Summary

There are multiple factors involved before the contractor conversion process. Open communication with the independent contractors is a major one. There’s also factors like financial restructuring in the company. The legal and compliance factors of the conversion part should also be taken care of.

As famously quoted by the former First Lady of the U.S, Michelle Obama— Flexible work makes employees loyal. True. Did you notice, the sentence still has “employees” in it? Lately, however, we have started to associate the word flexibility more with independent contractors rather than employees.

Not only associate, but also hire! Sure, it comes with its benefits. But businesses have started realizing it has long-term detrimental impacts as well. Thus, the need to convert contractor to employee arises.

We won’t directly jump into the contractor conversion process in this blog. Rather, we’ll begin with small steps. For example, how a contractor differs from an employee. We’ll also scrutinize the need to convert a contractor to employee.

Finally, we’ll move to the steps to consider before the shift. We’ll also learn about the employer-contractor communication before the conversion. Ready to go through this learning process with me? Let’s begin!

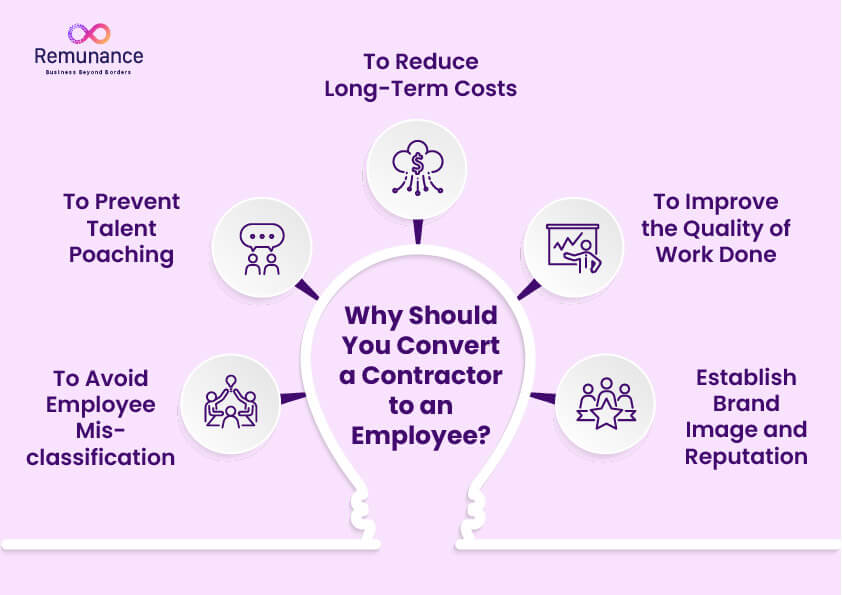

Why Should You Convert a Contractor to an Employee?

Yes, contractors can be a great resource when you need flexibility. However, I’m sure that at some point, flexibility starts feeling like a revolving door. You train them, they deliver, and then, poof! They’re gone, and so is their expertise.

That’s where the need for contractor conversion arises. When you convert a contractor to employee, it comes with significant benefits.

Stability and control pose among the prominent ones. How? Let’s discuss that along with the other major ones.

To Avoid Employee Misclassification

Did you know the payment penalties go up to USD 1,000 in the US for misclassifying employees? In the worst-case scenario, it can even lead to imprisonment for up to a year. Scary, isn’t it?

Yet, when you work with independent contractors, it’s a common threat to your business. Very often, your contractors walk like employees, talk like employees, and work like employees. Yet, they don’t receive the benefits and protections employees are entitled to.

Hence, governments are getting more and more stringent on misclassification. Considering the potential risks, contractor conversion is the definitive option for you. Here’s what you gain when you convert a contractor to employee:

- Legal protection: Neither the independent contractors nor the government can come after you tomorrow with legal threats. You can also avoid unnecessary audits.

- Tax benefits: Tax deductions are more controlled with a consistent tax structure and no back taxes.

- Avoid penalties: You are financially shielded with no surprise burden on your company budget.

To Prevent Talent Poaching

Moonlighting is pretty common among independent contractors. They juggle multiple clients at the same time. This happens especially in fields like technology, marketing, and design. The challenges for such scenarios?

- Increased competition for your top contractors.

- Lack of commitment to your work.

- Frequently delayed deadlines.

Now, let’s talk about the gains when you convert a contractor to employee.

- Exclusive focus: You get dedicated time and effort from your employees.

- Better performance: With no external contracts in their hands, employees can now deliver quality work.

