Summary

Employee benefits in India ranges from statutory to supplemental benefits. They include retirement plans, health insurance, gym membership, career development programs, etc. These benefits vary across states and evolve over time except for few mandatory ones.

Running a team in India demands more than basic compensation. The law mandates certain employee benefits in India, and expects to offer a few extras that are not mandatory.

The mandatory ones include provident fund, health cover through ESI, gratuity, maternity leave, and statutory bonuses.

In addition to these, many employers offer extra perks such as private insurance, flexible hours, and learning programs. They keep employees motivated and loyal.

If you’re managing a workforce here, you need to be updated and an expert on both the necessary and the optional ones. This will make your workplace stand out from your competitors.

Here’s what we’ll go through in this guide:

-

- What employee benefits in India include?

- Who qualifies for these benefits?

- The statutory benefits every employer is bound to provide

- The supplemental perks most companies add on top

- How do employee benefits vary across states in India?

- How to effectively and compliantly manage employee benefits in India?

This way, you’ll know exactly what you owe by law and what you can offer to build stronger teams.

What Are Employee Benefits in India?

When we talk about employee benefits in India, we’re talking about everything a company gives beyond just salary. Some of these are statutory benefits.

These types of benefits are not optional; the law says you have to provide them. The benefits that fall under this category are EPF for retirement savings, ESI for health cover, gratuity, and paid leave.

Then there are the extras that come with the compensation. Those employee benefits perks companies add on to make life easier and keep people happy.

These include private health insurance, flexible hours, transport allowances, and even wellness programs.

These aren’t mandatory, but they do help attract good talent and stop them from leaving too soon.

So, the employee benefits in India look like:

-

- Statutory benefits: The must-haves.

- Perks: The nice-to-haves.

- Significance: Compliant and more loyal teams.

We’ll now talk about the employees who can enjoy these perks and benefits in India.

Learn about the 25 unique employee benefits to attract top talent

Who Are Eligible for Employee Benefits in India?

In India, not all employee benefits are accessible to all employees. There are special criteria to avail each employee of benefits in India.

Let’s see what they are.

The Statutory Benefits

-

- EPF: If an employee earns up to ₹15,000 as basic pay and the company has 20+ staff, they’re in. If employees earn more, they can still get in, but only if the employer signs off.

- ESI: For salaries up to ₹21,000 a month (₹25,000 if disabled) and companies with 10+ employees. Covers almost everyone, including permanent, temp, part-timer, and even casual workers.

- Gratuity: A thank-you cheque after 5 years of continuous service. No 5-year wait if death or disability happens.

- Maternity benefits: Women who’ve worked at least 80 days in the past 12 months can take 26 weeks of paid leave for their first two kids.

- Statutory bonus: If employees earn up to ₹21,000 a month or work at least 30 days in the year, they’re eligible for this bonus. The bonus counts to a minimum of 8.33% of their salaries.

Now, who usually doesn’t come under this eligibility criteria? Contractors, freelancers, most interns, and higher-salaried folks above the EPF/ESI thresholds.

Contract workers sometimes get covered, but only if the agency is compliant.

The Extra Bonuses

These bonuses are completely company-driven. This is where employers try to look attractive. Some go all out, others just do the bare minimum.

Let’s see the eligibility criteria for each one of them.

-

- Health insurance: Most full-time staff get it. These benefits are variable for contractors.

- Meal vouchers or food allowance: Mostly for permanent employees.

- Transport allowance / cab facility: Common if employees are on night shifts or have long commutes.

- Leave encashment: Depends on tenure and company policy.

- Performance bonuses / variable pay: Based on appraisals and targets. Interns and freelancers don’t get this.

- Wellness perks: These benefits are totally optional, used as retention tools.

- Retirement extras: The superannuation funds or NPS contributions are usually for senior or long-term employees.

To summarize, statutory employee benefits in India are mandatory for nearly all employees. Others vary with the type of employer.

Curious about how employee benefits in India evolve with time?

Our team of experts will help you learn that

What Are the Major Statutory Employee Benefits in India?

In India, employees get extra support apart from their basic salaries. Companies offer benefits like retirement savings, health cover, paid leave, and even bonuses.

These benefits keep employees financially safe. Let’s look at each one of them closely.

