Summary

To set up a subsidiary company in India, register with the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013. You need to fulfill legal and RBI requirements, prepare and submit key documents. After getting necessary approvals and licenses, you get the Certificate of Incorporation (CoI) from the Registrar of Companies.

Setting up a subsidiary company in India is like standing at the edge of a great market with endless opportunities. A country like India offers immense industrial growth and an impressive talent bank. And these things are well within your reach once you set up your subsidiary.

However, it comes with a long list of processes, legal documentation, and approvals. And as a foreign company, this can become quite overwhelming, daunting even.

Therefore, it is important that you do your homework well before setting up a subsidiary company here.

This blog goes into the depth of the question — how to set up a subsidiary in India. It covers,

-

- All the documentation you need,

- The step-by-step process,

- Compliance checks required,

- Taxation, and

- Post set-up requirements

Let’s get right into it.

What is a subsidiary company in India?

A subsidiary company is a legal entity that is owned and controlled by a parent company.

The parent company must own more than 50% of all of the shares of the subsidiary. This allows the parent company to influence and control all the major decisions of the subsidiary. These include operations, finance, staffing, business strategy, etc.

Based on ownership, a subsidiary is divided into two major types.

-

- Partially owned subsidiary – The parent company holds more than 50% of the shares but less than 100%. Here, apart from the parent company, the other shareholders can influence the decision-making.

- Wholly owned subsidiary – The parent company holds 100% of the shares of the subsidiary company, meaning the decision-making lies wholly with the parent company.

And that, in short, answers what a subsidiary company is. Let’s now get into the challenges of setting up a subsidiary company in a country like India.

What are the challenges of setting up a subsidiary company in India?

I’d first like to start with the challenges of setting up a subsidiary company in India. Because most companies struggle at this very point, let’s understand the challenges and see how we can work around them.

1. Complex laws and regulations

There are quite a of laws you need to be compliant with. For example, the major act to comply with is the Companies Act 2013. This act is a foundational law that governs the incorporation, regulation, and operations of all companies in India.

Then, we have labor laws that differ from region to region. We also have laws from the RBI to comply with, especially under FEMA (Foreign Exchange Management Act). This act governs how money moves in and out of the country.

2. Bureaucratic challenges

To set up a subsidiary company in India, you need to register with multiple authorities. This involves a lot of documentation that is often prone to errors and reiterations. The documents need to be spot perfect, and that requires great attention and patience. You also need to apply for multiple licenses and permits. While seemingly straightforward, these processes can get quite time-consuming.

3. High costs

Setting up a subsidiary company in India is an expensive drill. There are costs involved in all registration and documentation. There are operational, staffing, administrative expenses, and maintenance costs. It’s a long, comprehensive list.

4. Taxation

Taxation is challenging due to the sheer volume of compliance requirements. For instance, taxes imposed by the government on foreign-owned companies can go up to 40%. Then there is the Income Tax Act, 1961, the Goods and Services Tax, 2017, etc. It requires careful tax planning and management to increase your tax compliance. Failing to comply with these laws can cause serious trouble, like financial penalties, interest charges, legal actions, and even reputational damage.

5. Talent acquisition and retention

If you’re not well aware of the local recruitment practices, this bit can become a real challenge. Mainly because you need to know where the top talent of India is applying. Then, position yourself as a desirable company on those platforms. This requires great reputation management, which can get difficult without local insights.

Suggested read: Why global companies are hiring employees from India.

6. Closure complexity

Many a time, it can happen that the market you set up your subsidiary company in India might not be a perfect fit for you after all. In this case, you may need to close your foreign subsidiary to save costs and move to a better market. This again proves to be a pretty tedious, time-consuming, and expensive process.

Getting help from local experts

I understand that these challenges may seem a bit difficult to overcome. Most of the time, they are — if you’re trying to do it all by yourself without local help and expertise.

Now if you go out and hire in-house expert professionals, it can get pretty expensive. And the key to a successful company setup in India is to do it with optimised costs.