- Better loyalty and retention: Employee-related perks increase job satisfaction and, ultimately, retention.

To Reduce Long-Term Costs

Independent contractors comparatively appear to be the cheaper option. No benefits, no long-term obligations, and no paperwork. However, this is only for a short term. The challenges that appear over time are:

- Fluctuating fees for different contractors

- Constant high fees for contractors

- Expensive and recurring recruiting process

Consequently, you end up burning more cash than you realize. Why contractor conversion makes more financial sense? Let’s see.

- Lower hourly rates: No premium hourly fees for their flexibility or expertise.

- Predictable budget: A fixed compensation structure for employees makes budgeting much easier.

- Reduced turnover costs: No more scrambling to hire or replace lost talent. This reduces recruitment costs.

To Improve the Quality of Work Done

When you convert a contractor to employee, you’ve the assurance of:

- Better workflow

- Consistent performance

- Better teamwork

- Increased productivity

What can you do better after the contractor conversion?

- High level of quality control

- Training and skill development of your employees

- Rewarding your employees to keep up their motivation

Learn more about independent contractors.

Establish Brand Image and Reputation

A stable and professional employee base always wins over a fluctuating contractor workforce. Your brand’s credibility soars in the job market. Let’s see what a strong brand image does after contractor conversion.

- Wide pool of talent is attracted to your company.

- Happy and loyal employees promote your company culture better.

- Employees become your brand ambassadors.

Now that we’ve discussed the need to convert a contractor to employee at length, let’s move forward. We’ll now talk about how an independent contractor differs legally from a full-time employee.

What Are the Legal Differences Between an Employee and an Independent Contractor?

Before you decide to convert a contractor to employee, you must know how they differ. The legal differences between an employee and a contractor lie in the following:

- Work schedule

- Compensation and benefits

- Control over the work process

In this section, we’ll talk about the crucial factors that differentiate a contractor from an employee. Let’s have a bird ‘ s-eye view of them.

Key Legal Differences

Full-time employees

- Employees work directly under the employer and follow a fixed work schedule.

- They have a fixed monthly or bi-weekly payroll structure.

- They receive employee benefits like health insurance, paid leaves, and retirement bonuses.

- Employers have complete control over their work process and daily tasks.

- They are protected under labor laws and rights in case of:

- Discrimination

- Wrongful termination

- Dispute in overtime pay

- Dispute in workers’ compensation

Independent contractors

- Independent contractors are self-employed and work on their own schedule.

- Their payment is done based on the projects or tasks they are working on.

- They are not entitled to any employee benefit. For example, an independent contractor in India is deprived of benefits such as:

- Provident Fund (PF)

- Gratuity

- Medical insurance

- Maternity/Paternity leaves

- They don’t enjoy any labor protection or rights as they work independently.

- They are responsible for handling their own taxes.

Our comprehensive guide about independent contractors will tell you all you need to know.

Key Considerations Before Starting to Convert Contractor to Employee

When you convert a contractor to employee, it’s a major transition. It involves multiple significant changes and your critical observation. To your surprise, the change goes much beyond the nature of relationship between you and the contractor.

What are the changes that need your scrutiny in a contractor conversion? Let’s find out!

Worker Classification Risks

- You must be legally compliant with the classification rules when you make the contractor conversion.

- By compliant, I mean everything from payroll structure to defining their work schedules.

- You must be prepared for audits on incorrect classifications from the government regulators.

Workflow Upgrades

Converting a contractor to an employee often requires changes to your company’s internal operations. Be prepared for the following adjustments:

- Plan for structured work hours for your soon-to-be-converted contractors.

- Plan for frequent feedback and open communication channels. This would help the contractors adjust to the new environment easily.

- Give them proper guidance about how resource allocation works in long-term projects.

Cost Implications

- When you convert a contractor to employee, your company needs financial restructuring.

- There would be added long-term costs like fixed compensation costs for employees.

- Then there are increased overhead costs like proper provision for IT equipment, training resources, etc.

- Filing taxes for your employees is another major cost addition in a contractor conversion.

Stricter Compliance Checks

- Make sure you draft proper employment contracts and terminate the existing contractor agreement.

- When you convert contractors to employees, ensure they align with intellectual property and confidentiality agreements.

- Plan for proper compliance and labor laws training for the contractors.

Differences in Liability and Legal Exposure

- Set clear grounds for wrongful termination, harassment, or discrimination with the contractors. This will save you from future lawsuits.

