The recent survey results from the British Chambers of Commerce (BCC) underscore a growing concern among UK firms about the economic landscape shaped by upcoming tax hikes.

The report reveals a significant reduction in hiring and increased pressure on businesses to raise prices. In this article, we delve into the key findings of the survey, analyze the implications for the labor market, and explore the broader economic effects of these changes.

Escalating Pressure on UK Firms

Rising Costs of Labour

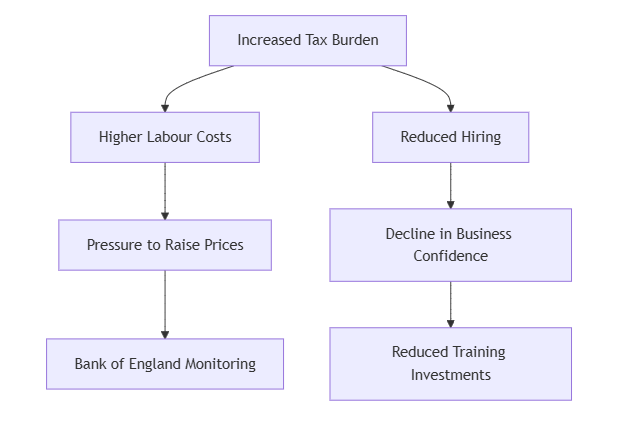

The BCC’s survey highlights that 75% of businesses are experiencing pressure to increase prices, primarily due to rising labor costs. This is a notable rise from 66% in the previous quarter, setting a record high since the inception of these surveys in 2017.

The impending increase in national insurance contributions and the minimum wage, set to take effect in April, are central contributors to this financial strain.

Decrease in Hiring

According to the survey, 16% of companies reduced their workforce in the fourth quarter, up from 13% in the third quarter. This reduction marks the highest level since early 2021. Firms are scaling back their hiring plans in anticipation of the increased costs associated with the new tax regime.

Decline in Business Confidence

Jane Gratton, Deputy Director of Public Policy at the BCC, remarked on the erosion of business confidence following the latest budget. The planned tax increases have forced employers to reassess their strategies for recruitment, retention, and staff development, further exacerbating the challenges they face.

Economic Context and Government Response

Economic Context and Government Response

Budgetary Measures and Their Rationale

The October 30 budget presented by Finance Minister Rachel Reeves introduced a £25 billion increase in payroll taxes. Reeves justified these measures as essential for fostering investment and revitalizing public services amidst mounting government borrowing costs. Despite these intentions, the business community remains apprehensive about the impact on their operational capabilities.

Bank of England’s Interest

The BCC’s findings will likely attract the attention of the Bank of England, which is closely monitoring corporate responses to the budget. Understanding these reactions is critical for shaping the Bank’s inflation outlook and monetary policy decisions.

Broader Business Trends

Comparative Surveys

The BCC’s report aligns with other recent surveys, such as the one conducted by Deloitte, which observed the steepest drop in firms’ hiring intentions since the onset of the COVID-19 pandemic in early 2020. This consistency across multiple sources underscores the pervasive nature of the economic challenges currently facing UK businesses.

Investment in Training

A worrying trend emerging from the BCC survey is the reduction in investment in staff training. Nearly one in five respondents reported cutting back on this crucial aspect of workforce development, which could have long-term implications for employee skills and overall productivity.

Recommendations

To navigate these challenging times, businesses must adopt a multifaceted approach. This could include leveraging technology to optimize operations, exploring flexible workforce arrangements, and advocating for policy support that mitigates the impact of tax hikes.

Conclusion

The findings from the BCC survey paint a stark picture of the challenges facing UK businesses in the wake of significant tax increases. The reduction in hiring, coupled with increased cost pressures, calls for strategic adjustments by firms and careful consideration by policymakers to ensure sustainable economic growth. By understanding and adapting to these dynamics, businesses can better position themselves to thrive in an evolving economic environment.

Economic Context and Government Response

Economic Context and Government Response Schedule a free call

Schedule a free call