Summary

India is an attractive country for businesses to expand. However many companies face issues related to starting a business operations in India. Here is the perfect read for you that will introduce you to the best model in India to start your business with.

Introduction

India is undoubtedly an attractive country for businesses around the world. According to a Japanese billionaire, Masayoshi Son, India is a land of vast opportunity.

India presents lucrative opportunities for global companies. However, when starting a business in India, the most important part is registering an entity. Registration of an entity in India is a time-consuming task that might discourage you from starting a business in India. But, does entity formation really matter?

No!!! Knowing this, there are some misconceptions about how to start a business in India without forming an entity. No need to worry! This is a perfect read for you to understand the solution and grab the lucrative opportunity of entering in Indian market.

Let’s understand how to start a business in India, what challenges need to be addressed, and which services are available. Additionally, we will understand the benefits of those services. So, let’s first understand what is entity formation.

Why Start Business Operations in India?

Let’s understand some more statistical reasons why to start business operations in India.

India– the fastest-growing economic country is the gold mine in terms of opportunities for businesses around the world.

Here you gain the advantage of:

Fast GDP Growth: The country’s economic future appears bright based on recent projections. The International Monetary Fund (IMF) has kept its growth prediction for India’s fiscal year 2025 at 7%. For the current fiscal year, the World Bank has increased its growth forecast for India from 6.6% to 7%. With a real GDP growth of 8.2% in FY 2023–2024, India surpassed forecasts and cemented its status as the main country with the quickest rate of growth.

Large Talent Pool: India is one of the leading countries in terms of youth population, which makes it obvious that it has a vast talent pool. As of 2024, about 65% of India’s population is between the ages of 15 and 64, making it uniquely positioned to harness the potential of a large working-age population. Especially in the technology, engineering, and business services sectors. Basically, India doesn’t have one Sundar Pichai; there are plenty more.

Cost-Effective: From the salary of the employee to the infrastructural cost, India is one of the most cost-efficient countries. If you compare the costs between India and the USA, a drastic difference will appear in your vision. In terms of being a cost-effective option, India is an attractive country for startups.

Proficiency in Language:

The extensive use of English in India lowers language barriers in business, which facilitates operations for multinational corporations. One out of five Indian adults can speak English, with 16% being able to talk in the language and 4% reporting fluency.

Men, residents of cities, and those with higher levels of education are more likely to speak English. English proficiency is most prevalent in Karnataka (73.33%), followed by Uttar Pradesh (68.75%) and Kerala (61.66%).

Government Support: The Indian government has designed policies like “Make in India” and “Startup India” to support foreign business. These initiatives simplify the process for foreign companies to start a business in India.

Access to the Locations: Businesses can reach markets in Southeast Asia, the Middle East, and Africa thanks to India’s geographic location.

Now that we know the reasons for why starting a business in India, let’s understand the challenges a business may face.