- Ensure proper formalities like severance pay and notice periods for employee termination.

Are you ready to consider all the said processes before a contractor conversion? Even if you do, the process doesn’t end here.

There are still a few steps left before you successfully convert a contractor to employee. Let’s see what they are in the next section.

How to Handle the Conversion Discussion When You Convert Contractor to Employee?

A clear and structured communication can solve half the challenges during a contractor conversion. It sets clear expectations about the new job roles and responsibilities for both sides.

In this section, let’s hunt for the answers to the potential questions. The questions you might face as an employer during a contractor conversion.

Define the Transformation Scope Clearly

- Clarify new job responsibilities. Define how the workflow will change with this transformation.

- Answer critical questions on work schedule. For example, What will be the work hours? Or how will it affect the work-life balance?

- Clearly define the reporting structure.

- Additionally, inform them about the performance evaluation system.

Offer Transparent Employment Contracts

- Provide a solid explanation of the terms and conditions of the employment contract.

- Highlight the employee benefits and added perks properly.

- Inform them about benefits adjustments like performance-based bonuses.

Discuss Tax and Payroll Adjustments

- Explain the technical aspects of payment and deductions on the paychecks.

- Also, mention the other factors that affect the tax withholdings and salary deductions. Some of them include health benefits and retirement contributions.

- Clarify the payment frequency and mode of payment to the contractors.

Discuss Employee Benefits Clearly

- Outline the company-sponsored health insurance coverage.

- Define other benefits like paid time off (PTO) and retirement plans.

- Specify the eligibility and requirements for accessing benefits clearly.

Acknowledge Their Perspective

- Cater to their concerns and anxieties about the new role with empathy. Be open to discussing how their work-life balance may change and what flexibility they can still have.

- Demonstrate your interests as an employer in their career growth opportunities.

- Build a natural employer-employee relationship by listening to their feedback.

Feeling overwhelmed? Well, Remunance can aid you perfectly here. Also, Remunance does a lot more than just help you with communication. Curious to know what. Let’s see.

How Remunance Helps You to Convert Contractor to Employee Easily?

Need to convert an independent contractor in India into an employee? Let me walk through the easiest option for the process. Join the Remunance team! Confused why? Here’s why:

- Remunance’s response time is quick as a flash. When I say that, I mean 2 business days or less.

- Remunance has a global footprint with clients spanning across 22 countries. You can guess the international expertise we bring to the table.

- We are called the “Employer of Choice” in India. Meaning that businesses trust us when it comes to managing employees.

Whether you’re in the U.S., UK, or anywhere in between, your contractor conversion will be as polished as a marble. Take that as a guarantee card from our team.

This blog was a starter pack to convert a contractor to employee. Our team is already prepped to begin with the transition process. They have an exhaustive list prepared to help you and your contractors understand this shift in advance.

FAQs

Why is it required to turn a contractor into an employee?

If a contractor works like a full-time employee with fixed hours, ongoing tasks, and company tools, you might risk misclassification penalties. Converting secures compliance, gives job security, and promotes loyalty. Besides, you avoid legal troubles and potential penalties from tax or labor authorities.

What risk does it hold legally if you don't convert a long-term contractor?

Back taxes, penalties, and sometimes lawsuits become the punishment for misclassification. The definition and nature of many other employee rights are entirely different from those of contractors, yet authorities can see long-term contractors as misclassified employees. In such cases, he will owe unpaid benefits, social security contributions, and possibly, even legal fees.

What would be the impact of converting from contractor to employee on costs?

There arises additional expenditure in hiring an employee. The payroll taxes, benefits, and other compliance-related expenses. This could also possibly lead to turnover, higher retention, and even an increase in productivity. While it may appear that contractors are the less expensive route initially, the long-term risks of misclassification and rehires can far out-weigh any potential savings.

Could converting a contractor to employee status affect flexibility of the company?

Yes, but not necessarily in a bad way. Employees offer predictability, and deeper engagement along with increased long-term value for the company. If flexibility is such a huge concern, then one can negotiate work-from-home, flexible hours, or part-time contracts so that the two can be married together.

What is the best method of transitioning a contractor to an employee?

First, bring everything out in the open regarding expectations, benefits, and role changes. The contracts will need updating, payroll adjusting, and local compliance with labor law ensured. Provide onboarding support for an easy transition and to aid in making them feel valued in this new role.

Schedule a free call

Schedule a free call