Summary

To navigate India’s market effectively, consider these five things before forming a subsidiary company in India: business goals, cultural nuances, assess costs, compliance with Indian laws, and an exit strategy. Find the detailed breakdown of these factors and a lot of in the blog below.

Are you excited to start your subsidiary company in India?

Before you hop on to the express train, there are five important things we would like you to know before forming your India subsidiary.

These insights are essential for a smooth setup and operation, and are curated to have a powerful impact.

As you read through this article, I am sure that the journey to your India subsidiary began. You have identified key drivers, including brand building, exit valuation, and sales opportunities.

We are here to help answer questions about the incorporation process before you start forming a subsidiary company in India.

Through our comprehensive guide, we will walk you through the practical aspects of setting up a subsidiary company in India and discuss its associated costs.

These include operational costs, margins, arms-length pricing, and the time and resources available to the management to learn about the new culture.

Incorporation of a Foreign Subsidiary Company in India (Process)

To set up a foreign subsidiary in India, follow the Companies Act, 2013, and the Foreign Exchange Management Act (FEMA).

Steps to Incorporation of a Foreign Subsidiary Company in India:

-

- Choose Business Structure: A Private Limited Company is typically ideal for foreign subsidiaries.

- Obtain Digital Signature Certificates (DSC): Needed for filing electronic documents.

- Apply for Director Identification Numbers (DIN) for all directors at the MCA portal.

- Reserve Company Name: Use the RUN service on the MCA portal. Make sure it follows naming rules and isn’t already taken.

- Prepare Incorporation Documents:

- Include the Memorandum of Association (MoA) and Articles of Association (AoA).

- Gather identity and address proofs for directors and shareholders.

- Notaries must notarize and authenticate foreign documents.

- Submit an Incorporation Application: Use the SPICe+ form. Include the eMoA (INC-33) and eAoA (INC-34). On approval, you’ll receive the Certificate of Incorporation, PAN, and TAN.

- Open a Bank Account: Manage financial transactions in the company’s name.

- Post-Incorporation Steps:

- File Form 20A (Declaration for Commencement of Business).

- Get GST registration if required.

- Meet any other regulatory needs.

Talking to legal and financial experts who understand Indian corporate laws helps a lot.

Remunance Employer of Record

Ready to Grow Your Business in India?

Let our experts handle the legalities, paperwork, and compliance—so you can focus on growing your business.

What is a Subsidiary Company in India?

A subsidiary company in India is a business entity that is controlled by another company, known as the parent or holding company.

The parent company usually owns at least 50% of the shares or has the power to choose most of the directors.

Although a subsidiary is linked to the parent company, it is a separate legal business with its own identity.

This framework enables foreign businesses to establish a local presence in the Indian market and capitalize on its expanding economy and vast talent pool.

Although it operates in accordance with Indian laws, the subsidiary aligns with the strategic objectives of its parent company.

Establishing a subsidiary company in India can be a strategic move for companies seeking to expand their global presence, gain market knowledge, and capitalize on regional opportunities.

Drivers for Forming a Subsidiary Company in India

Every company has one or more of the drivers listed below as the reason for forming a subsidiary company in India.

Ensure you have thought through the process, objective, and reason for why you want to incorporate the Indian subsidiary.

1. Building Company Culture and Branding

When you, as a foreign company, contemplate setting up a business in India.

The first and foremost driver for attracting talent in India is to create a brand and culture for your company.

Your brand has significance that attracts potential employees.

Global technology companies view the Indian market through various lenses to attract more users or generate revenue.

Business-focused SMEs are increasing their investments in the Indian market to tap into a growing talent pool.

2. The Entity that can be controlled and is a Part of the Group

As a wholly owned subsidiary (WOS), the holding company has complete control over decision-making and financial matters.

This is because you make a 100% investment in the subsidiary.

3. IP Protection

Protection of intellectual property in earlier times required physical presence and manual logins by employees.

Today, you can easily control Intellectual Property by integrating all your data into the cloud.

A cloud-based information security system makes this process seamless.

