Summary

Understanding the salary structure in India is key for employers and employees. This blog breaks down key components like basic pay, allowances, deductions, and benefits—helping global businesses ensure compliance and transparency while hiring in India.

We all know you can’t board a plane without your boarding pass. Understanding a salary structure in India means having that boarding pass, without which recruitment process will be difficult.

Like a boarding pass, understanding salary structure is key to successful hiring in India. A well-formed salary structure in India is important on multiple fronts. Not only does it have statutory advantages, but it also helps better attract and retain employees.

On the legal front, it helps with being compliant with local laws. On the employees’ front, it is important to build a satisfied and motivated workforce. A good salary structure is that player in the team who ensures you keep winning the competitive market.

So, assuming you’re intrigued enough, let’s get into the meaty details of salary structures in India. This blog covers everything from common terms in a salary slip, deductions, benefits, and a sample salary slip at the end. It also aims to highlight key differences in salary components between Indian and foreign markets. Without any further ado, let’s get started.

Key Factors Shaping Salary Structure in India

Two major factors primarily govern salary structure in India. These are the two main reasons why building a proper salary structure is important, both to the employees and the employer.

1. Salary Breakup

One important reason for creating an employee salary structure is to provide employees with a clear and transparent salary breakdown. This helps them understand their deductions and monthly take-home pay (in-hand salary).

Another important point to note here is that not every salary breakup structure for every employee is similar. They can be different based on a number of factors. Let’s take a look at some of the factors why salary breakup formats can be different.

-

- Additional deductions: Employees with loans or different insurance plans may have extra deductions. This adds more elements to the net salary, thus changing the salary breakup format.

- Variable pay: In some industries and for some specific roles, employees may receive variable pay or bonuses. This bracket is more performance-based and can fluctuate monthly or annually. Salaries in sales are a good example of this.

- Salary range: Salary brackets play another important role in determining an employee’s salary structure. For example, low-salaried employees have different statutory benefits and deductions compared to high-salaried employees.

- Company policy: Different companies can have their policies regarding pay scales, bonuses, and benefits. Some companies may prioritize certain benefits over salary, while others may focus on a higher base pay.

There are multiple variables at play when it comes to creating a compelling employee salary structure here in India. As long as employees are happy and the salary structure is aimed at benefiting them, you’re good to go. Let’s now see what the statutory factors are that contribute to why salary breakup structures are created.

Confused About Salary Breakups and Deductions?

Get expert guidance on creating transparent and compliant salary structures in India. Discover how to align your payroll with employee satisfaction and statutory norms.

2. Statutory Compliance

The second important reason why salary breakup structures are created in India is to comply with statutory requirements. Components in the salary are shaped by mandatory regulations laid down by the government.

Employers must comply with these regulations. For example, there are five mandatory statutory requirements that both employers and employees have to comply with. Let’s take a look at them.

-

- Income tax: Income tax is a mandatory deduction based on an employee’s income slab under the Income Tax Act. Employers deduct tax at source (TDS) from monthly salaries. The amount varies based on income and exemptions, like housing loans, medical expenses, or tax-saving investments.

- Professional tax: Professional tax is a state-imposed tax on employment income, applicable only in certain Indian states. Employers make a monthly deduction, supporting state infrastructure and welfare. The deduction amount depends on income slabs, with higher brackets paying more.

- Labour Welfare: Labour welfare contributions are small, state-mandated amounts for worker welfare. Each state has specific requirements, often supporting housing, healthcare, and education. Employers, and sometimes employees, make nominal deductions for this fund.

- EPF: The Employees’ Provident Fund Act, 1952, requires both employer and employee to contribute 12% of basic pay. Dearness allowance (DA) is also included in this contribution. These contributions build the employee’s retirement fund.

- ESIC: Employee State Insurance Corporation (ESIC) contributions are mandatory in organizations with salaries below a set threshold. ESIC, under the Employees’ State Insurance Act, provides medical, insurance, and support benefits. Both employer and employee contribute, with the employer’s share typically higher. ESIC funds cover healthcare, hospitalization, and disability or maternity benefits.

Breakdown of Indian Salary Components

To create a payroll structure appealing enough in India, you must know what are the components of salary breakup. You need to know how to leverage each component of it to make your salary slips a shining star. Salary structure in India are basically created with three main components. These components are –

-

- Fixed pay,

- Variable pay, and

- Awards and bonuses

Each component plays a different role in making up the employee salary structure. They have a distinct purpose both in terms of keeping the employees motivated and financial planning. Let’s understand each of these components.

