We know changing an offshore development team in India can be tough. That’s why we created an employee cost calculator to give you a rough estimate. Companies can grow fast by using skilled workers in India. They save costs and enjoy a strong IT infrastructure. Our detailed guide covers all the actions, models, and best practices. It helps you build an offshore workforce that drives corporate success.

Input a number and use our employee cost calculator to test various results.

Strategic Advantages of Offshore Teams in India

Companies looking to boost their development capacity now choose India as their site. We often discover that the benefits of offshore teams go far beyond cost control.

Unmatched Talent Pool and Technical Expertise

India’s strong educational background in STEM fields generates plenty of qualified workers. We collaborate with experts in data analytics, software development, and new technologies. This ensures that each project benefits from high-quality technical knowledge.

Cost-Effective Operations and Resource Optimization

Offshoring to India saves money, as shown in the employee cost calculator above. Lower operating expenses and labor costs let companies save money. This gives them more resources for innovation and growth. In today’s ever-changing market, financial flexibility is essential for success.

Robust IT Infrastructure and Technological Prowess

The nation’s solid digital infrastructure ensures steady production. We have fast internet, advanced data centers, and widespread technology use. We build dependability into our processes. This leads to happier clients and faster project delivery.

Cultural Synergy and Time Zone Benefits

India’s strong English skills help it fit well with Western business methods. This fit supports effective project management and clear communication. The time zone difference means we can work all day. This helps our clients get constant improvements and real-time updates along with true cost of employee calculator.

Government Initiatives and Market Stability

The IT Department has expanded as a result of government programs such as Digital India and other incentives. We use these projects to tap into a growing market. This boosts the chances of scaling our offshore operations.

Offshoring vs. Outsourcing: A Clear Differentiation

Understanding the differences between outsourcing and offshoring can help you to decide the degree of control, integration, and strategic influence on your company, which you can also check through true cost of employee calculator above.

| Key Factor | Offshoring | Outsourcing |

| Definition | Setting up a dedicated team in a foreign country under direct company control. | Delegating specific tasks to a third-party service provider. |

| Control | Complete control over team processes and management. | Limited control; management is typically in the hands of the vendor. |

| Cultural Integration | Deep integration with company culture and values. | Minimal integration; alignment varies by project. |

| Cost Structure | Higher initial investment with greater long-term savings. | Lower upfront costs with billing based on project scope or hourly rates. |

| Scalability | Highly scalable with adjustments tailored to evolving company needs. | Scalability is subject to the vendor’s capacity and terms. |

| Knowledge Retention | Superior retention of intellectual property and in-house expertise. | Potential risk of knowledge loss or limited IP protection. |

This difference enables us to suggest the optimal course of action depending on project needs and strategic goals.

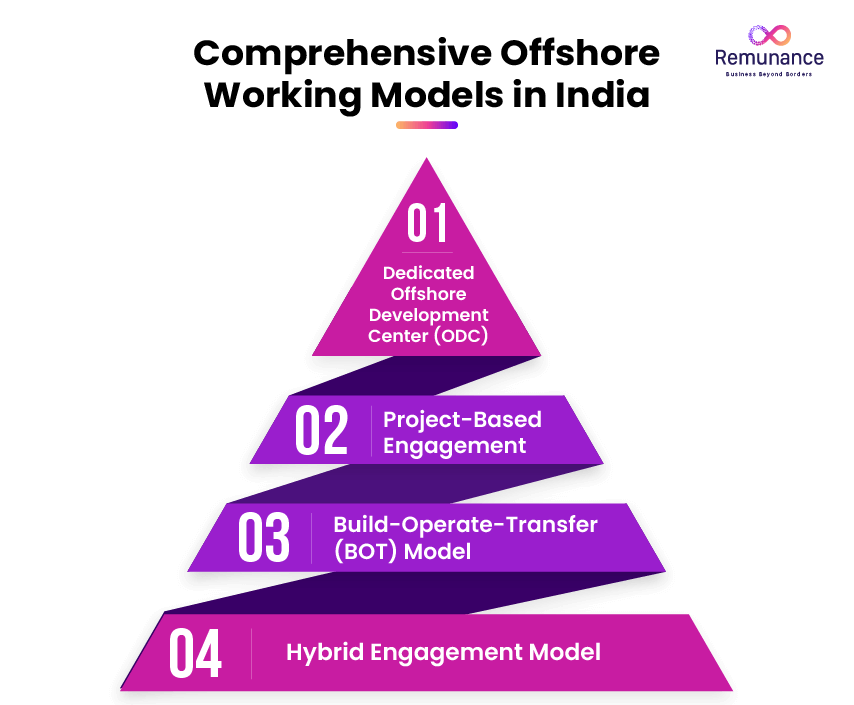

Comprehensive Offshore Working Models in India

Success in the long run depends on selecting the correct engagement model. We assess many models depending on strategic alignment, control, and adaptability.