4. Valuation During the Exit

The companies that are eyeing the acquisition as a possible exit do see a better overall valuation by having a subsidiary company in India.

This is due to the lower burn rate and a better talent pool.

5. Sales Opportunity in India

The Indian economy is projected to remain the fastest-growing in 2017, with a growth rate of 7.7%.

This forecast is based on the United Nations’ “World Economic Situation and Prospects 2017” report.

India is a place with many opportunities for business expansion.

PM Narendra Modi encourages building international relations and shifting their focus from China to India.

Whether it’s in consumer goods, OTT (over-the-top) services, online education, or the gaming industry, India has promising emerging markets globally.

Ready to witness the thriving potential of the Indian market?

Incorporate your subsidiary in India today and leverage the talent, growth, and opportunities.

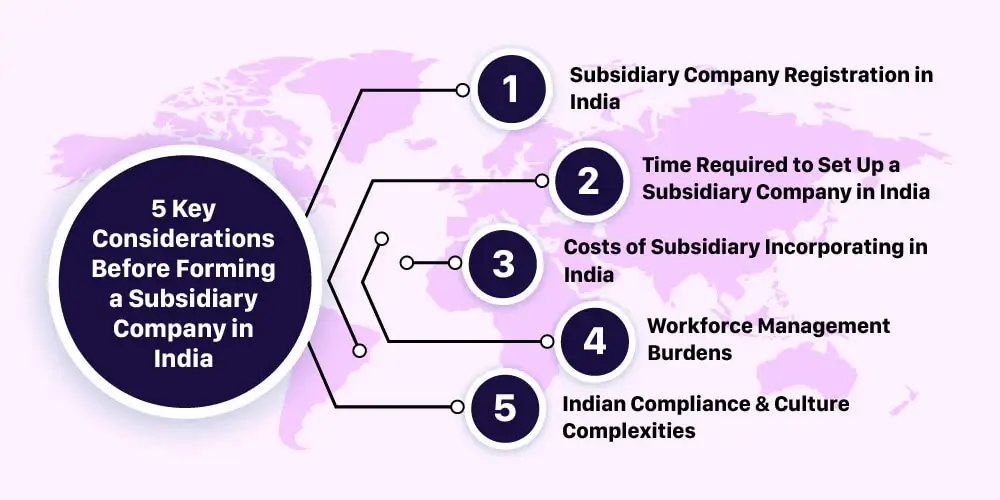

5 Key Considerations Before Forming a Subsidiary Company in India

Top 5 things to know before forming a subsidiary company in India

1. Process of Incorporation and Registrations

To register a foreign company in India, your subsidiary requires two directors and two shareholders.

One director must live in India. Both directors need a DIN (Director Identification Number). This helps avoid administrative delays.

Shareholders can be individuals or businesses.

The parent company must be publicly limited.

The company has to comply with the rules and regulations of the Companies Act, 2013.

In simple words, it cannot be owned by an LLC, partnership, or individual.

The process involves name approval and incorporation when bylaws are submitted.

For a corporate address in India, your subsidiary firm must be registered in India. Your parent company can be anywhere.

After forming, a business must register with numerous government entities to operate successfully.

2. Time Required for Incorporating a Subsidiary Company

Setting up a business entity in India may require a duration of 2-4 months.

All the decisions need to be approved by your parent company over the subsidiary company.

3. Money

Forming a subsidiary in India will cost anywhere from $645 to $ 2,582.

A public limited company with a minimum paid-up capital of $6436 can be formed.

In addition to this one-time cost, also consider the following 2 important cost considerations.

-

-

What are the running costs of incorporating a subsidiary Company in India?

Forming a subsidiary in India means it will be subject to a statutory audit. This audit is conducted in accordance with the Companies Act, Income-tax Act, and the transfer pricing audit guidelines.

You’ll also need to comply with labor laws, pay taxes, and handle filings such as monthly, quarterly, and annual returns.

This includes Goods and Services Tax (GST) and Tax Deducted at Source (TDS). Otherwise, it will be subjected to delayed filing fees and penalties, considering the professional fees for each of these.

