Summary

Closing your Indian subsidiary can become a difficult decision, especially when you have top Indian talent you don’t want to let go of. With an EOR, you don’t have to. Before closing your subsidiary, you can employ an EOR model and transition your employees to continue working with them. All while meticulously striking off your company.

Closing a subsidiary company is no piece of cake and we all know that. The reasons to close a subsidiary could vary from changes in market conditions, a shift in business strategy, or reallocation of costs.

Regardless of these reasons, closing an entity always gets complex and complicated. This involves dealing with regulatory filings, tax clearances, legal paperwork, employee offboarding, asset management, and a whole bunch of complex processes.

In addition to these complexities, companies are primarily concerned with letting go of their best, top-performing employees. For instance, if you were to wind down your subsidiary, you might worry about the future of employees with your company.

But hold on. You don’t have to say your goodbyes just yet. With the right local partners and strong strategies, you can retain your best employees even before closing your entity.

The local partners here are employer of record (EOR). Before closing your subsidiary, you can transition your employees to EOR and continue working with them.

The success of this whole process of EOR transition and closing a subsidiary depends on a well-structured plan, process, and a supportive strategy. This blog talks about exactly that. I first take you through the strategies for transitioning your employees to EOR and then the process of successfully closing your entity.

How to Retain Talent While Closing a Subsidiary?

When you’re closing down your subsidiary, the greatest uncertainty caused is to your employees. These are the people who have contributed to your success. More importantly, they have the experience and expertise related to your work. Even if you’re closing your subsidiary, you can retain these employees to avoid losing them.

This can be done by switching from your subsidiary to an EOR model. They allow you to retain your best talent and they take care of your employees while you focus on your company closure procedure.

This means the employees continue to work for you; they are just shifted to the payroll and administration of your EOR partner in the specific country. In this section, I have outlined the strategies you can implement to make sure your employees feel valued, secure, and ready to make the EOR transition.

-

Communication strategy

Communication is the key to a successful transition. You need to notify all employees and key stakeholders about this decision to close your subsidiary and move to EOR. The key here is to be open and honest with your employees. Let them know what’s happening and why, well in advance.

After working with your subsidiary for a considerable time, employees may grow attached to the subsidiary. Employees can already feel threatened with the subsidiary closing down. Having a new team manage their HR and administration can stir questions and make them feel uneasy.

You should introduce your EOR partner to your employees and ensure they’re well acquainted with the EOR teams and their systems.

You need to be proactive and conduct one-on-one meetings, team meetings, town halls, etc. Have continuous discussions to help them understand the rationale behind closing the subsidiary and EOR transition.

Address their concerns with empathy, and make sure they understand how this transition to EOR will benefit them. It’s all about transparency and reassurance. You need to make sure you’re minimizing employee disruption in this subsidiary to EOR switch, as much as is possible.

-

Handling employee-related compliance

While you take careful measures to keep employees as stress-free as possible, you also need to manage this on the legal front. This includes making sure you’re compliant with all local laws. You need to settle all dues like gratuity, provident fund, earned leaves, etc.

Partnering with Remunance can greatly help you manage this front. When you choose Remunance, you also choose compliance relief. We take all burden of all compliance and do it on your behalf. You don’t need to consider employee compliance when transitioning to EOR.

-

Reputation management

In a market like India, it is quite the possibility that you closing your subsidiary can impact your brand. Decisions like lay-offs and closures are often perceived in a negative light in the industry. You need to take extra measures to maintain a positive image and not let this closure impact your brand image negatively.

Take active measures in building a positive narrative by treating employees fairly, settling dues responsibly, and maintaining open communication. When you take proper care of your employees with careful planning, your employees help you manage your reputation by vouching for your company.

Be open and transparent loud about this closure. Assure your employees of this being a step ahead in the journey of the company. Assure your employees that they are very much a part of the journey and company growth.

