Summary

This guide dives deep into the strategic decision of leasing versus buying business equipment. It breaks down financial metrics like cash flow, total cost of ownership (TCO), and net present value (NPV) to help you make a sound decision.

You’ll explore the benefits and drawbacks of each option—from immediate asset ownership and tax perks in outright purchases to improved cash flow and upgrade flexibility in leasing.

Strategic choices on equipment finance can significantly affect operational efficiency and long-term profitability in the modern corporate environment.

We have carefully examined the leasing versus outright purchase options to provide you with a comprehensive guide evaluating the financial, operational, and strategic implications.

Our comprehensive strategy is designed to empower decision-makers with clear, practical information, thereby enabling effective capital management that is adaptable enough to accommodate changing technology and market conditions.

Business Equipment Financing Overview

Modern companies can get the necessary business equipment from a variety of funding sources.

Choosing between a lease and outright purchase presents different benefits and drawbacks.

This guide highlights the subtleties of both financing strategies, providing a side-by-side analysis of essential criteria, including tax consequences, total cost of ownership (TCO), and cash flow management.

Understanding these essential elements helps companies align their financing plans with their specific operational needs.

Decisions about leasing and buying business equipment affect not only current cash flows but also long-term financial stability.

Our study emphasizes rigorous financial measures in addition to operational factors, ensuring that every aspect of equipment financing is thoroughly examined.

Outright Purchase of Business Equipment

Immediate Ownership and Capital Investment

Usually seen as a direct investment in a company’s operating capability, purchasing equipment outright is an organization choosing an outright acquisition that takes total ownership and management of the IT asset from the first day.

This paradigm allows for flexibility in use, customization, and even the creation of returns through resale or depreciation advantages.

Advantages of Outright Purchase

-

- Immediate Asset Ownership: Complete control over the tools, including the capacity for instantaneous modification or sale.

- Tax Benefits: Direct depreciation claims and potential tax deductions can help improve financial statements.

- Long-Term Cost Efficiency: If the usable life of the equipment extends significantly beyond the financing period, avoiding regular lease payments could result in reduced overall expenses.

- Customization and Flexibility: Freedom to upgrade or include the machinery into specialized procedures free from contract restrictions.

Disadvantages of Outright Purchase

-

- High Upfront Costs: Significant initial capital investment, which might strain liquidity.

- Depreciation Risks: Faster obsolescence brought on by rapid technology developments reduces the resale value.

- Maintenance and Repair Costs: The owner bears whole responsibility for continuous upkeep, repairs, and improvements.

- Potential for Underutilization: When equipment use varies, the asset might not offer consistent value in relation to its cost.

Equipment Leasing, A Strategic Alternative

Leasing is a flexible financing source that lets companies acquire modern technologies without having to pay significant upfront money.

Leasing helps with adequate cash flow management by distributing expenses over a specified period and provides the freedom to upgrade machinery to keep pace with technological developments.

Types of Equipment Leasing

-

- Operational Leasing: Under this approach, equipment is leased for a designated period to satisfy temporary operating requirements. Usually including support and maintenance, it guarantees that the lessee stays concentrated on key company operations.

- Financial Leasing: Often seeming like a long-term rental, financial leasing could provide a way to buy the equipment at lease end. Its design allows the asset’s declining value over time to be matched with usage.

Advantages of Leasing Equipment

-

- Improved Cash Flow: Leasing greatly lowers initial costs and releases funds for other company operations.

- Predictable Expense Management: Fixed monthly or annual payments help to create more accurate financial forecasts and budgeting.

- Technological Edge: Leasing guarantees simple improvements, therefore ensuring that your company stays technologically innovative and on the leading edge.

- Maintenance and Support: Maintenance services and lease agreements usually help lower running costs and guarantee minimum downtime.

- Flexibility: Businesses can decide at the conclusion of the lease term to buy the equipment, return, or upgrade depending on changing operating requirements.

Disadvantages of Leasing Equipment

-

- No Immediate Ownership: During the lease term, the lessee does not build equity in the asset.

- Potentially Higher Total Cost: Particularly in cases of a buyout, leasing payments can, over time, total more than the cost of buying.

- Contractual Constraints: Leases could include limited customizing choices and penalties for early termination.

- Dependency on Lessor Stability: The reliability of the lease arrangement might be affected by the leasing company’s financial situation.

