Companies like Tesla and General Motors (GM) are encountering unheard-of difficulties as the global electric vehicle (EV) market develops, particularly in cutthroat regions like China. Although the sector is still seeing amazing expansion, changing dynamics in customer tastes, government legislation, and market competitiveness are changing the scene for EV makers. This paper explores the changing market and points up chances for expansion as well as plans for overcoming obstacles in 2025.

The Changing Scene of the Chinese EV Market

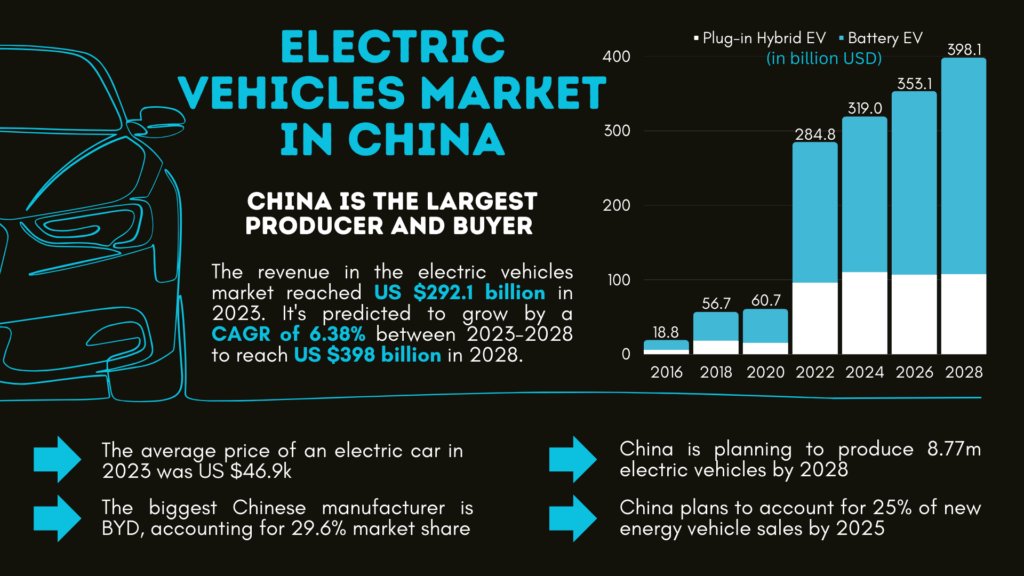

With a sizable portion of world sales, China is still the top EV market in the globe. However, rising local manufacturer competition from BYD, NIO, and Xpeng has greatly accelerated the race. These domestic players provide reasonably priced yet high-performance cars, which makes it difficult for foreign companies to keep their supremacy.

Main Factors Driving the Increase in Domestic Electric Vehicles:

- Government Support: Domestic players’ competitiveness is improved by kind subsidies and incentives.

- Technological Advancements: Local producers can cut costs by means of better battery technologies and manufacturing efficiencies.

- Understanding and Meeting Consumer Needs: Understanding and meeting the particular needs of Chinese consumers helps domestic brands to have a strategic advantage.

Obstacles for World EV Giants

From price pressures to regulatory complexity, Tesla and GM are facing different challenges in the Chinese market.

The Following Are Some Main Factors Influencing Their Performance:

- Pricing Wars: Chinese automakers’ aggressive pricing policies compromise margins for foreign rivals.

- Dependence on Imported Components: Raises logistical difficulties and expenses.

- Cultural Disconnect: Insufficient market penetration can result from mismatched local consumer preferences.

Strategic Responses:

Strategic responses are what global actors need to use to combat these problems—that is, creative ideas. Possible fixes are:

- Working with Nearby Vendors

- Implementing Region-Specific Models

- Funding Innovative Manufacturing Facilities

The Part Technology and Innovation Will Play in 2025

In the EV sector, innovation still defines competitiveness most importantly. Businesses making investments in next-generation technology are more likely to take front stage in the market.

Rising Patterns to Track:

- Solid-State Batteries: Faster charging speeds and higher energy densities make solid-state batteries ready to transform the EV sector.

- ADAS (Advanced Driver-Assistance Systems): Integration of sophisticated driver-assistance systems improves the attractiveness of premium electric cars.

- Constant Software Upgrades: Help to increase vehicle lifetime and enhance user experience.

World Policy and Regulatory Environment

The EV market is being formed in great part by governments all around. Policy actions greatly affect market dynamics, from emission rules to subsidies.

China’s Regulatory Emphasis

China’s strict pollution rules and aggressive electrification plans confirm even more of its leadership in the world in terms of EV acceptance. For foreign manufacturers, these rules do, however, also provide compliance difficulties.

Globally Changing Policies:

- United States: Under the Inflation Reduction Act, tax credits promote homegrown electric vehicle manufacture.

- Europe: By 2035, the European Union’s “Fit for 55” campaign seeks to phase out internal combustion engines.

Prospective Investments in Electric Vehicle Stocks

The growing EV industry has rich prospects for investors. Finding the appropriate stocks calls for a strong awareness of market trends, competitive positioning, and development possibility.

Top EV Stocks to Track through 2025:

- Tesla (TSLA): Despite obstacles, Tesla is a powerful actor because of its innovative pipeline and brand value.

- BYD (BYDDF): Using vertical integration, this Chinese producer stays cost leader.

- Rivian (RIVN): With an eye on a specialized but expanding market, Rivian specializes in electric vehicles and SUVs.

- Lucid Motors (LCID): Renowned for its luxury EVs, Lucid emphasizes innovative technology and high-end consumers.

The Road Ahead

Achieving sustained growth in 2025 for EV producers depends on strategic investments, market adaption, and creativity combined.

Important Tactics:

- Diversification: Increasing product lines to feature quality and reasonably priced models.

- Localization: Establishing supply chains and manufacturing plants in important markets.

- Partnerships: Working with tech firms for cutting-edge technologies like artificial intelligence and driverless driving.

In Conclusion

Though it presents difficulties, the EV market of 2025 is likely to undergo revolutionary expansion. Businesses that give invention, flexibility, and strategic cooperation top priority are more likely to flourish. Given they remain sensitive to market dynamics and new developments, the industry presents a wide range of prospects for investors.

Staying ahead of consumer tastes and technical developments will help the EV sector transform world transportation and reshape mobility as we know it.