- Retirement and Social Security: This benefit plan is designed to support employees financially after retirement.

- Health and Disability: This benefit covers the medical expenses of an employee in the event of an emergency.

- Compensation and Leave: This benefit covers the mandatory and festival holidays of the year.

Retirement and Social Security

This is about building a safety net for the future. The idea is to save while you work and use it later.

-

- Provident Fund (EPF): Both employees and employers contribute money every month. It grows into a retirement fund.

- Pension (EPS): A part of that contribution goes into a pension plan. It helps after retirement or in case of disability.

- Gratuity: It is a token of appreciation from your employer for your years of service.

Health and Disability

Health problems or accidents can occur at any time. That’s why statutory benefits are important.

- ESI Scheme: Covers medical care for employees and their families.

- Cash Support: Provides assistance to employees on maternity leave, sick leave, or dealing with a disability.

- Workplace Accidents: If employees are injured at work, the law ensures they or their family receive fair compensation.

Compensation and Leave

Employees also get some breathing space and fair pay in between everyday, mundane work life. They are as follows.

- Maternity Leave: New mothers get up to 26 weeks of paid time off.

- Child Care: Bigger companies have to provide crèche facilities.

- Paid Leave: Annual leave, sick leave, and casual leave are all covered by law.

- Minimum Wages: Employers can’t pay below the fixed legal rate.

- Bonuses: Many companies pay extra during festivals as part of employee benefits or perks.

The above list summarizes the statutory benefits available to employees in India. Let’s move on to the supplemental employee benefits in India now.

