Quick Summary:

There are various types of health insurance for employees in India. Some of them are group and individual health insurance. Others include top-up plans and OPD plans. There are various ways of offering good health insurance. Such as you can use digital insurance platforms. Or, you can partner with an EOR.

Offering health insurance for employees in India isn’t a bow on top. It’s kind of the ultimate mantra to build a strong remote team. There should be one thing certain for your remote team. No matter if they’re working from bustling metros or sleepy hill towns with patchy Wi-Fi. There should be access to quality healthcare. And no, yoga and green tea won’t fix everything.

Hence, you, as an employer, should be well-versed in the following things:

-

- Types of health insurance in India

- Key features of a good health insurance in India

- Cost of health insurance in India

- How to offer health insurance in India

Hence, we bring this blog to you to address all the pointers above. We really want you to roll out premium health benefits before you roll out another productivity app.

What You Must Know about Health Insurance for Employees in India?

Now, it’s time for you as an employer to be aware of certain health insurance for employees in India. This way, you can support your remote team’s health from a distance. Wondering about how to get that cheat sheet? We’ve curated this section dedicatedly for that.

In India, employee benefits are no longer limited to on-site staff. Remote employees also equally expect protection and care. In fact, according to a 2023 survey by NASSCOM, Indian remote workers have started considering health insurance a top priority.

Hence, let’s break down what employers need to know.

Why Health Insurance Matters More Than Ever?

Health insurance for employees in India is no longer an optional benefit. It’s a mandatory perk provided by all companies. Here’s why it should be on your radar:

-

- Rising medical costs: Healthcare expenses in India are at a growing pace. According to Financial Express, it is supposed to record a 13% rise in 2025 alone.

- Increased mental health needs: Remote workers often face isolation and stress. Plans with mental health support can be a great help for such employees.

- Attracting top talent: A competitive health plan can be a dealmaker in today’s hiring market.

For remote workers, flexibility in healthcare access is just as crucial as coverage itself.

What to Look for in a Remote-Friendly Health Plan?

When choosing health insurance for remote workers, make sure it’s suited for a distributed team. Here’s what to check for:

-

- Pan-India coverage: Employees should be covered no matter their city or town.

- Cashless network hospitals: Ensure the insurer has a strong network across India.

- Telemedicine & online consultations: Ideal for remote teams who may not live near big hospitals.

- Mental health support: This is becoming a must-have feature in modern plans.

- Customizable add-ons: Include maternity, dental, or wellness programs based on your team’s needs.

Offering health insurance for employees in India that checks these boxes helps you stand out. It shows your team that you truly care.

Types of Health Insurance for Remote Teams in India

Okay, now you’re aware of the basic elements of health insurance for employees in India. Let’s move forward and dissect the types of health insurance for remote workers in India.

1. Group Health Insurance

This is one of the most common ways companies offer health insurance for employees. They do so for good reason. Let’s see why.

What it is: A single health policy that covers all your employees under one plan.

What it usually covers:

-

- Hospitalization expenses (pre and post)

- Surgeries and treatments

- Maternity benefits (waiting period typically ranges from 9-24 months)

- COVID-19 and other infectious diseases

- Cashless treatment at network hospitals

Pros:

-

- Cost-effective for the employer

- Easy to manage one plan for everyone

- No medical tests needed for most plans

- Can be extended to cover spouses, children, or parents

Best for: Mid-sized to large teams, or startups with steady funding.

Example: A foreign tech startup with 20+ remote employees can opt for a group policy. It would be applicable anywhere across India. This policy ensures everyone gets access to the same healthcare benefits.

2. Individual Health Insurance with Reimbursement

Don’t have a large team? This flexible approach might work best.

What it is: Employees purchase their own individual plans, and you reimburse them fully or partially.

How it works:

-

- Set a health insurance allowance (e.g., ₹10,000 per year)

- Employees choose any insurer or plan they like

- Submit receipts for reimbursement

Why it works:

-

- Gives freedom of choice to employees

- Low admin work for employers

- Scales easily with a growing team

Best for: Small remote teams, independent contractors, or companies just starting out.

Here’s a quick tip: Set a reimbursement policy and share it clearly with the team to avoid confusion later.