And so, I would like to suggest to you that you opt for external professional service. Mainly, third-party service providers in India help you set up your subsidiary company.

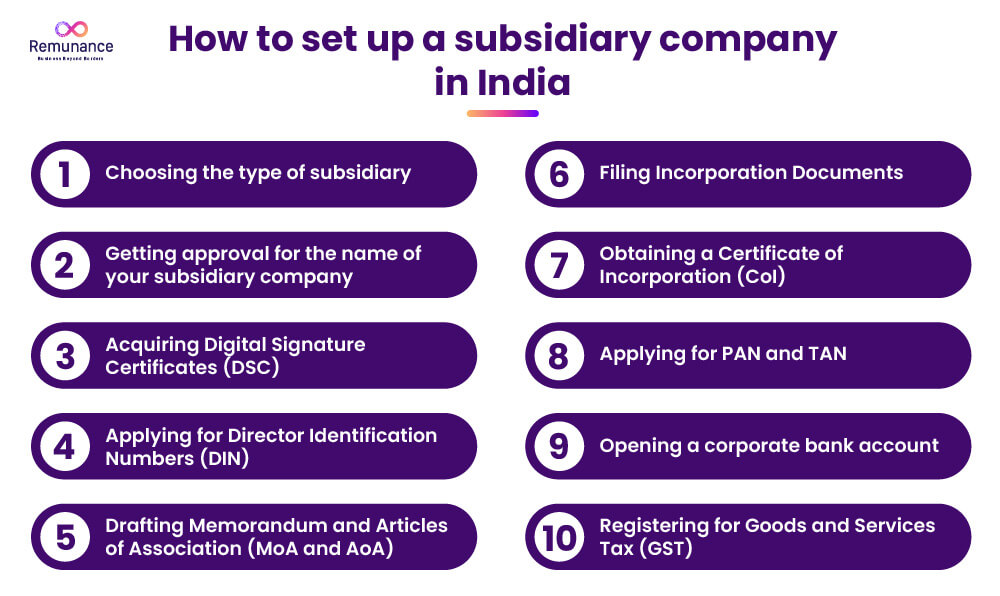

What is the process of setting up a subsidiary company in India?

Alright, with challenges out of the way, let’s now focus on the process of setting up your subsidiary company in India. If you cast around the internet, you will find dozens of processes telling you how to set up a subsidiary company in India. Most of them will be confusing, with too little or too much information to process.

And that is why we bring to you an uncomplicated process to understand and use as a base to start off of.

To begin with, all the steps below are done through the online portal of the Ministry of Corporate Affairs (MCA). It is specifically a form called SPICe+ or Simplified Proforma for Incorporating Company Electronically Plus.

1. Choosing the type of subsidiary

Before getting into the steps of how to set up a subsidiary company in India, you need to make one important decision. It is deciding what type of subsidiary you want to set up and what your expectations are out of it.

Do you want it to be a cost center or a branch office? Or maybe you want to enter the selling market and sell your goods and services? Determining this would set a proper stage for your further process.

For instance

Let’s understand the process of setting up a wholly owned subsidiary company in India.

2. Getting approval for the name of your subsidiary company

The first step after deciding on the type of subsidiary is getting approval for the name of your company. Here, you would have to go to the portal of the Ministry of Corporate Affairs (MCA) and register your name.

There are certain rules and regulations here that you need to abide by.

For instance, you want your subsidiary’s name to be the same as your parent company’s name. You’d have to add ‘India’ to make it clear that the subsidiary is based in India.

You must have seen global giants like Coca-Cola India Pvt. Ltd., Nestle India Limited, Samsung India Electronics Pvt. Ltd, etc.

3. Acquiring Digital Signature Certificates (DSC)

This certificate is important for you to be able to conduct electronic business transactions and to comply with your statutory filings, like with the MCA.

A DSC or a Digital Signature Certificate is like the digital version of your physical signature. It accounts for the authenticity, originality, and credibility of all your digital documentation.