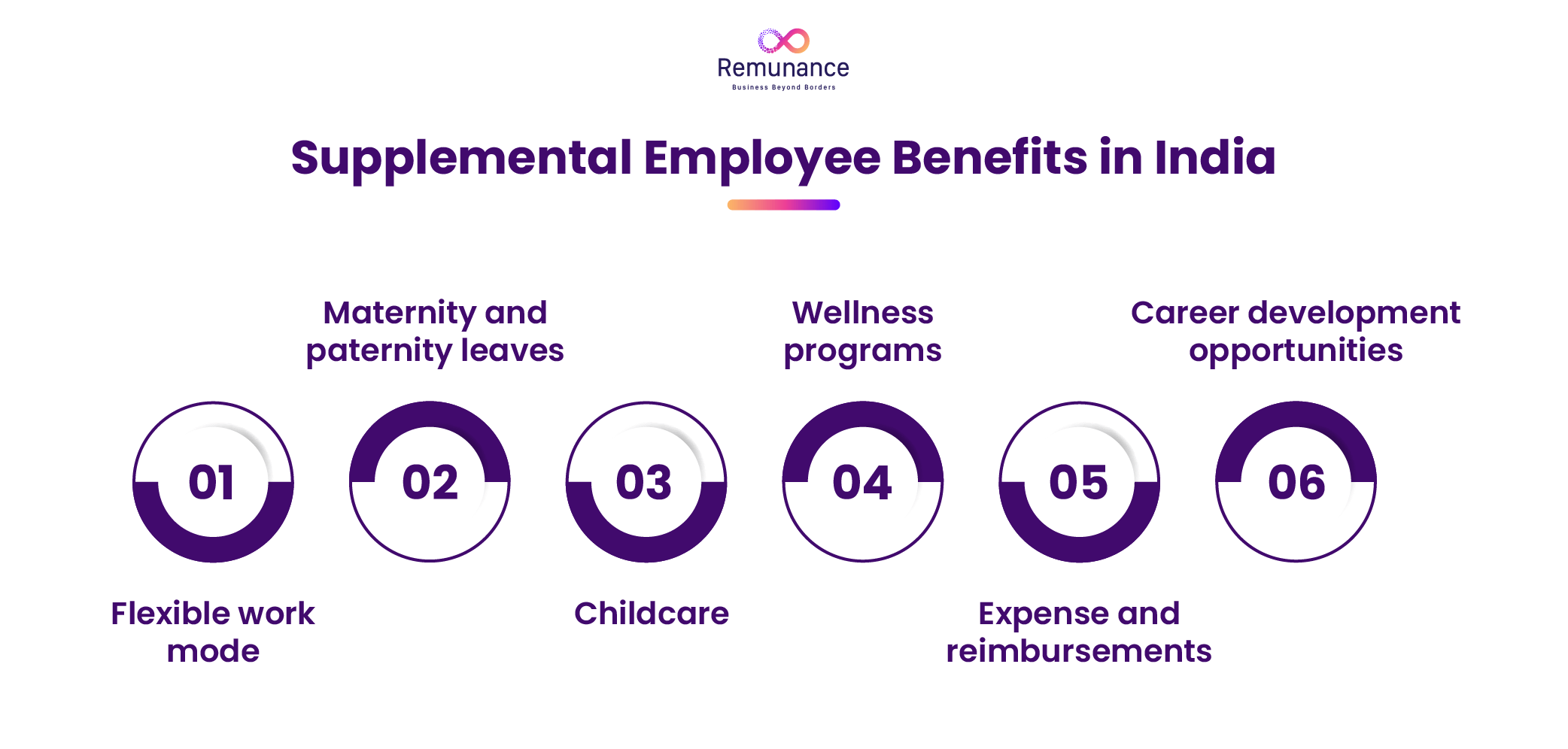

What Are the Supplemental Employee Benefits in India?

Other than statutory benefits for employees, Indian employees are also entitled to extra perks and benefits.

These supplemental perks are some of the most valued types of employee benefits in India.

Let’s see what they are.

Learn the best way to offer employee benefits to your remote team.

-

- Flexible work arrangements: Offered by employers to maintain employees’ work-life balance.

- Paternity Leave: Offered by employers for new parents to manage both office and home effectively.

- Childcare Support: Offered by employers so that parents can better focus on their kids while working.

- Wellness Programs: This benefit is focused on providing extra care for employees’ health.

- Expense Benefits: This benefit is for employees who are involved in office-related tours or other similar expenses.

- Career Development: This benefit is focused on skill development for employees to increase their productivity and pave the way for their future careers.

Flexible Work Arrangements

Work doesn’t always have to mean sitting in an office from 9 to 6. Many companies now make flexibility a norm.

-

- Hybrid or remote work lets employees split time between home and office.

- Flexi-hours give people the choice of when to start or end work.

- Part-time work or job sharing helps those who don’t want full-time schedules.

Paternity Leave

Maternity leave has been around forever. But now, more companies are also supporting dads.

-

- Paid paternity leave is becoming common in private firms.

- Some companies keep it gender-neutral, so both parents can take time off.

- Adoption leave is also included in many policies.

Childcare Support

Parents at work often have one big question: who’s looking after the kids? That’s why childcare benefits are important.

-

- On-site crèches in offices make life simpler.

- Companies tie up with daycare centers near employee homes.

- Vouchers or subsidies help cover childcare costs.

- Virtual tutors or “online nannies” are now offered for remote workers.

Wellness Programs

Health benefits have gone much beyond medical insurance now. Wellness has become a real focus of employee benefits in India.

-

- Gym memberships or fitness challenges keep people active.

- Confidential counseling sessions help employees deal with stress.

- Annual health check-ups and vaccines are offered.

- Money management and retirement planning sessions are also popular.

Expense Benefits & Reimbursements

Nobody likes paying out of pocket for work-related stuff. That’s why companies reimburse or cover many of these costs.

-

- Internet and phone bills for remote workers.

- Meal vouchers or subsidized food at the office.

- Relocation expenses if you move for work.

- Fuel allowances for using your own vehicle.

Career Development Programs

Career growth is one of the most sought-after types of employee benefits in India. Companies know this, and they invest in it.

-

- Workshops and online courses to upskill.

- Tuition fee support for certifications or degrees.

- Mentorship programs to build leadership skills.

- On-the-job training for real, hands-on learning.

These perks aren’t mandatory like statutory benefits, but they make a big difference.

For many employees, they’re the reason to choose one company over another.

Remunance Employer of Record

Build a Happier, More Productive Team in India

Offer more than just the basics—give your remote employees the supplemental benefits they truly value. From wellness programs to flexible work options, ensure your global team feels supported and engaged.

Talk to Our HR Experts Today

How Do Employee Benefits in India Differ Across States?

In India, statutory benefits for employees are set nationally but differ widely across states. Let’s see how.