1. Fixed Pay

Fixed pay forms the base of any Indian salary breakup format. It’s the guaranteed component employees receive regardless of their performance or business outcomes. Fixed pay often includes elements such as

-

- Basic Salary

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Special Allowance

- Professional Tax

- Employees’ Provident Fund (EPF)

2. Variable Pay

Variable pay is a performance-based component, adding flexibility and incentive to the salary breakup format. Unlike fixed pay, variable pay depends on individual or team achievements, driving employees to exceed targets. This portion often includes

-

- Time Shift Allowance

- Incentives

- Reimbursements

- Benefits

- Gratuity

- Food coupon

- Medical Insurance

3. Awards and Bonuses

Awards and bonuses are basically a corporate way of saying, “You reap what you sow”. They add an extra layer of motivation and recognition to the salary breakup structure. These components celebrate employee milestones, such as project completions, anniversaries, or exceptional performance. While variable pay is performance-based, awards and bonuses are often recognition-based. Some of the awards and bonuses include:

-

- Performance Bonus

- Statutory Bonus

- Retention Bonus

- Signing Bonus

- Joining Bonus

Want to create an attractive and compliant salary structure for your team in India?

Let our experts help you design a salary breakup that motivates talent and fits your business goals.

Common Terms in Indian Salary Breakup Structure

We now have a good idea of why employee salary structures are created and what their components. Let’s now see what are the most common terms falling under these components.

1. Basic Salary

To explain in short, the basic salary is the fixed component of an employee’s salary and forms the core part of the compensation. It is totally taxable and typically forms 40-50% of the CTC. Say, if an employee’s CTC is ₹5 lakh, their basic salary might be around ₹2 lakh per annum.

2. House Rent Allowance (HRA)

The name contains the answer. Employee housing allowances, or HRAs, are given to workers to assist with housing costs. The amount varies depending on the city of residency. Additionally, in some circumstances, it is entirely or partially tax-exempt. For instance, HRA may account for as much as 50% of the base pay in metropolitan areas and as much as 40% in non-metropolitan ones.

3. Allowances and Bonus

Bonuses and allowances are paid on top of the base pay. Allowances are extra money given to workers to help with certain costs, like housing, transport, and medical care. Bonuses, on the other hand, are performance-based rewards offered to staff members in recognition of reaching specific goals or benchmarks.

4. Gross Salary

Gross Salary is the sum of basic + allowances + bonuses + any other benefits. This salary is calculated before any deductions like taxes, provident fund contributions, or other deductions. For example, if an employee’s basic salary is ₹50,000 and they get ₹10,000 in allowances, their gross salary would be ₹60,000.

5. Labor Welfare Fund

The Labor Welfare Fund is a benefit fund that is created by employers to provide welfare facilities to workers, such as housing, medical facilities, and education. The contribution rates and specific benefits can vary depending on the state regulations. For example, under the Maharashtra Labour Welfare Board, 50% cost of course textbooks is covered by the government for the children of workers. The government also finances the family members of students who have passed the first phases of MPSC and UPSC exams.

6. Gratuity

A gratuity is a lump sum amount paid to an employee by the employer. It is paid as a gesture of gratitude for the services given by the employee. This benefit is reserved only for those employees who have completed 5 years of continuous service with the same employer. The gratuity is calculated under the Payment of Gratuity Act of 1972. The formula for this is (15 x your last drawn salary x tenure of working) / 26.

7. Medical Insurance

Medical Insurance is a benefit provided by employers to cover the medical expenses of employees. It is a deduction for the employees and is tax-deductible under Section 80D of the Income Tax Act of 1961. It can also include health insurance, group medical policies, and other health benefits. Almost 80% of companies in India offer medical insurance as part of their compensation package.

8. Employee Provident Fund (EPF)

EPF is a retirement benefit scheme where both the employee and employer contribute a certain percentage of the employee’s basic salary and dearness allowance. The current contribution rate is 12% of the basic salary from both the employee and employer. This fund helps employees save for their retirement and is a crucial part of the payroll structure.

9. Employees’ State Insurance Corporation (ESIC)

ESIC provides social security to employees in case of sickness, maternity, and employment injury. It is mandatory for establishments with more than 10 employees and a monthly wage bill of over ₹21,000. The current contribution rate is 3.25% of the employee’s wages from the employer and 0.75% from the employee.

10. Public Provident Fund (PPF)

The Public Provident Fund (PPF) is a popular long-term investment scheme backed by the government of India. It’s designed to encourage savings and provide financial security to individuals. Here are some key features:

Interest Rate: 7.1% per annum

Minimum Investment: ₹500 per annum

Maximum Investment: ₹1.5 lakh per annum

Tenure: 15 years, which can be extended in blocks of 5 years

Tax Benefits: Contributions up to ₹1.5 lakh are eligible for deduction under Section 80C of the Income Tax Act. PPF accounts offer guaranteed returns and are considered a safe investment option for individuals with a low-risk appetite. The interest earned and the returns are not taxable under Income Tax.