-

Compulsory margin money, income tax (arm’s length pricing), and repatriation of money

To manage a business or form a subsidiary company in India, you must prove to the government that you will make a profit because Indian subsidiaries can’t lose money.

Your subsidiary company must invoice its costs because it’s a cost center (no sales). Without other money, you’ll need to pay staff, auditor fees, office rent, and more.

Your cost center must invoice the parent firm to operate.

When starting a business in India, you must include a 12-18% arm’s-length cost margin. Auditors set this proportion.

The Indian government opposes 0% profit margins. Your parent firm must provide a percentage to support your subsidiary company’s operations.

If you don’t have sufficient revenue to cover costs, consider sending a percentage margin to your Indian subsidiary.

This amount builds up in Indian banks and is out of reach. You can only send that money home by paying shareholders’ dividends.

The government taxes dividends 30%. In addition to the profit margin, the government will impose a tax slab percentage. This affects parent company fund flow.

-

4. Availability of Time Bandwidth with the Management

Staffing your India Subsidiary with the right talent is crucial.

It’s essential to create a comfortable workspace and implement a robust strategy for managing HR, insurance, benefits, payroll, risk management, and administrative operations.

This strong foundation ensures your India Subsidiary can operate smoothly while maintaining high standards in employee training and office infrastructure.

In addition, compliance with Indian laws is key to covering monthly payroll, taxation, accounting, and auditor coordination.

Hiring a dedicated team and implementing effective performance management, periodic interactions, and direct reporting will empower your India Subsidiary to overcome challenges such as time zone differences, geographical barriers, and language hurdles.

Balancing these factors with the demands of your parent company will help streamline operations and foster long-term success for your India Subsidiary.

Increased compliance load

If you wish to run a business in India, you will need to incur additional costs for business compliance and operational expenses.

This includes HR operations, administration, and auditor fees, as well as salary tax deductions and timely government tax payments for each employee.

Consider employee-related laws such as PF, employee state insurance, salary TDS, professional tax, and minimum wages.

You’ll also need to account for bonuses, maternity costs, gratuity, and leave encashment.

5. Understanding the Indian Culture to Form a Subsidiary Company in India

Culture plays a vital role in the decision to establish a subsidiary in a particular country.

You choose India for its diversity.

India is made up of diverse regional states, each with its own unique language and geography.

These differences make each individual distinct in their own way.

Before establishing a subsidiary in India, consider whether you’re ready to conduct business with such a diverse population.

This diversity plays a key role in shaping operations.

Expert Guidance for Forming a Subsidiary Company in India with Remunance

At Remunance, we focus on small and medium enterprises that wish to set up a local company in India.

Rajendra, the founder, has crafted a business model that benefits India by ensuring the PEO business is both strategic and compliant.

If a subsidiary is a cost center, consider the taxation aspect closely

Incorporating an entity has become more convenient today as compared to traditional times.

If a subsidiary is a cost center (with no sales in India), it is advisable to consider the taxation aspect closely.

This includes a transfer pricing margin and a minimum 25.168% income tax in India, which needs to be maintained.

Test the ground before forming a subsidiary company

A PEO, i.e., professional employment organization, provides hand-holding while setting up a legal entity and business operations.

Remunance extends its expertise in forming a subsidiary in India without any hassles or security issues.

Remunance ensures that the entity functions smoothly in India with proper government authority registrations.

Registering a subsidiary in India is more specialized than standard company formation. We offer end-to-end support exclusively for overseas companies.

Get started with Remunance’s PEO services for more information.

Ensure you can transfer the staff from the outsourcing/PEO agency

You can efficiently hire desirable staff with the help of a PEO agency.

A PEO agency will provide you with hand-picked potential employees through their trained professionals.

Once you’ve built your team in India through a PEO or outsourcing agency, you can transfer them to your subsidiary.

This ensures a smooth transition and helps kick-start your operations.