Step-by-Step Process for Building Your Offshore Team in India

We use a strong method to create an offshore workforce. This team fits your needs and helps meet your goals.

1. Define Vision, Goals, and Requirements

-

Strategic Vision: We start by summarizing your long-term goals and corporate vision.

-

Scope and Skills: Clearly state what the project needs and the skills required.

-

Budget and Timeline: A good project schedule and budget set the stage for success.

2. Identify the Ideal Location and Infrastructure

-

Regional Analysis: We look at major IT hubs like Bangalore, Hyderabad, and Pune. We focus on their infrastructure quality and resource availability.

-

Operational Costs: We compare expenses in Tier 1 and Tier 2 cities. This helps us find a balance between efficiency and talent.

-

Connectivity: You can’t negotiate reliable digital infrastructure. It includes internet speed and access to data centers.

3. Select the Right Offshore Development Partner

-

Experience and Expertise: We team up with companies that have a solid history and rich knowledge in their area.

-

Cultural Fit: The selected partner should share your values. This helps them to work well with your main team.

-

Due Diligence: We check past project results, quality standards, and hiring practices.

4. Structure Your Offshore Team

-

Team Composition: We set roles for project managers and developers. Each role meets project needs, helping everyone work together.

-

Clear hierarchies: Having management systems and reporting lines defines roles. This keeps everything running smoothly.

-

Role clarity: Comprehensive job descriptions and performance standards help to maximize output.

5. Establish a Legal and Operational Framework

-

Compliance: We work with legal experts to ensure we follow local labor laws and rules.

-

Security Protocols: Strong IT security practices protect intellectual property and data.

-

Operational Policies: The aim is to set up SOPs for daily tasks, reports, and communication.

6. Integrate Technology and Communication Tools

-

Collaboration Platforms: We make it easy to work together using tools like Slack, Microsoft Teams, and Zoom.

-

Project Management Software: To track and manage tasks well, use tools like Jira, Trello, or Asana.

-

Real-Time Reporting: Dashboards and frequent updates guarantee that every interested party stays current.

7. Define Performance Metrics and Continuous Improvement Strategies

-

KPIs: It’s easier to monitor team performance when we define key criteria. These include client satisfaction, quality, and output.

-

Feedback Loops: Frequent performance evaluations and helpful comments support ongoing development.

-

Training Programs: Ongoing skill development helps the team stay current with business trends.

Use the employer cost calculator above to get all the details. Then, make a quick decision.

Navigating Challenges and Mitigation Strategies

Although offshore teams have many advantages, we also recognize that difficulties could develop. Reducing hazards and guaranteeing seamless operations depend on proactive plans.

Addressing Cultural and Communication Barriers

-

Cultural Training: To close any cultural differences, we organize cross-cultural training courses.

-

Language Proficiency: Using India’s high degree of English competency reduces misunderstandings.

-

Regular Meetings: Daily or weekly meetings help to promote openness and alignment.

Managing Legal and Regulatory Complexities

-

Consult an expert attorney. They help you grasp local labor laws. They also protect your intellectual property and ensure data security.

-

Contractual Safeguards: Clear agreements include clauses on dispute resolution to guard both sides.

-

Continuous Monitoring: Keeping up-to-date with legislative developments helps us to respond quickly.

Enhancing Integration and Team Management

-

Onsite Visits: Management teams’ regular visits help to build cooperation and confidence.

-

Team Building: Frequent team-building activities and online conferences help to strengthen the team.

-

Performance Reviews: Regular performance reviews keep the team aligned with strategic goals.

Overcoming Technological Hurdles

-

Robust IT Systems: Funding dependable technological infrastructure reduces downtime.

-

Cybersecurity Measures: New security systems guard private information.