Comparative Financial Analysis

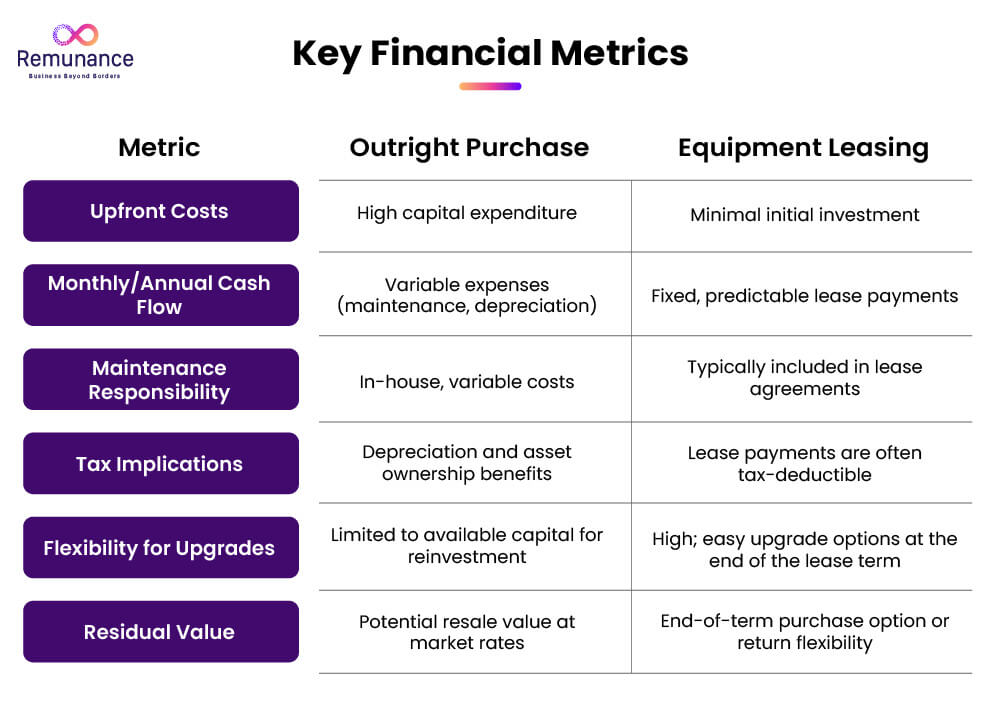

Examining equipment financing calls for a thorough review of several financial criteria; we have divided the comparative study into three main areas: cash flow, net present value, and total cost of ownership.

Cash Flow Impact

Outright Purchase:

-

- High Initial Outlay: Calls for a sizable cash reserve for purchase, therefore draining money meant for other investments.

- Lower Recurring Costs: The only ongoing expenses once the equipment is bought are operational ones and maintenance.

Leasing:

-

- Lower Upfront Costs: With minimal initial capital needed, leasing appeals to startups and cash-strapped companies.

- Predictable Monthly Payments: Help to minimize big lump-sum expenses and promote better budget planning.

Businesses operating on tight margins or with unpredictable income streams rely on cash flow analysis.

Total Cost of Ownership (TCO)

Outright Purchase TCO Considerations:

-

- Asset Depreciation: The value of the asset changes with time; fast technological developments could hasten deterioration.

- Maintenance and Repair Costs: Ownership comes with continuous expenses for maintenance, repairs, and finally upgrades.

- Potential Resale Value: Under favorable market conditions, a depreciated asset can still have value.

Leasing TCO Considerations:

-

- Recurring Lease Payments: Throughout the lease, these payments can mount up and cause a TCO larger than that of a one-time purchase.

- Included Services: Many lease agreements combine support services and maintenance to help to lower hidden running costs.

- End-of-Term Options: Being able to upgrade or return the leased equipment at its end will maximize cost effectiveness.

Net Present Value (NPV) Analysis

NPV provides a financial snapshot by considering the time value of money.

-

- Purchasing Equipment: Usually produces a better NPV since the asset is shown on the business balance sheet. Resale value and depreciation advantages help to project a promising financial future.

- Leasing Equipment: Because of the continuous outflow of lease payments, may show a lower or even negative NPV. In strategic decision-making, though, better cash flow and operational flexibility can balance this.

Based on our experience, companies that give retaining liquidity top priority while still using new technologies find leasing to be a more appealing choice despite maybe a higher total cost.