Delay it as much as possible to ensure you can do without a subsidiary company

Once you consider all the aspects required to open a subsidiary in India, such as the time required, operational costs, administrative headaches, tax payments, and HR management.

It is advisable to delay forming a subsidiary company in India for as long as possible.

We do not think you should open a subsidiary company here, but consider whether you can do without one for a considerable time.

The closure is more difficult

Closing a company is far more demanding than forming one—it’s both costly and time-consuming.

You face several preconditions, such as the risk of triggering bankruptcy clauses or the need to secure a no-objection certificate, all of which can complicate the process.

For your India Subsidiary, striking off the company’s name from the Registrar of Companies generally takes around 3-4 months, though delays may occur if the ROC objects.

You’ll need to complete the E-form STK-2 and have your documents verified.

Winding up a private limited company can take a year or two after obtaining clearance from government departments.

Plan carefully to ensure a smooth closure and secure the future of your India Subsidiary.

Get it formed from an agency that has done it multiple times

Remunance addresses your concerns regarding time-bound company formation, complete compliance, hiring a reliable team, and conducting methodical work.

Remunance understands the Indian pulse better.

We have a deep knowledge of the laws here. We will help you set up a company conveniently under the provisions of the Companies Act and get approval from the Reserve Bank of India as well.

Your concern about entering into new territory and dealing with compliance issues will be smoothly taken care of by us.

Why Choose Remunance for Your Subsidiary Formation in India?

Remunance, as a leading EOR service provider in India, has assisted over 120 clients from 22 countries, ensuring smooth compliance operations.

We understand the Indian pulse and have deep expertise in Indian employment laws and regulations.

Our comprehensive support, from recruitment to ongoing compliance assistance, ensures that setting up your Subsidiary company in India under the Company Act and Reserve Bank of India guidelines is hassle-free.

We address your concerns about entering new territory and managing compliance issues seamlessly.

At Remunance, our mission is to empower foreign companies to succeed in India.

With our expert services, you can experiment and learn how to manage all your requirements effectively, paving the way for a successful India Subsidiary.

When you’re ready to operate independently, you can transition your dedicated team smoothly to your India Subsidiary for a strong market start.

About Remunance

Remunance is an Employer of Record (EOR) services provider in India, helping global companies hire, manage, and support full-time employees without setting up a local entity. We take care of HR, payroll, compliance, and benefits so businesses can focus on growth while building their teams in India with confidence.

Remunance enables businesses from UK, Australia, Canada, France, US, and the Middle East to recruit, hire, and manage workforce and benefits in India.

FAQs

What are the primary benefits of setting up a subsidiary company in India?

Setting up a subsidiary in India provides you with incredible benefits, including tax savings, access to a large pool of cost-efficient skilled labor, and most importantly, access to one of the fastest-growing economies, India also offers various PLIs (Production-linked Incentives) and special schemes for Make in India Projects.

How long does it take to establish a subsidiary in India?

Subsidiary registration process in India usually takes 2–4 months. This is a particularly tedious process as it involves multiple factors such as getting approvals, registering with the MCA (Ministry of Corporate Affairs), and opening an office.

What is the cost of forming a subsidiary in India?

Including a subsidiary in India might have one-time expenses ranging from USD 645 to 2,502. Public limited corporations must pay minimum paid-up capital USD 6,424. Regular audits, tax payments, and legal filings as mandated under Indian law include continuous expenses.

What are the tax obligations for foreign subsidiaries operating in India?

Local tax laws—including corporate income tax, Goods and Services Tax (GST), and Tax Deducted at Source (TDS)—must be followed by foreign subsidiaries in India. Furthermore, should the subsidiary’s profits be returned to the parent business, they are liable to repatriation taxes. Subsidiaries have to additionally keep a minimum 12 to 16% profit margin, which is liable to a 22 to 25% tax yearly.

What challenges should companies expect when managing a workforce in India?

In India, workforce management is knowing local recruiting regulations, creating compliance HR policies, and managing benefits and payments. Companies have to follow Indian labour rules including paid leaves, provident funds, and other required perks. Managing a team in India also requires a good cultural understanding.