11. Professional Tax

Professional Tax is a tax levied by state governments on individuals earning an income from salary or practicing a profession. The rates and slabs vary from state to state, but it generally ranges from ₹100 to ₹2,500 per month.

12. Income Tax

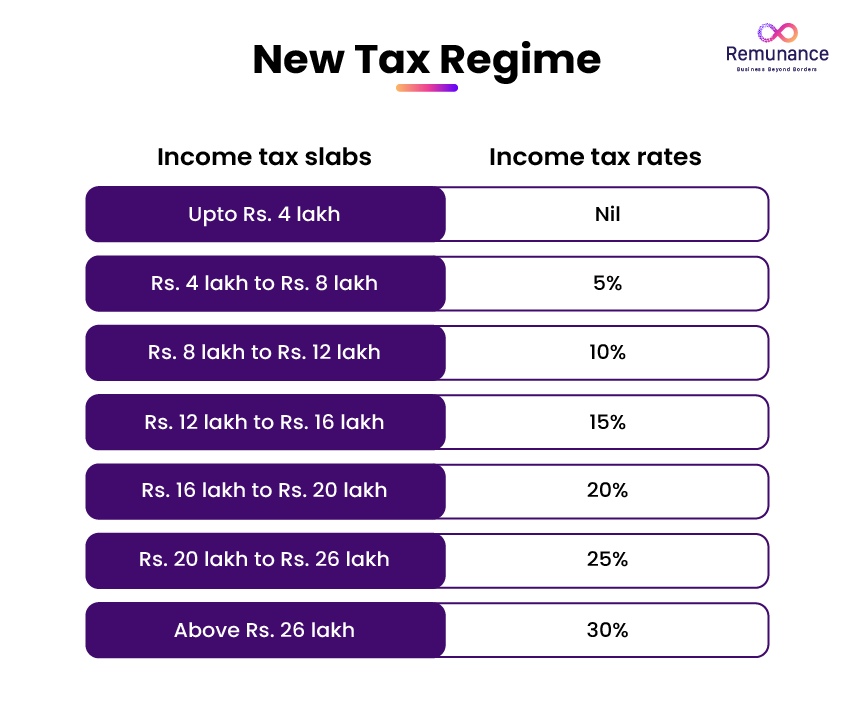

Income Tax is a direct tax levied by the government on individuals and entities based on their income or profit. In India, the income tax system follows a progressive slab rate, where the tax rate increases as the income rises. For the financial year 2024-25, the tax slabs for individuals under the new regime below 60 years of age are as follows:

New income tax regime in India showing latest tax slabs and rates for FY 2024-25

The government also offers deductions under Section 80C. These deductions include investments in PPF, EPF, life insurance premiums, and more, up to ₹1.5 lakh per annum. This helps individuals reduce their taxable income and save on taxes.

Understand how does an EOR provide employee liability coverage?

13. Cost to Company (CTC)

CTC stands for Cost to Company and represents the total annual expenditure a company incurs on an employee. This includes the salary, benefits, bonuses, and any other expenses related to employment. It’s a comprehensive figure that gives a complete picture of an employee’s total compensation package. For instance, a recent survey by Keka HR revealed that the average CTC for entry-level positions in India is around ₹3.5 lakh per annum.

14. Net Salary

The amount an employee actually takes home after all deductions have been made from the gross salary is called net salary. This includes taxes, provident fund contributions, and other deductions. For example, if an employee’s gross salary is ₹60,000 and deductions total ₹15,000, the net salary would be ₹45,000.

And with that, we cover the most important and most common sections and terms in the employee salary structure. This forms a good base for understanding salary structures in India. However, payroll structures can be different based on the pay bracket and even across some industries.

Key Salary Heads: India vs. Foreign Countries

For better understanding, we put together a comparison between the Indian and US salary stubs. Let’s take a look at the differences.

| Key Salary Heads | India | USA |

|---|---|---|

| Forming the base pay of the salary | Basic | Regular |

| Sum of base pay + any bonus, allowances or overtime | Gross Salary | Gross Pay |

| Common Deductions | Employee’s Contribution to PF Professional Tax Income Tax |

Medicare Social Security Federal Tax State Tax Others |

| Common Benefits | Employer’s Contribution to PF Employees’ State Insurance Corporation (ESIC) Insurance Gratuity |

Employer Match 401k Group Term Life |

| Salary after all deductions and tax | Net Payment without tax | Net Pay |