Important Notes on Tesla’s 2024 Performance

Leading electric vehicle (EV) company Tesla Inc. (NASDAQ: TSLA) underwent its first annual drop in deliveries in 2024, therefore marking a turning point in its history under Elon Musk.

With interest-free financing and free fast-charging, among other significant end-of-year incentives, Tesla reported a 1.1% decline in deliveries over the year from last. This drop highlights growing difficulties, including changing market dynamics, more competitiveness, and less subsidies in important areas.

Tesla’s Yearly Delivery Performance

Tesla delivered 1.79 million vehicles worldwide in 2024, falling short of analysts’ estimate of 1.806 million units and Musk’s prior projection of minor increase. The collapse comprises:

- Deliveries for Models 3 and Y total 451,930 units.

- Other Models: 23,640 Cybertruck; Model S, Model X

- 495,570 total Q4 deliveries—below the projected 503,269 units

This drop raises issues regarding market saturation and changing consumer tastes since it stands in sharp contrast to Tesla’s past years of exponential expansion.

Important Factors Affecting Tesla’s Expansion

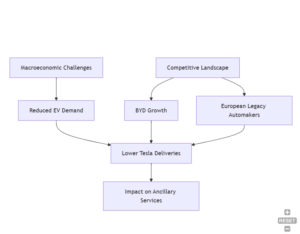

1. fierce rivalry

With a 12.1% rise in battery-electric vehicle (BEV) sales, China-based BYD, a main rival of Tesla, will have 1.76 million units in 2024.

European Pressure: VW’s Skoda Enyaq SUV highlighted increasing competitiveness from legacy manufacturers by outperforming Tesla’s Model Y in Europe.

2. Changing Consumer tastes

Consumers in the United States gravitated toward less expensive hybrid models, so influencing Tesla’s EV leadership.

Analysts have pointed out that Tesla’s present lineup is almost market saturation, thus new models or updated designs are called for.

3. Macroeconomic Opportunities

Rising interest rates discouraged possible EV consumers even with Tesla’s financial incentives.

Phasing off subsidies in Europe and other countries significantly lessened Tesla’s competitive edge.

Strategic Action and Future Possibilities

A. Cybertruck: Mixed Reception

With its futuristic look, Tesla’s much awaited Cybertruck made its public in 2024. Early indicators, meanwhile, show a weak demand. Delivery figures are still unknown, which makes investors wary about its capacity to propel next expansion.

B. Emphasize self-driving technologies.

Tesla’s approach still revolves mostly around Musk’s goal for a fleet of self-driving taxis. Still years from implementation, autonomous technology has little direct effect on revenue.

C. China: A Spot of Brightness

Among world problems, Tesla’s performance in China was a remarkable exception:

Record sales—an 8.8% rise from 2023—over 657,000 vehicles sold.

Aggressive discounts: In the biggest auto market worldwide, strategic pricing helped Tesla keep its lead.

Political and Regulatory terrain

There could be regulatory benefits from Tesla’s connection with President-elect Donald Trump. Musk’s financial support of Trump’s campaign puts Tesla in a position to gain from expeditious approval of driverless cars. Potential legislative changes like removing the $7,500 EV tax credit, however, could endanger the U.S. EV market going forward.

Analyst Understanding and Market Consequences

Reduced Deliveries and Market Saturation

Reduced deliveries might hamper Tesla’s ancillary income sources, including charging, insurance, and autonomous driving software, according to Morningstar’s Seth Goldstein.

Prospects for Future Expansion

If Tesla is to reach Musk’s lofty objective of 20–30% sales increase in 2025.

They Must:

- Accelerate manufacturing of reasonably priced car variants

- Increase its hold in Asia and Europe, two fiercely competitive markets.

- Using focused marketing increases demand for the Cybertruck.

Schedule a free call

Schedule a free call