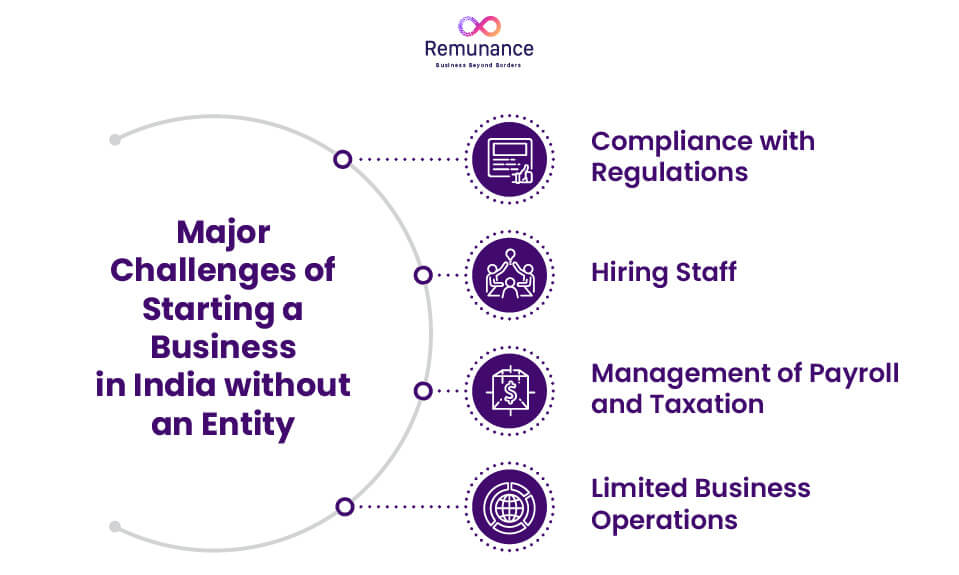

Challenges of Starting a Business Without an Entity

It is quite disturbing to read about challenges after reading about advantages. But, to achieve something one has to go through so many things. Let’s understand the challenges a company faces while starting a business in India without forming an entity.

Compliance with Regulations: Indian tax and labor laws are intricate. Companies without an entity are subject to strict contractual duties, payroll taxes, and employment rules. If you do not have an entity and still looking for a team in India, there is a chance of permanent establishment risk, which results in hefty penalties.

Hiring Staff: Direct hiring staff without an entity can be challenging. Without a legal presence, businesses cannot offer statutory benefits or compliant employment contracts.

Management of Payroll and Taxation: Without a recognized organization, it can be difficult to guarantee correct payroll processing, social security contributions, and tax deductions.

Limited Business Operations: Companies that don’t have a legal entity may not be able to establish specific business operations or sign formal contracts with Indian clients. For example, if a SaaS company from the United States wishes to join the Indian market and offer software services to Indian customers. They are unable to enter into official contracts with local businesses that necessitate adherence to Indian tax laws and data protection requirements, nevertheless, since they lack a legal organization in India.

Solutions for Operating Without Entity Formation

We’re not leaving you with the challenges, but providing three interesting solutions. We have three comprehensive options such as EOR services, Outsourcing, and contractors which will help you in starting a business in India without having an entity.

EOR Services

The Employer of record (EOR) is a service provider that is a legal employer of the employees on behalf of foreign companies. In India, PEO is often referred to as EOR though both have some differences in nature. PEO acts as a co-employer and the employer of record takes the full responsibility of the employee. It handles legal activities, including payroll processing, compliance issues, and benefits administration.

The employer of record service is the ideal option for start-ups who want to enter the Indian market without forming an entity. The employer of record services helps you with employment contracts, social security contributions such as employee provident fund(EPF), Employees’ State Insurance (ESI), and other statutory requirements such as:

- Payroll Processing & Tax Compliance

- Gratuity Payments

- Professional Tax (PT)

- Labor Welfare Fund (LWF) Contributions

- Shops and Establishments Act Compliance

- Minimum Wages Compliance

- Bonus Payments

- Workplace Safety Regulations

- Maternity and Paternity Benefits

- Termination and Severance Pay

Due to this, you can focus on your daily operations.

Some of the most important advantages are that you can hire the best talent in India with the help of EOR, avoid hefty penalties, and streamline your administrative work.

Outsourcing

Without having an entity, you can outsource the business functions. Outsourcing helps with customer support, IT services, and back-office operations in Indian firms. It reduces overhead expenses and operational complexity by enabling companies to assign work to outside service providers. However, outsourcing frequently lacks the direct employee supervision, compliance assurance, and stability that an Employer of Record (EOR) provides.

Advantages of outsourcing:

- Cost savings: By outsourcing, infrastructural and HR administration expenditures are avoided.

- Concentrate on Core Business: While external contractors oversee operations, businesses can concentrate on strategic growth.

Disadvantages of outsourcing:

- Limited Control: Managing daily operations through outsourcing partners limits direct control over procedures.

- Data Security Risks: Working with third-party providers may put confidential company information at risk.

- Quality Issues: Without direct supervision, it may be difficult to guarantee constant service quality.