3. Top-Up or Super Top-Up Plans

Already offering basic health coverage? Or working with employees who have personal insurance? Add a top-up!

What it is: An add-on plan that kicks in once the base coverage is exhausted.

Benefits:

-

- Higher coverage at lower premiums

- Works well with existing policies (whether personal or group)

Ideal for:

-

- Teams with mixed coverage (some may already have insurance)

- Cost-conscious companies that want to offer extra protection

Example: Suppose an employee’s personal insurance covers up to ₹3 lakhs. Here, you can offer a super top-up plan that adds another ₹5–7 lakhs on top.

4. OPD & Wellness-Focused Plans

Healthcare is more than just hospital stays. This is applicable especially for remote workers who may face stress, burnout, or general health issues.

Look for plans that include:

-

- OPD (Out-Patient Department) coverage for doctor visits, diagnostics, and medication

- Mental health support (therapy, online counseling)

- Free annual health check-ups

- Teleconsultation and online doctor access

- Fitness perks and wellness programs

Why it matters for remote teams:

-

- Remote workers don’t always have access to local hospitals

- Mental wellness support is a big plus in isolated work environments

Here’s an interesting fact. Some modern insurers and startups offer wellness-forward health insurance for remote workers in India. Plum, Onsurity, or Loop Health are among them, to name a few.

5. International or Travel-Based Coverage

Do you have team members who are constantly traveling?

In this case, look for:

-

- International health insurance plans

- Travel medical insurance with COVID and emergency care

- Digital nomad insurance

Best for:

-

- Global remote teams

- Contractors or consultants who work abroad occasionally

Things to check:

-

- Coverage in countries they travel to often

- Emergency evacuation and hospital access

- Reimbursement vs. cashless claim options

That’s all the important types of health insurance for employees in India, you need to know. Let’s move forward to the next crucial section.

Key Features of Good Health Insurance for a Remote Team in India

Let’s get into the next crucial thing to know about health insurance for employees in India. It’s how you can go the extra mile for your employees. And for that, you need to know what good health insurance coverage looks like. Let’s get started.

1. Coverage for Preventive Health Checkups

Many health issues can be caught early with regular checkups. However, remote workers may not always take the initiative. That’s why preventive health checkups are a smart addition to any health insurance for remote workers.

What to look for:

-

- Annual health screenings at no extra cost

- Free diagnostic tests like blood pressure, cholesterol, and diabetes

- Access to health reports through a mobile app

This feature encourages a culture of wellness and early detection. This saves both money and health in the long run.

2. Outpatient Department (OPD) Expenses

Most people visit doctors more often than they get hospitalized. Yet, many insurance plans only cover inpatient costs. If you’re serious about offering meaningful health insurance for employees in India, OPD coverage is a must.

OPD coverage should include:

-

- Doctor consultations (general physicians and specialists)

- Diagnostic tests and X-rays

- Minor procedures done without hospitalization

- Medicines prescribed during OPD visits

For remote teams, this means better day-to-day healthcare access. Also, they don’t have to bear full out-of-pocket expenses.

3. Zero Waiting Period for Pre-Existing Conditions

Confused about this one? Let’s explain. Health insurance in India usually has a significant waiting period for pre-existing diseases. And the time frame is usually 2 to 3 years. But some insurers offer zero or reduced waiting periods. This happens especially for group policies.

Why it matters:

-

- Your employees may already have chronic conditions. Such as diabetes, hypertension, or thyroid issues, to name a few.

- Instant coverage helps them access care immediately, without delays.

- This is particularly valuable for high-end professionals who always tend to work under pressure.

When offering health insurance for employees, this is a strong value add.

4. Health & Wellness Rewards

Who doesn’t love to achieve something in the form of rewards? And what’s the best way to offer that than health insurance? The most precious reward without a question! Some modern insurance plans include health and wellness reward systems. These programs actually benefit proactive employees.

Typical wellness features include:

-

- Earning points for walking, exercising, or completing health quizzes.

- Redeemable vouchers or discounts on premiums.

- Integration with fitness devices or apps like Google Fit or Apple Health.