4. Applying for Director Identification Numbers (DIN)

Generating a Director Identification Number (DIN) is the next step, which allows the legal identification of the directors of your subsidiary. MCA makes the DIN mandatory for all individuals who intend to act as the directors on the board of your Indian subsidiary.

This allows for their identification and accountability and helps the government track the corporate activities of your directors.

5. Drafting Memorandum and Articles of Association (MoA and AoA)

Now, these two documents serve as the foundation of your Indian subsidiary. Why? Because these decide the scope of your subsidiary’s activities, objectives, internal governing policies and operational framework.

Memorandum of Association – The MoA outlays what the company’s relationship will be like with the external world. It specifies the scope of your subsidiary’s activities and operations.

For example, engage in the production and export of consumer electronics, define its registered office, and the amount of capital it operates with.

An MoA also outlines its capacity to enter into contracts with external business partners.

Articles of Association – The AoA acts as the internal guidebook or rulebook of sorts for the management of your company. This talks about what things will be like within your organization.

For example, the roles and responsibilities of your directors and officers, what your dividend policies are, your methods of auditing the books, etc.

6. Filing incorporation documents

This is the step where your subsidiary gets legally established in India. Like I mentioned above, the form used for your incorporation on the portal of MCA is the SPICe+ form. This has two parts to it.

-

- One where you reserve the name of your subsidiary which we did in step 2.

- The second is where you submit all the necessary documents required to set up your subsidiary, which happens in this step.

And you do not need to worry — as we go ahead, the next section mentions all the documents required for you to submit for the incorporation of your subsidiary company.

7. Obtaining a Certificate of Incorporation (CoI)

Getting your Certificate of Incorporation (CoI) is the official recognition of your Indian subsidiary company being successfully set up. Upon getting this certificate, you are eligible to start and run your business operations in India. To complete this step:

-

- You need to make sure all documents are complete, verified and submitted.

- Then, you have made the necessary payment of the fees required to obtain the IoC.

- Next, you get the verification from the Registrar of Companies (RoC).

- And then, the issuance of your CoI is successful, which includes your Corporate Identification Number (CIN)

8. Applying for PAN and TAN

Applying for your Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) is the next important step in setting up your subsidiary company. These two documents serve as identifiers for your tax-related activities. It is also necessary for your compliance with the Tax Department.

These two documents are usually applied for while you’re submitting all documents in step 6. Your PAN and TAN are created when steps 6 and 7 are successful.

9. Opening a corporate bank account

To run all the financial transitions of your Indian subsidiary, you need to open a corporate bank account in India. You need documents like your Certificate of Incorporation and your PAN and TAN.

10. Registering for Goods and Services Tax (GST)

Now, if you are planning to make taxable sales in India, you have to register for the Goods and Services Tax (GST). You can apply for this online on the official Goods and Services Tax (GST) website.

It is mandatory for a foreign subsidiary to register for GST.

-

- If the turnover for service providers exceeds Rs. 20 lakh per annum

- If the turnover for goods suppliers exceeds Rs. 40 lakh per annum

- If the subsidiary does interstate supply of goods and services, irrespective of the turnover.

And that would be a comprehensive process of setting up your Indian subsidiary. Let’s now move towards the essential documents that are required while doing this process.

What essential documents are needed to set up a subsidiary in India?

To simplify your understanding of the documents needed, I’ve divided this section into parts. Let’s see what these parts are.

1. Documents you need from the foreign parent company

-

- Certificate of Incorporation – This CoI needs to be a certified copy of the parent company’s incorporation in its home country

- Board resolution – This is the formal resolution which authorizes that your Indian subsidiary is successfully established.

- MoA and AoA – You need to present the MoA and AoA of your parent company

2. Documents you need for directors and shareholders

This further gets divided into two parts

-

- Documents for your foreign directors and shareholders

-

-

- A self-attested passport copy

- Address proof with their recent utility bill, bank statement, or driving license, any of which are not older than two months.

- A recent passport-sized color photograph

- Business visa and stamped passport copy that prove their presence in India at the time of signing the documents (This is only if the documents were signed in India)

-

-

- Documents for Indian directors and shareholders

- A self-attested copy of their PAN or Permanent Account Number.