Key Elements of Lease Agreements

A strong leasing strategy is built on a strong lease agreement.

Below, we list the key components that should be carefully considered when writing a leasing agreement.

1. Definition of Parties

The agreement should specify exactly who the lessee of the equipment is and who the lessor of the equipment is.

Avoiding conflicts depends on each party clearly understanding their roles and obligations.

2. Lease Term and Payment Structure

-

- Lease Duration: Specify the exact start and end dates as well as the renewal or early termination requirements.

- Payment Terms: Specify the calendar, periodicity, and quantities. List any early termination or late payment penalties.

3. Equipment Specifications

You have to submit thorough descriptions of the leased equipment covering make, model, serial numbers, and condition.

This ensures that both parties are aware of the asset’s situation simultaneously.

4. Maintenance and Repairs

Clearly state your roles in routine maintenance, repairs, and inspections.

Clearly state the extent of coverage and any related expenses should maintenance services be part of the lease.

5. End-of-Term Options

The lease agreement should articulate end-of-term options, including:

-

- Return of Equipment: Terms for returning the asset in its current condition.

- Upgrade Options: Procedures for Transitioning to Newer Models.

- Purchase Options: If applicable, the predetermined price for an end-of-term buyout.

6. Legal and Financial Considerations

-

- Penalties and Fees: Outline any penalties for breaches of the agreement.

- Insurance Requirements: Specify any insurance obligations to cover potential damages.

- Regulatory Compliance: Make sure the lease follows both national and local rules.

Legal and Operational Considerations

Legal and operational considerations greatly influence your decision between leasing and buying. To safeguard the interests of both sides, we have noted a few essential factors that have to be taken into account.

Regulatory Compliance and Contractual Clarity

The legal soundness of the lease or purchase contract is quite essential. Legal professionals should analyze contracts to make sure every clause is enforceable and unambiguous.

This consists:

-

- Clear Dispute Resolution: Mechanisms for handling conflicts.

- Termination Clauses: Conditions under which the contract can be legally terminated.

- Warranty and Liability Provisions: Words that specify the extent of warranties and liability should the equipment break down.

Operational Continuity

Operationally, the choice of financing source can influence everyday operations.

While leasing offers flexibility to accommodate rapid technical changes, outright purchases enable seamless integration into existing systems.

We recommend that businesses evaluate the following:

-

- Usage Frequency: The equipment’s criticality to operations and frequency of use.

- Upgrade Cycle: The anticipated equipment lifetime in relation to developments in the market.

- Maintenance Capabilities: The capacity of the company to handle technical problems and repairs internally instead of outsourcing.

Risk Management

Leasing and buying both have specific inherent hazards. While leasing agreements may include hidden charges or restricted conditions, outright acquisitions expose companies to fast obsolescence.

A comprehensive risk analysis should comprise:

-

- Financial Risk: Impact on liquidity and debt levels.

- Technological Risk: Potential for the equipment to become outdated.

- Operational Risk: Disruptions due to maintenance issues or contractual limitations.

Technological Advancements and Business Flexibility

One must always be operational in agility. In this sense, leasing equipment can present a significant benefit by:

-

- Facilitating Upgrades: letting companies consistently access the newest technologies free from the weight of reselling or disposal of old machinery.

- Reducing Downtime: Utilizing the included maintenance services ensures that equipment remains in optimal working order.

- Supporting Scalability: letting companies modify their equipment mix in response to changes in corporate strategy or expansion.

In sectors where technical innovation is a primary driver of competitive advantage, the ability to upgrade or replace equipment with minimal friction is crucial.

Selecting a flexible financing structure helps businesses ensure they always have the necessary tools to meet changing market needs.

Practical Comparative Scenarios for Better Understanding

Scenario 1: A Startup in a Rapidly Evolving Market

A tech-based firm sees fast expansion, and regular equipment requires changing. With limited funds, the business chooses an operational lease allowing for two-year technological updates.

The consistent leasing payments help enhance cash flow, while the bundled maintenance services help lighten the internal IT team’s responsibilities.

The preservation of capital and the freedom to upgrade show benefits even if the overall cost throughout the lease term is higher.

Scenario 2: An Established Manufacturing Firm

Operations of a reputable manufacturing company depend on specific machinery. Because of its lengthy service life and possible customization, the company chooses to buy the equipment straight forward.