Contractors

Without the requirement for direct employment, contractors can assist companies in launching operations in India by offering temporary labor options and specialized expertise. They give businesses the flexibility to scale teams and conduct rapid market testing. However, contractors provide less long-term stability, control, and compliance security than an Employer of Record (EOR).

Steps to Start Business Operations in India Without an Entity

Starting a business in India is a step-by-step process. Let’s understand each step one by one. How it is complex, what needs to be addressed!

- Establish Your Business Goals: Specify your goals, target market, and operational needs to enter the Indian market.

- Select a Service Provider: Consider the providers’ experience, compliance, and level of competence.

- Employing and Onboarding Employees: Assist the supplier of your choice with hiring, onboarding, and managing staff.

- Assure Compliance: Confirm that your activities abide by regional tax laws, labor legislation, and corporate guidelines.

- Establish Business Processes: Work with your service provider to set up procedures for banking, invoicing, and contract administration.

- Track Performance: To guarantee business expansion in India, continuously evaluate and improve processes.

Benefits of Choosing EOR in India

- Faster Market Entry: Opt to begin operations in a matter of weeks rather than months.

- Cost Efficiency: Steer clear of the hefty expenses associated with legal compliance and entity setup.

- Risk Mitigation: With expertly managed compliance, lower financial and legal risks.

- Flexibility: Adjust operations to business requirements.

- Emphasis on Core Activities: Assign administrative and human resources responsibilities to experts while concentrating on business expansion.

How to Select the Right Service Provider

In a big country like India, it is quite difficult to find the right service provider. For smooth operations, selecting the best EOR provider is essential. Consider the following aspects:

- Industry Experience: Look out for a provider who has a thorough awareness of experience in your industry.

- Assurance of Compliance: Verify if the supplier has a solid history of adhering to Indian laws.

- Service Offerings: Determine if the supplier provides full-service like payroll, benefits, and human resources management.

- Cost Structure: To guarantee openness, compare pricing structures with other competitors and look for any hidden charges.

- Client Support: If a client has questions about law or human resources etc, a trustworthy provider should provide timely assistance and advice.

- Technology and Reporting: Using cutting-edge HR tech platforms for personnel tracking, payroll management, and reporting can increase productivity.

Conclusion

First of all, we appreciate your decision to choose India for expansion. Because, in India, you will get plenty of business opportunities. Companies can take advantage of EORs or outsourcing services and enhance productivity. By selecting the correct service provider, companies can benefit from cost-effective operations, hassle-free market access, and compliance assurance.

So till now, we hope everything is clear about how to start a business in India without having an entity. If so, get in touch with us now to experience the best employer of record service and execute your strategic move of expansion.

FAQs

Can a foreign company legally hire employees in India without setting up a local entity?

Yes, by collaborating with an Employer of Record (EOR), a foreign business can hire workers in India without creating a formal corporation. While maintaining operational control over the workforce, an EOR manages payroll, compliance, taxes, and benefits as the foreign company’s legal employer. Businesses can grow swiftly and legally with this strategy, which eliminates the hassle of entity formation.

What are the advantages of using an Employer of Record (EOR) over setting up a subsidiary in India?

Compared to creating a subsidiary, using an Employer of Record (EOR) has the following benefits:

Speed: Rather than taking months, onboarding new personnel takes days.

Economical: There are no setup fees for legal, administrative, or compliance requirements.

Regulatory compliance: The EOR is in charge of processing payroll, tax laws, and labor laws.

Flexibility: Easily scale operations up or down without being bound by entity-related obligations.

Lower risk: Steer clear of the long-term debts and complicated legal issues that come with permanent establishment.

How do payroll and taxation work when hiring through an EOR in India?

An EOR in India handles payroll processing for a foreign company that hires through them while making sure local tax regulations are followed.

The EOR collects and sends employees’ income tax (TDS, or Tax Deducted at Source).

oversees statutory payments for professional tax (PT), employee state insurance (ESI), and provident fund (PF).

Pays salaries in Indian Rupees and provides tax returns and pay stubs.

This guarantees complete adherence to Indian employment laws without necessitating the foreign business to register for Indian tax duties.

Schedule a free call

Schedule a free call