European Markets Lead Global Gains with Defense and Industrial Sectors

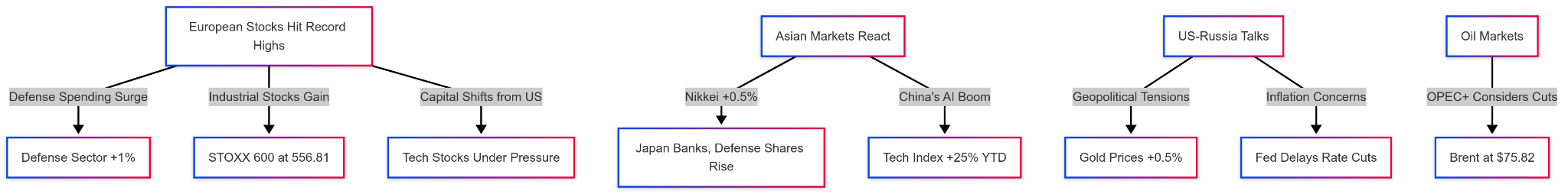

European stock markets have reached unprecedented levels as investors continue to shift capital into non-U.S. markets, seeking refuge from the inflationary pressures exacerbated by U.S. trade tariffs. The pan-European STOXX 600 index soared to a record high of 556.81 points, with aerospace and defense stocks playing a pivotal role in driving the rally. The defense sector alone climbed 1% on Tuesday, building upon a 4.6% surge on Monday, driven by mounting expectations of increased military spending across Europe.

With U.S. inflation running hotter than the Federal Reserve’s 2% target, investors are eyeing European markets as an attractive alternative. European stocks, which have seen their biggest weekly investment inflow since January 2023, are benefiting from their significant exposure to industrials—sectors poised to capitalize on continued economic growth.

“The idea is very simple: U.S. tech stocks are overvalued, whereas European stocks present attractive value,” noted Florian Ielpo, multi-asset portfolio manager at Lombard Odier Investment Managers. “Traditional industries, which dominate European indices, are gaining fresh investor interest.”

Rising Borrowing Costs Amid Fiscal Stimulus Hopes

While stock markets surge, the eurozone’s borrowing costs have climbed, reflecting expectations of increased government spending. Germany’s benchmark 10-year bond yield touched 2.51%, its highest level since January 31, following remarks from European Commission President Ursula von der Leyen about ramping up financial support for Ukraine. This surge comes as the U.S. and Russia prepare for high-stakes diplomatic discussions on potential peace agreements, raising geopolitical uncertainty.

Key Market Indicators:

- STOXX 600 Index: 556.81 (All-time high)

- Defense Stocks: +1% on Tuesday, after a 4.6% rally on Monday

- German 10-Year Bond Yield: 2.51% (Highest since Jan 31)

- U.S. Gold Futures: $2,923 per ounce (+0.8%)

Gold Prices Climb Amid Inflation and Tariff Uncertainty

Gold, a traditional safe-haven asset, has gained 0.5% to $2,911.4 an ounce, with U.S.-traded gold futures rising 0.8% to $2,923. The rally follows Goldman Sachs’ upward revision of its year-end gold price forecast to $3,100, citing rising inflationary pressures and heightened geopolitical risks.

Asian Markets React to Global Trends

Asian markets mirrored Europe’s gains, with Japan’s Nikkei index climbing 0.5% as bank and defense-related stocks followed the European surge. Meanwhile, China’s stock market witnessed strong performance, boosted by a rare meeting between President Xi Jinping and business leaders aimed at boosting investor confidence. The Hang Seng index reached its highest level since October, while Chinese technology stocks soared to a three-year high before slight profit-taking set in.

China’s AI Boom:

- Tech index up 25% year-to-date

- AI stocks leading gains

- Xi Jinping’s rare business meeting drives confidence

Britney Lam, founder of LAM Group, emphasized China’s edge in the AI race, stating, “With access to data, energy, talent, and cutting-edge chips, China is well-positioned to dominate the AI sector.”

Currency and Commodities Outlook

In the foreign exchange market, the euro strengthened 0.2% to $1.0455, bolstered by upcoming German elections that may introduce fiscal stimulus measures to support the struggling economy. The Japanese yen remained strong at 151.86 per dollar, maintaining its recent gains following Japan’s robust growth data, which has increased speculation about an imminent rate hike.

The British pound held steady at $1.2597, just below its highest level in two months, as traders awaited key employment and inflation reports due later in the week.

Meanwhile, oil prices continued to see volatility. Brent crude rose 0.77% to $75.82 per barrel following reports that OPEC+ may reconsider its scheduled supply increases in response to market conditions. Notably, former U.S. President Donald Trump has publicly urged the group to lower prices, adding another layer of political tension to the energy markets.

Investors Await U.S.-Russia Talks and Federal Reserve Policy Clues

Looking ahead, markets are closely monitoring developments in the upcoming U.S.-Russia negotiations and their potential impact on global security and economic stability. Additionally, Wall Street investors remain cautious as the Federal Reserve continues to push back against early rate cut expectations, with key inflation metrics still hovering 0.5% above the Fed’s 2% target.

“The pressures on Europe to substantially increase defense spending have escalated rapidly over the last week,” noted Deutsche Bank economist Mark Wall, reinforcing expectations for sustained military budget growth.

Conclusion

The global financial landscape is evolving rapidly, with European stocks leading the charge amid rising defense expenditures and industrial sector strength. While U.S. equities face uncertainty due to inflationary pressures and Federal Reserve policy constraints, investors are increasingly turning to Europe for value-driven opportunities. Meanwhile, Asia’s markets continue to benefit from China’s AI boom and strategic government intervention.

Looking ahead, traders will closely watch U.S.-Russia talks, upcoming inflation reports, and OPEC+ decisions, all of which could significantly shape market trends in the coming weeks. With global economic conditions shifting, diversification and strategic positioning remain key for investors navigating these turbulent times.

Schedule a free call

Schedule a free call