Although the initial outlay is significant, the corporation benefits from tax advantages, reduced long-term maintenance costs, and flexibility in modifying equipment to accommodate changing production demands.

Here, the direct ownership concept aligns with the company’s strategic emphasis on operational stability and long-term cost control.

Scenario 3: A Service-Oriented Enterprise

Leasing equipment is a decision made by a service-based organization, depending on its contemporary IT architecture.

This allows the business to continually improve its technology, thereby ensuring that staff members have access to modern tools without a significant impact on cash flow.

The lease agreement covers thorough maintenance and support, therefore enabling the company to focus on service delivery rather than equipment administration.

Financial Models and Metrics

We present a thorough analysis of financial models comparing leasing with buying, providing a strong foundation for informed decision-making.

Companies trying to measure the consequences of every choice can find a road map in this study.

Key Financial Metrics

-

- Cash Flow Analysis: A thorough monthly and annual cash flow analysis showing the effects of leasing payments against depreciation charges and maintenance-related ownership expenses.

- Total Cost of Ownership (TCO): An all-inclusive computation including purchase price, leasing payments, running costs, upkeep, and finally, resale or buyout values.

- Net Present Value (NPV): Accounting for the time value of money and risk considerations, an analysis of the present value of future cash flows connected with every option yields.

Operational and Strategic Considerations

Strategic Alignment

One must match the funding approach to more general corporate objectives.

Leasing is the best choice when the goal is to keep technological agility and save cash.

On the other hand, buying could be the preferable option if long-term asset retention and customization are of top importance.

Operational Efficiency

The dependability and adaptability of the equipment affect the efficiency of daily activities.

Lease terms include maintenance and support services, which help to reduce operational interruptions.

This guarantees the minimum of equipment downtime, thus promoting general company output.

Market Competitiveness

One of the main differences in competitive marketplaces is the capacity to react quickly to technical developments.

Leasing provides the flexibility needed to maintain a competitive edge by allowing for regular improvements without the financial burden of significant capital projects.

Vendor Partnerships

Adequate equipment financing usually depends on the degree of vendor cooperation.

Working with trustworthy lessors or suppliers who provide clear terms, thorough assistance, and industry-specific flexibility is our recommendation.

From a transactional relationship to a strategic alliance, a trusted partnership can change the equipment financing process.

Conclusion

Our thorough investigation has revealed, through clear findings, the several benefits and drawbacks of leasing corporate equipment rather than purchasing it.

The choice depends on a careful juggling of operational continuity, long-term cost-effectiveness, cash flow management, and strategic alignment with corporate goals.

This article provides a comprehensive foundation for evaluating your options for equipment financing.

Businesses can make informed decisions that support sustainable development and competitive advantage by weighing factors such as current capital requirements, maintenance obligations, and future technical needs.

Our comprehensive financial models, combined with legal and operational insights, are designed to support your strategic planning, ensuring your company remains flexible and well-prepared for the future.

A strategic analysis of leasing versus buying is not just a financial, but also a fundamental component of your entire business strategy for firms trying to maximize capital efficiency while remaining at the forefront of technology.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.

FAQs

Is Leasing Suitable for All Types of Equipment?

For equipment prone to fast technical change or high maintenance requirements, leasing is very helpful. In the long term, buying could be more affordable for assets with solid technology and long operational lifetime.

How Do Tax Benefits Compare?

There are tax benefits from both funding techniques. Depreciation can offer major tax benefits with straight purchases. Lease payments, on the other hand, are usually regarded as operational costs and provide instant tax benefits. The best option will rely on your company’s financial goals and tax plan.

What Role Does Equipment Usage Frequency Play?

Mission-critical activities or high-frequency use may call for complete acquisition to guarantee ongoing availability and control. However, leasing gives the required flexibility to scale up or down without long-term commitments if equipment use is erratic or vulnerable to technical obsolescence.

How Should Businesses Manage Maintenance and Upgrades?

One major operational consideration is maintenance. Often, maintenance services and lease agreements help simplify administrative tasks and lower unanticipated costs. Conversely, owning tools calls for committed maintenance resources. Selecting the appropriate financing plan depends on weighing the cost and ease of upkeep of several choices.

What Are the Risks Associated with Leasing?

Among the possible hazards include early termination fines, hidden costs, and reliance on the financial stability of the lessor. To reduce these dangers, one must carefully go over the leasing agreement including legal provisions and service assurances.