- A self-attested copy of their Aadhar Card

- Address proof with their recent utility bill or bank statement, not older than two months.

- A recent passport-sized color photograph

- Documents for Indian directors and shareholders

3. Documents related to the Indian subsidiary

-

- MoA and AoA mentioned above in the process of how to set up a subsidiary company

- Proof of registered office address that needs to have

- Ownership proof, or

- Rent agreement with No Objection Certificate (NOC) stating that they know and have no issues with you running your business on their grounds

- Utility bill that includes electricity bill or water bill (should not be older than two months)

4. Statutory forms and declarations you need to present

-

- Director Identification Number (DIN)

- Digital Signature Certificate (DSC)

- Declaration by Directors (Form DIR-2), which is consent given by an individual as a director

- Declaration of Directors/Shareholders (Form INC-9), which confirms the compliance of the subsidiary with the Companies Act, 2013

- PAN undertaking, which is a declaration from foreign directors and shareholders that even though they don’t have PAN cards, they are still recognized and approved by the Indian government.

And that extensively covers all the documents you need to gather up while setting up a subsidiary company.

What are the post-setup requirements for setting up a subsidiary company?

In India, successfully setting up a subsidiary company is an amazing achievement, a great milestone. But it is definitely not the end. There are still a bunch of procedures that you need to follow to get your subsidiary up and running smoothly. Let’s take a look at what they are.

1. Hold your first board of directors meeting

This is an important initial step. After 30 days of incorporation, it is now the time to call for the first Board of Directors. Section 173(1) of the Companies Act 2013 does not make this a mere formality.

Instead, it forms the very foundation of subsidiary governance. Where key strategies will be created and your mission will be set in motion. So, line up that agenda and get those directors together.

2. Administrative disclosures

Now, isn’t that just basic transparency? Under Section 184(1) of the Companies Act 2013, your directors must follow a basic rule. They have to give written notice if they or any other key managerial person has any interest in another company or arrangement.

It might involve their concern in any other firm, company, or association. This must be sent mandatorily on Form MBP 1. Therefore, it is very much essential to maintain transparency with your board. And to align and regulate everyone’s interests for the benefit of your subsidiary company.

3. Issuing share certificates

An individual needs a claim over their stake. Isn’t it? So, do not let this step become irrelevant for you. In fact, you get 60 days following the incorporation. These share certificates represent ownership.

It would ensure that your shareholders have a formal claim over their respective stakes in the business. It’s one of the most essential steps where trust and commitment build confidence among investors.

4. Compliance with RBI

Registering a foreign company in India incurs some formalities of the Reserve Bank of India. Keep the necessary compliance formalities intact with the central bank by filing FCGPR and FC-TRS forms.

For example,

-

- You need to report the receipt of any foreign investment coming your way to the RBI within a timeline of 30 days.

- You need to submit Form FC-GPR (Foreign Currency-Gross Provisional Return) to report the issuance of shares to foreign investors. The timeline again is 30 days.

- On or before the 15th of July each year, you need to provide RBI with all the details, including the annual returns on your foreign liabilities and assets.

5. Employee payroll and benefit setup

In this step, you enroll your employees under Provident Fund (PF), Employee State Insurance (ESI), and health schemes. Setting up an Indian subsidiary also ensures that the well-being of your team members is taken care of. There are certain essential acts of payroll compliance in India that you must know as they form the foundation of payroll in India.

Essential Acts of Payroll Compliance in India You Must Know

6. Accounting and auditing

Subsidiaries are mandated to prepare their financial statements per the Indian Accounting Standards. These standards closely align with the International Financial Reporting Standards (IFRS). Compliance with these standards is absolutely mandatory.

In addition, foreign subsidiaries that are operating in India should have their books audited by a Chartered Accountant on an annual basis. These audits of financial statements must be filed with the Registrar of Companies.