National vs. State Laws

-

- The Provident Fund and Maternity Benefit Act creates the baseline.

- State Shops and Establishments (S&E) Acts modify rules depending on location.

Leave Policies

-

- The number of sick and casual leave days varies by state.

- Some states allow sick leave encashment.

Minimum Wages

-

- Fixed by each state, based on cost of living, skill, and industry.

- Creates big differences in employee benefits in India.

Public Holidays

-

- National holidays are common everywhere.

- Each state declares its own additional holidays.

Working Hours & Overtime

-

- Regulated under state S&E Acts.

- Some states permit 7-day operations under certain conditions.

National Benefits with State Rules

-

- Programs like Employees’ State Insurance (ESI) vary in compliance and applicability.

- Industry and state decide how they’re implemented.

New Categories of Workers

-

- Some states now provide social security and welfare funds for gig workers.

- Shows expansion in types of employee benefits in India.

Industry & Company Size Impact

-

- Tech vs. manufacturing has different structures.

- Larger organizations usually provide broader statutory benefits.

Thus, understanding how the different types of employee benefits in India differ across states is crucial.

It means knowing how geography, sector, and company size affect entitlements.

How to Manage Employee Benefits in India?

To manage employee benefits in India, you have to follow a few important steps. First, take care of the statutory benefits for employees, and then think about what extra employee benefits and perks will attract and retain top talent.

Cover the Statutory Benefits First

-

- Compliance with Indian employment laws is mandatory.

- Get registered with EPFO and ESIC.

- Pay contributions on time. That’s the foundation of statutory benefits.

Feedback from Employees

-

- Don’t guess. Ask your employees.

- Run a quick survey or even just talk to them.

- Different age groups care about different things. A 25-year-old may want learning perks; a parent may care about childcare.

Add Perks on Top

-

- Once you’ve got compliance sorted, add more.

- Health cover, flexible work hours, wellness programs; these go a long way.

- Good perks make people feel valued, not just employed.

Use Tools or Outsource

-

- Benefits can get tough if you’re doing it manually.

- HR software helps with enrollment and tracking.

- Smaller companies often outsource to experts. It’s cheaper than building a whole team in-house. Some also partner with an employer of record to take care of employee benefits in India.

Preach them properly

-

- If employees don’t understand their benefits, they won’t care about them.

- Use onboarding, handbooks, quick workshops, and even short mailers.

- Always show the bigger picture where employee benefits are more lucrative than the actual compensation.

Keep Updating on Your Perks

-

- Employment laws change. Consequently, your employee benefits need to change, too.

- Keep checking if your package still outperforms your competitors.

- Compare with what others in your industry are offering. Stay competitive.

Hence, to manage benefits, you always have to keep yourself updated about different types of employee benefits in India and how they’re evolving.

Simplify Employee Benefits Management with Remunance

Managing employee benefits in India can be complex — from compliance and contributions to customizing perks that retain talent. Let Remunance handle it for you. We ensure complete statutory compliance, attractive benefit structures, and smooth administration tailored for your workforce in India.

Conclusion

Employee benefits in India are no longer a lousy decision taken by employers. They decide how attractive you look as an employer and how long people stay with you.

The legal side keeps your business safe, but the extras are what actually win over talent. Companies that treat benefits as an investment and not an expense end up building stronger, loyal, and more productive teams.

If you want to stand out in India’s crowded talent market, you need to make employee benefits your priority. It’s one of the simplest ways to turn payroll into a competitive edge.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.

Recent

FAQs

What are statutory benefits in India?

Statutory benefits are the mandatory employee benefits in India which include retirement plans, health insurance, etc. These are mandated by the Indian government.

What are the different types of employee benefits in India?

Employee benefits in India are divided by 2 main categories. Statutory and non-statutory benefits. Statutory are the ones that are mandated by Indian employment laws and must be provided by all companies operating here.

Non-statutory laws are decided by the employers to make their employees’ life better and uplifted.

What is the difference between statutory and supplementary benefits?

Statutory employee benefits include the utmost necessary benefits taht an employee owes from the company. This includes EPF, ESI, gratuity, etc.

Supplementary benefits are solely decided by the employers and varies from company to company. It includes wellness programs, gym memberships, flexible work hours, etc.