-

Asset disposal and transition

As we come to the end of a successful employee transition, we arrive at the beginning of closing the entity. With shutting down a company comes the great responsibility of handling both physical assets and intellectual property. This includes physical assets like office equipment, furniture, etc., and IP assets like contracts, trademarks, proprietary software, etc. These assets too need to be transitioned or disposed of carefully to ensure proper asset management.

-

Knowledge transfer and continuity

In the EOR transition, it is absolutely essential to transfer key employee information, records, and policies smoothly. Transferring this information accurately is key to a proper continuity of the employees without any major hassles. The company management and the EOR professionals need to sit together and discuss all these details making sure they are all updated and aligned well.

With these strategies followed promptly, you’re looking at a smooth employee transition and a good, positive start to the closure of your subsidiary company. Once all this is settled, you’ve covered up quite some tasks required in the shutdown process while transitioning employees.

For example, by transitioning to EOR, you have settled in the dues and liabilities related to employees. When you reach the step of settling all dues and liabilities in the shutdown process,

Let’s now get to the subsidiary company closure procedure.

How to Shut Down a Foreign Subsidiary Company?

Closing a foreign subsidiary company in India is like winding down a large project. You need to assess all deliverables, wrap up pending obligations, reassign critical resources, and ensure compliance with all rules before officially signing off.

What makes this process simpler? Making a strategic plan and following it step by step. Let’s discuss this step by step in striking off your subsidiary in India.

The closure of foreign subsidiaries is governed by the Companies Act, 2013. In this blog, we are going to discuss the voluntary strike-off closure procedure under Section 248 of this act. This procedure is applicable only if your subsidiary is

- no longer operational,

- is debt-free, and

- has no significant liabilities.

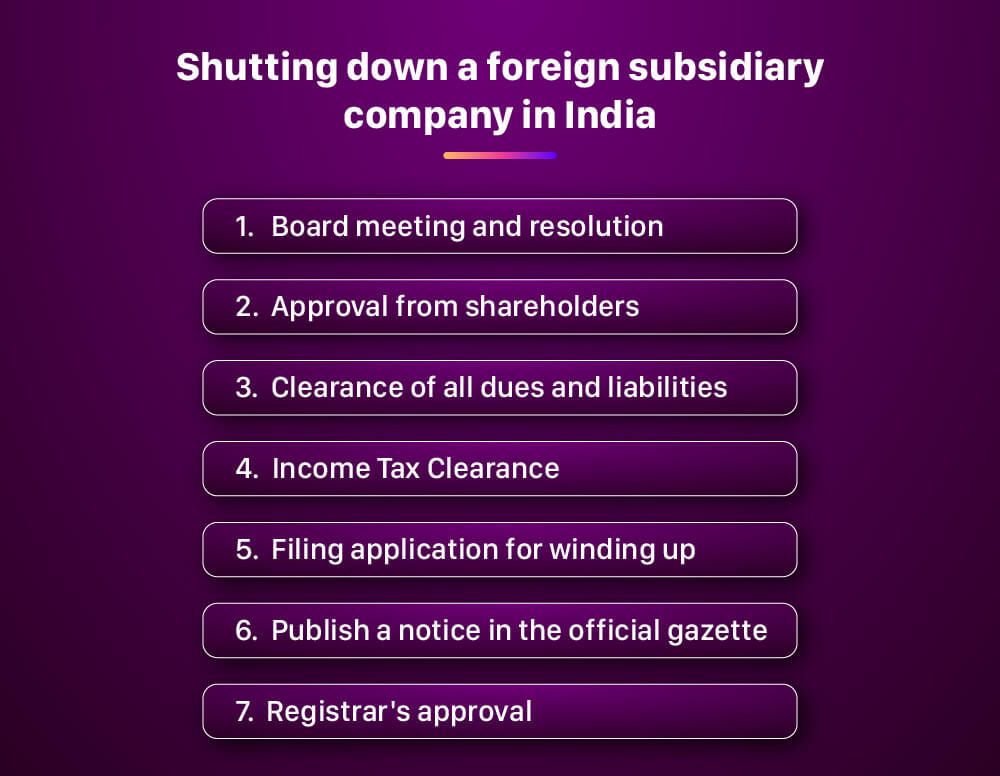

According to the laws mentioned in this act, I have curated a 7-step process that covers the entirety of closing a subsidiary. It first starts with proving that your company has done no business operation on Indian land in the past year.