Subsidiaries are also required to comply with the Income Tax Act, 1961, as per the terms of turnover mentioned in the previous section. This requires companies to conduct a rather thorough examination of the company’s financial records and tax filings.

7. Annual compliance

Annual compliance is another mandatory compliance on the list. Indian subsidiary registration is not an event, but it is a process. This will make your business legit when you do so.

-

- You need to submit the annual returns and your financial statements to the Registrar of Companies.

- You need to hold a minimum of four meetings each year. The gap between each meeting should not exceed 120 days.

- Your statutory registers should be thoroughly updated, such as the Register of Directors, Register of Members, and Register of Transfers.

- You should also be compliant with the Intellectual Property Laws that apply to your business, such as the Patents Act, 1970 or the Trademarks Act, 1999.

8. Corporate tax filings

To avoid serious penalties, compliance with corporate tax filings is essential. A standard corporate income tax rate for a foreign companies setting up a subsidiary in India is currently 35%. This is a reduction from the earlier rate of 40% on income earned on Indian soil.

Companies also must file for an annual income tax return. This return should document all the income earned within the country and the tax liabilities that come with the income.

If the tax liability of a foreign subsidiary exceeds Rs. 10,000 in a fiscal year, they need to pay advance tax. According to Wikipedia, this is the schedule for advance tax payments:

-

- On or before 15 June – 15 percent of advance tax liability

- On or before 15 September – 45 percent of advance tax liability

- On or before 15 December – 75 percent of advance tax liability

- On or before 15 March – 100 percent of advance tax liability

Remember these steps and be in control while managing your Indian subsidiary.

Conclusion

And my corporate ladies and gentlemen, that is how we set up a subsidiary company in India. Yes, the process is long and relentlessly tiring. From bureaucratic paperwork to assembling the local team, the process bears its challenges. But given the perks India offers you — great talent and vast consumer market — it is a journey that is 100% worth it.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.

Frequently Asked Questions

What is a wholly owned subsidiary of an Indian company?

A wholly owned subsidiary of an Indian company means a separate legal entity in which a foreign parent company holds a 100 percent ownership. This will allow the overseas company to control the management in full but must comply with Indian laws and regulations for business activities.

What are the requirements for a subsidiary company?

The subsidiary company must have a parent company, a board of directors, a registered office in the host country. It must abide by local regulations, tax registration, legal documents, capital investment, and above all, it must comply with FDI rules.

How to set up a subsidiary in India?

Procedure to establish subsidiary in India Type of company on which subsidiary would be based Registration with the Ministry of Corporate Affairs Requirement of approvals as necessary Draft legal documents Assistant acquiring Director Identification Number Tax registrations issued. Maintenance of compliance with Indian Regulations

How much does it cost to set up a subsidiary in India?

The cost involved to set up a subsidiary in India lies between $1,000 and $5,000, depending upon the company structure and fees that may apply regarding legal services as well as governmental charges. A subsidiary in India will incur additional costs, including compliance, professional services, and continued upkeep.

What are the rules for subsidiary companies in India?

All subsidiary companies incorporated in India needs to follow norms similar to the Companies Act, 2013, FDI policies, tax policies, and RBI guidelines. A proper registration, board structure, financial reporting, and appropriate maintenance of sector-specific norms are required.

How is a foreign company registered in India?

A foreign company in India registers itself by filing the vital documents including Memorandum of Association (MoA) and Articles of Association (AoA) accompanied by necessary approvals from the Ministry of Corporate Affairs (MCA). This guarantees that it obeys Indian corporate law.

Recent

Also read

EOR or Subsidiary: Which One to Choose for Global Expansion?

Parameters to Decide Location While Forming a Subsidiary in India

Employer of Record: To Simplify Subsidiary Formation in India

5 Things to Know Before Forming a Subsidiary Company in India

Retain Top Talent While Closing a Foreign Subsidiary in India

Disclaimer

This blog is made for information purposes. Everybody is requested to get advice from an expert before making a decision based on the information given in the blog. Remunance disclaims any liability/loss or damage caused by using the information, directly/indirectly, given in this blog.