The High-Stakes Battle for OpenAI’s Future

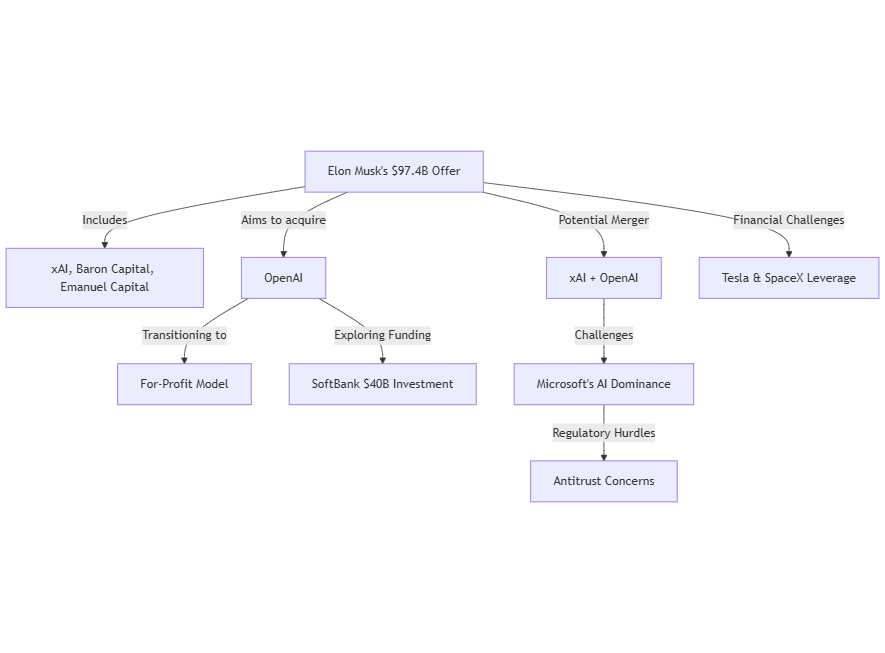

In a bold move that could redefine the artificial intelligence industry, Elon Musk and a consortium of investors have offered $97.4 billion to acquire control of OpenAI. This bid comes at a time of increasing tensions between Musk and OpenAI CEO Sam Altman, particularly over the company’s transition from a nonprofit to a for-profit entity. If successful, the acquisition could significantly alter the trajectory of OpenAI and its role in the AI landscape.

The Consortium Behind Musk’s Offer

Elon Musk’s bid for OpenAI is not a solo endeavor. The billionaire, who founded xAI in 2023 as a competing AI startup, has partnered with Baron Capital Group, Emanuel Capital, and other undisclosed investors. With significant backing, Musk’s group aims to steer OpenAI back toward its original vision—an open-source, safety-focused AI development initiative.

Potential Merger with xAI

One of the more intriguing possibilities arising from this bid is the potential merger of OpenAI with xAI. The latter recently secured $6 billion in funding at a $40 billion valuation, positioning it as a formidable force in the AI sector. A merger could create a powerful AI entity under Musk’s leadership, challenging dominant players such as Google DeepMind and Microsoft-backed OpenAI.

Why Musk Wants OpenAI Back

Elon Musk co-founded OpenAI in 2015 as a nonprofit aimed at ensuring artificial intelligence benefits all of humanity. However, he left the company in 2018, citing differences over its direction. Since then, OpenAI has transitioned into a capped-profit model, attracting significant funding from Microsoft and other investors. Musk has repeatedly criticized this shift, arguing that the organization has strayed from its original mission.

The Lawsuit Against OpenAI and Sam Altman

In August 2024, Musk filed a lawsuit against OpenAI, alleging that Altman and others violated contractual agreements by prioritizing profit over public good. The legal battle has added further complexity to OpenAI’s efforts to secure additional funding and establish itself as a for-profit enterprise. Musk’s latest bid, if accepted, could put an end to this dispute and re-align OpenAI with its founding principles.

Financial and Regulatory Hurdles

Despite Musk’s considerable wealth—his Tesla stock alone is valued at approximately $165 billion—securing the funds for a $97.4 billion takeover will require substantial financial maneuvering. Analysts suggest he could leverage his stakes in Tesla and SpaceX or seek additional investors. However, given his recent $44 billion acquisition of Twitter (now X), banks may be hesitant to extend further credit.

Antitrust Concerns and Market Implications

A takeover of OpenAI by Musk would undoubtedly attract scrutiny from regulatory bodies, particularly concerning antitrust laws. OpenAI is one of the most valuable private companies in the world, recently reaching a valuation of $157 billion. A deal of this magnitude could raise concerns about market concentration and competitive fairness in the AI industry.

OpenAI’s Response to the Takeover Bid

Sam Altman and OpenAI’s board have shown little interest in Musk’s proposal. According to reports, OpenAI is exploring alternative fundraising options, including a potential $40 billion investment round led by SoftBank Group. In a public response to Musk’s bid, Altman posted on X: “No thank you, but we will buy Twitter for $9.74 billion if you want.”

Microsoft’s Stake in the Matter

As a major backer of OpenAI, Microsoft holds significant influence over the company’s decision-making. The tech giant has invested billions into OpenAI and integrated its AI models into flagship products such as Azure and Copilot. If Musk’s bid were to succeed, it could disrupt Microsoft’s strategic plans and force a reassessment of its AI partnerships.

Impact on the AI Industry

The outcome of Musk’s takeover bid will have far-reaching implications for the AI sector. If successful, it could lead to a restructuring of OpenAI’s leadership and operational philosophy. Alternatively, if OpenAI rebuffs the offer, it could accelerate its efforts to secure alternative funding and further distance itself from Musk’s influence.

The Future of AI Governance

At the heart of this battle is a fundamental debate over AI governance. Should AI development be driven by open-source collaboration and public good, as Musk advocates? Or should it be guided by market forces and investor-driven growth, as OpenAI’s current leadership pursues? The resolution of this conflict will shape not only OpenAI’s future but also the broader trajectory of artificial intelligence development.

What Comes Next?

As the dust settles, several key questions remain unanswered:

- Will OpenAI’s board reconsider Musk’s offer in light of mounting pressure from investors?

- How will Microsoft and other stakeholders react to the potential shift in ownership?

- Could regulatory concerns ultimately block the deal from going through?

- What alternative strategies will OpenAI pursue to solidify its financial position?

One thing is certain: the AI industry is at a pivotal moment. Whether or not Musk succeeds in his bid, this move will set the stage for future power struggles in the race for AI supremacy.

Conclusion

Elon Musk’s $97.4 billion bid for OpenAI represents one of the most significant corporate moves in the AI sector. With deep implications for AI governance, funding structures, and market competition, the battle over OpenAI’s future is far from over. As events continue to unfold, stakeholders across the industry will be watching closely, knowing that the outcome could redefine the future of artificial intelligence.

This high-stakes battle between Musk and OpenAI is set to shape the future of artificial intelligence. Whether through consolidation or continued competition, the next chapter in AI’s evolution is being written now.

Schedule a free call

Schedule a free call