This is a great way to keep remote workers engaged, motivated, and healthier. This especially helps when they’re sitting for long hours.

5. Portability & Continuity Options

Remote teams can be dynamic. Someone might go freelance, take a sabbatical, or move to another company. And you, as an employer, should support and motivate their journey ahead.

This calls for good health insurance for remote workers. The one that ensures these remote workers don’t lose coverage during these transitions.

What to check:

-

- Can the employee convert the group policy to an individual plan?

- Is there a seamless portability process when switching insurers?

- Do they retain their benefits (like no claim bonuses or waiting period credits)?

This builds trust between you and your team, even if they part ways with your company.

6. Global Emergency Coverage

Your employees should be protected from all kinds of unexpected health issues. No matter where they’re working from.

Global emergency coverage should include:

-

- Emergency hospitalization abroad (for accidents or serious illness)

- Reimbursement or cashless options in international hospitals

- Coverage for medical evacuation if required

7. Tax Benefits for Employers and Employees

A good health insurance should be good for your wallet, too. Offering health insurance for employees in India brings tax perks for both parties.

Here’s how:

-

- Employers can claim it as a business expense under the Income Tax Act.

- Employees can claim deductions under Section 80D for premiums paid for family coverage.

- Helps reduce overall taxable income, which means more take-home pay.

8. Dedicated Relationship Manager or HR Dashboard

Managing a remote team’s health insurance can become a full-time job. Unless you pass on the responsibility to some local expert. Such as an employer of record partner in India.

Look for insurers that provide:

-

- A dedicated relationship manager for quick support

- A digital HR dashboard to add/remove employees

- Easy tracking of claims and coverage details

- Help with renewals and documentation

These features save hours of your admin work every month. Now let’s move forward to the expense part of all the lucrative things we’re discussing.

Cost of Health Insurance for a Remote Team in India

This section explains the driving factor of health insurance for employees in India. How much do you need to spend to offer this life-changing benefit to your employees?

What Affects the Cost of Health Insurance in India?

Let’s start with the factors on which health insurance in India depends. And trust me, there are multiple significant factors here.

- Age of employees: In India, older team members usually get higher premiums than younger ones.

- Team size: Here, bigger teams within a company mean better group discounts. Interesting right?

- Type of coverage: The basic hospitalization charges are usually cheaper. However, full coverage like OPD, dental, or wellness might bear premium charges.

- Location: Health insurance in India is location-specific. This is because medical expenses in metro cities cost way more than in Tier 2/3 cities.

- Add-ons: The premium is certainly increased by any extra coverage. Maternity, critical illness, or mental health coverage are a few among them.

- Claim history: A high number of past claims can push premiums up during renewal.

Now let’s look at the cost structure of health insurance for employees in India.

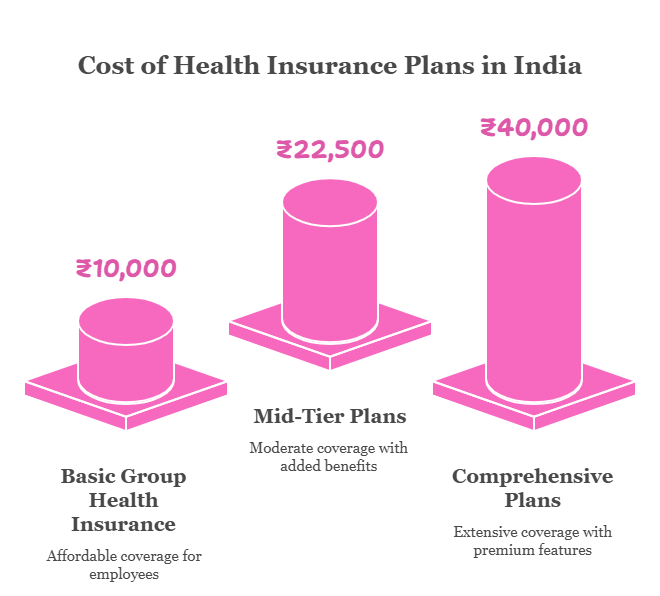

Clear Breakdown of the Health Insurance Cost

Through this section, you can estimate costs for health insurance for remote workers in India. Let’s get started.