Step 1 – Board meeting and resolution

The first thing you need to do is call a meeting with your Board of Directors. The purpose of this meeting shall be to

- Pass a Board Resolution – This resolution entails a formal decision to initiate the voluntary closure of your subsidiary in India.

- Approval to Call an (EGM) – An EGM is an Extraordinary General Meeting. The approval to call an EGM comes from the Board to get the shareholders in loop with the strike-off decision. In this meeting, the date is decided to conduct the EGM.

Step 2 – Approval from shareholders

The EGM is conducted to make sure you have the approval of your shareholders for the strike-off. You pass a special resolution here where you have to make sure at least 75% of the shareholders approve the decision to strike off the company.

Step 3 – Clearance of liabilities

After getting proper approval from your Board and your shareholders, it is now time to start actually closing the entity. This starts with first clearing all your dues.

- Settle dues and liability – This includes paying off all outstanding dues like statutory payments, employee salaries, vendor payments, etc. This means that the company should not have any creditors or outstanding obligations including all said taxes, filing returns, etc.

- Getting the No-Objection Certificate (NOC) – The NOC is a legal document needed from key stakeholders stating that they acknowledge and accept the shutdown decision. These stakeholders are vendors, employees, legal bodies like banks, etc.

You get these documents from the said people after clearing all your dues with them. It is legal proof of every transaction being settled between you and the concerned party.

Step 4 – Income Tax Clearance

Before filing an official application to the RoC to strike off the subsidiary, you need to clear all your tax-related activities.

- File final tax returns – This includes submitting the subsidiary’s final income tax return. You’ve to make sure all income and expenses are accurately reported and accounted for. This step ensures closing the subsidiary’s all tax obligation.

- Getting tax clearance certificates – After successful tax return filings, you need to request a tax clearance certificate from the Income Tax Department to confirm no pending tax liabilities, disputes, or outstanding dues.

Read how you can save taxes by transitioning to EOR.

Step 5 – Filing application for winding up

With the approvals and dues duly sorted, we come to our next step. This step is filing an application with the Registrar of Companies (RoC). One of the key documents here is Form STK-2. This is an official application for striking off the subsidiary. Along with this form, you will also need to take with you the following:

- An indemnity bond – filed in Form STK-3 and signed by all directors, is a promise to handle any company liabilities that may or may not arise, even after it’s officially struck off.

- An affidavit – which is a sworn statement by directors to confirm that the company has no liabilities and pending dues.

- Statement of accounts – audited financial statements that show the company’s current financial status. You’ve to make sure this statement is not older than 30 days from the filing date.

- Resolutions from Board and Shareholders – those two resolutions we got in steps 1 and 2, yes, copies of those. If the resolution has not been passed, you need a legal consent from the shareholders to proceed.

- A statement concerning any pending litigation with respect to the company.

- Bank closure certificate

Step 6 – Publish a notice in the official gazette

The next step now is to push a public notification about closing the subsidiary. This step is initiated by the RoC to notify the public and stakeholders about your intention to close the subsidiary.

This notice is published in the Official Gazette, which is a government publication. Sometimes the notice is also published in local newspapers. A window of 30 days is given here for any objections to be raised by creditors, employees, or any other stakeholders.

Step 7 – Approval of the Registrar

Once the 30-day period is over and there are no objections, the registrar will proceed. They will review your application and all supporting documents relating to it. If everything is in order,

- Your subsidiary will be struck off the records

- You will receive a Certificate of Dissolution, officially marking the end and closing your subsidiary.

And with that, you will have successfully closed your subsidiary, opening up the door for more business opportunities. Once the subsidiary is struck off, companies don’t need to file annual returns. Hold on, companies don’t need to file any kind of returns. All compliance is taken off of your plate at this point.

Schedule a free call

Schedule a free call