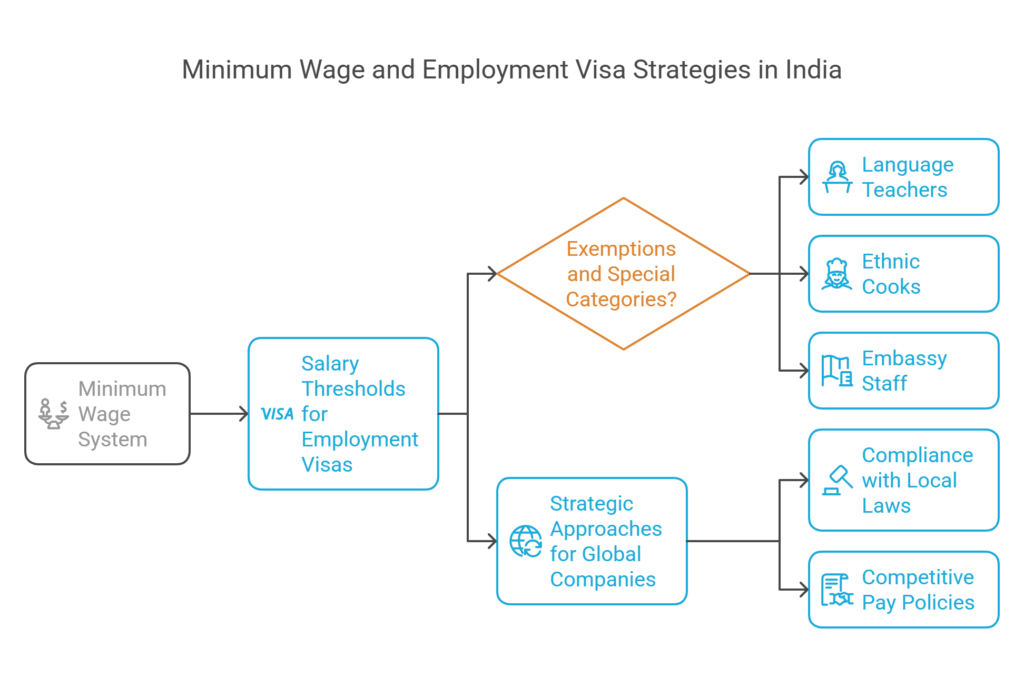

Minimum Wage Issues for Foreigners and International Companies

Salary Thresholds for Employment Visas

The minimum wage system does not particularly apply to expats employed in India. Still, there is a required pay scale for getting an employment visa. Most expatriate positions now demand a minimum yearly pay of USD 25,000. This criteria guarantees that foreign experts get competitive pay and that their employment does not negatively influence local employment market.

Exemptions and Special Categories

Some foreign workers—such as language teachers, ethnic cooks, or embassy staff may be exempt from the regular pay scale. Multinational companies must grasp these subtleties if they are to create their expatriate pay plans. By means of thorough contact with immigration specialists, one can negotiate these exceptions and guarantee seamless visa processing.

Strategic Approaches for Global Companies

Globally running companies in India have to use a two-prangle approach. Compliance and workforce stability depend on wages policies being internally in line with local laws. Externally, by means of competitive and equitable pay policies, the company can establish ethical employment practices and draw top people, therefore strengthening brand name. This double strategy not only reduces legal risks but also improves the company’s reputation in a cutthroat workforce.

Conclusion

Designed to provide companies, investors, and legislators the tools they need to negotiate a complex and changing terrain, our thorough reference to India’s minimum wage in USD for 2025 is meant to Understanding the historical development, legislative changes, and regional differences helps stakeholders to make wise decisions that strike a mix between ethical labor standards and cost effectiveness.

We have looked at the twin function of central and state governments, underlined sector-specific pay systems, and matched India’s pay standards with those of surrounding countries. We have also covered compliance systems, the effects of upcoming trends, and particular issues for international businesses and expatriates. Equipped with this thorough understanding, companies may boldly enter the Indian market using its cost advantages and guarantee strong regulatory compliance.

Anyone trying to grasp the complexity of India’s minimum wage system will find a vital tool in our in-depth investigation. Businesses can not only reach compliance but also create an environment that upholds fairness and competitiveness by means of meticulous preparation and smart execution. We hope this guidance will be a great instrument for effective market launch and steady development in India.

Schedule a free call

Schedule a free call