Basic Group Health Insurance

-

- Cost: ₹5,000 to ₹15,000 per employee/year

- Covers:

-

-

-

- Hospitalization

- Daycare procedures

- Emergency ambulance

-

-

-

- Best for: Startups and small teams looking for essential coverage

Mid-Tier Plans

-

- Cost: ₹15,000 to ₹30,000 per employee/year

- Covers:

-

-

- Hospitalization + OPD (outpatient)

- Maternity (with waiting period)

- Pre- and post-hospitalization expenses

-

This type of plan is best for teams who want more than just the basics.

Comprehensive Plans

-

- Cost: ₹30,000 to ₹50,000+ per employee/year

- Covers:

-

-

- Everything in mid-tier + dental, vision, wellness programs

- Mental health support

- Health check-ups, teleconsultations

-

This type of plan is best for companies focused on long-term employee retention.

Now, before you decide on any particular plan, just make sure to compare all of them properly. The correct health insurance plan can change the way your employees look at you.

How to Provide Health Insurance for Remote Team in India?

Are you determined to offer health insurance for employees in India by now? However, maybe you’re still confused about where and how to start? Don’t worry! We’ve got plenty of options for you. Also, let me remind you all that these options are perfectly suitable for a remote team.

1. Group Health Insurance Plans

We’ve already talked about this in the earlier section of the blog. You can get good coverage at affordable rates with fully digital onboarding.

2. Digital Insurance Platforms

Apart from the already mentioned ones, these platforms manage health insurance for employees in India:

-

- Policybazaar

- Nova Benefits

They help with everything from choosing plans to managing claims, all online.

3. Work with an Insurance Broker

A broker can guide you through the process, recommend plans, and handle the admin. Great for first-timers.

4. Health Reimbursement Arrangement (HRA)

Let employees pick their own policy and reimburse them. It’s flexible and ideal for remote-first teams.

5. Health Allowance or Stipend

Offer a set amount monthly or yearly. It’s simple and easy to roll out, but less structured.

6. Use an Employer of Record (EOR)

This is basically a lazy road to take. An EOR handles everything on your behalf. That includes local hiring, payroll, benefits, and managing health insurance for remote workers. Perks of leveraging this model?

-

- They ensure compliance with Indian labor laws.

- You don’t need to set up a legal entity in India. (Or what we call subsidiary formation in India)

7. Partner with Wellness Startups

Platforms like YourDOST and MindPeers combine wellness services with insurance. This way, you can offer a complete health package.

Did offering health insurance for employees in India get easier than ever? I believe it did!

Conclusion

Now, you can offer much better health insurance for employees in India. And, it’s so much more than just checking a box on your HR list. After all, your employees deserve so much more than receiving KPIs or KRAs.

Also, with the right health insurance, you can cut down those “Sorry, can’t make it, I’m at the clinic again” messages. Or, “Can I expense this?” question for every medical bill.

So go ahead and protect your team like you protect your passwords. This way, you show your remote employees in India that ‘Health is Wealth’ really matters.

FAQs

Are remote employees covered by health insurance?

Yes, typically. If you are a full-time remote employee, most companies are going to cover you under their normal health insurance plan. However, if you are freelancing or working on a contract, this responsibility shifts to you. Some clients may offer health insurance, but it is relatively rare.

Is it mandatory to provide health insurance to employees in India?

Kind of. Properties existing under ESI must be insured when there exists a minimum of ten people earning less than ₹21,000 per month. Above that pay, it is not a requirement, but still, the majority of companies offer group health insurance as a perk.

What is group medical insurance for employees in India?

It is a medical policy bought by the company for its employees. Usually, it covers hospitalization bills, treatments, and sometimes even treatments involving family members. It works out cheaper than individual policies. Most medium to large companies nowadays offer it, along with some startups.

What is the minimum number of employees required to qualify for small group health insurance?

Usually, 7 is the requisite number; however, certain insurers may plan with just 5 persons. That count could consist of employees and their families. But that might depend on the insurer; the very small contingent can obtain coverage as well- it’s not just for large companies

Schedule a free call

Schedule a free call