-

Backup Plans: Creating backup plans and redundancy guarantees perseverance during technological failure.

Key Considerations for Long-Term Offshore Success

Setting up an offshore team in India requires careful planning and ongoing focus. We concentrate on several important elements to guarantee long-term success:

Cultural Compatibility and Communication

A good offshore team runs on open communication and mutual respect. We emphasize cultural awareness. This ensures that onshore and offshore crews stay in touch regularly and openly. This strategy promotes a good workplace and helps to clear misinterpretations.

Security, Compliance, and Data Privacy

Strong security measures and following regulations are crucial now. Data breaches can be very harmful. We protect intellectual property and customer data. We use modern cybersecurity systems and follow international standards.

Strategic Partner Selection and Relationship Management

Choosing a suitable companion is quite vital. We exclusively deal with partners who exhibit both technical ability and cultural fit. Long-term partnerships make our offshore team flexible and creative. They help us adapt to changing business needs.

Cost-Performance Optimization

One must strike a balance between performance and economy. We conduct detailed cost-benefit studies. We look at hidden costs like training, communication, and transition times. Keeping an eye on performance indicators helps us boost our return on investment. It also helps us use resources better, as shown in our employee cost calculator.

Talent Acquisition, Training, and Retention

We understand that an offshore team is only as powerful as its talent. We build teams using trusted companies and local recruitment networks. Our teams are highly qualified and committed to lifelong learning. Regular training and chances for career growth help keep top talent. This way, the team stays ahead in the industry.

Legal, Regulatory, and Tax Considerations

Legal landscape knowledge is non-negotiable. We team up with legal experts. They help us with Indian labor laws, intellectual property rights, and tax laws. Being proactive reduces risks. It also makes sure that all systems, both rational and contractual, are strong and compliant.

Conclusion: Scaling Global Operations with Confidence

Investing in a strong offshore team in India is wise for your company’s future. It’s more than just a logistical choice. We ensure our success in a competitive global market. We do this by using India’s tech strengths, cultural fit, and cost savings.

This handbook provides a clear road map. It includes everything from outlining your idea to choosing the right site. It also involves building solid legal frameworks and using the latest technologies. Every offshore project ensures measurable results. We have active plans to tackle common issues.

Building an offshore team in India is a proven method. It helps companies use resources better, speed up innovation, and stay competitive. We promise to use our expertise to help you adapt to this changing landscape. Together, we can achieve great operational performance.

What is an employee cost calculator?

An employee cost calculator estimates the total cost of employing someone in India. It includes salary, taxes, and benefits. This helps employers budget accurately and understand the full expense of hiring.

How do I use the employee cost calculator?

To use the calculator, input the employee’s gross salary. The tool calculates net take-home pay and total employer costs. It considers deductions such as taxes and contributions. This provides a clear view of both employee earnings and employer expenses.

How to calculate the cost of hiring an employee?

To determine the cost of hiring an employee in India, add the following:

-

- Gross Salary: The agreed-upon salary before deductions.

- Employer Contributions:

- Provident Fund (PF): 12% of basic salary.

- Employees’ Pension Scheme (EPS): 8.33% of basic salary.

- Employees’ State Insurance (ESI): Applicable if salary is below a certain threshold.

- Bonuses: Any performance or annual bonuses.

- Benefits: Health insurance, gratuity, etc.

- Recruitment Costs: Expenses related to hiring processes.

Summing these gives the total cost of hiring an employee.

How do I stay compliant in hiring and paying a global employee?

To ensure compliance when hiring and paying global employees:

-

- Know Local Laws: Learn the labor laws, tax rules, and work standards in the employee’s country.

- Use EOR Services: EORs manage local compliance, payroll, and benefits. This makes international hiring easier.

- Maintain Accurate Records: Keep detailed records of employment contracts, payments, and tax filings.

- Regular Audits: Conduct periodic audits to ensure ongoing compliance.

These steps help in adhering to international employment laws and avoiding legal issues.

Who pays the employees' salaries and taxes?

Usually, the employer pays the employee’s salary and the taxes too. This means taking income tax (TDS) from the employee’s pay. It also includes adding to social security programs like PF and ESI. In international cases, a company can use an Employer of Record (EOR). The EOR handles these payments for the company.

Schedule a free call

Schedule a free call